Miami-Dade County, located in Florida, has a number of charity subscription agreements that aim to support various charitable organizations and causes. A charity subscription agreement is a legally binding contract between a donor and a charity, outlining the terms and conditions under which the donor will provide regular, ongoing financial contributions to the charity. These agreements are typically designed to establish a long-term relationship between the donor and the charity, allowing the donor to make regular contributions to support the charity's programs and initiatives. In return, the charity may offer certain benefits or perks to the donor, such as exclusive access to events, recognition on the charity's website or promotional materials, and regular updates on the impact of their donations. The specific terms and conditions of a Miami-Dade Florida charity subscription agreement may vary depending on the charity and the level of contribution. Some common types of charity subscription agreements in Miami-Dade County include: 1) Monthly Subscription Agreement: This type of agreement requires the donor to make a fixed monthly contribution to the charity for an extended period of time, typically one year or longer. The amount of the monthly contribution is determined by the donor and may range from a few dollars to a substantial amount. 2) Annual Subscription Agreement: In this agreement, the donor commits to making an annual contribution to the charity. The donation amount is predetermined, and the donor fulfills their commitment by making a lump-sum payment once per year. 3) Lifetime Subscription Agreement: This type of agreement is an exceptional commitment, where the donor agrees to provide ongoing financial support to the charity for the duration of their lifetime. The donation amounts in lifetime subscription agreements are generally higher compared to monthly or annual agreements. 4) Corporate Sponsorship Agreement: Businesses and corporations in Miami-Dade County may enter into corporate sponsorship agreements with charities. These agreements involve regular financial contributions from the company, often accompanied by additional benefits such as marketing exposure, logo placement, and recognition at charity events. Miami-Dade Florida charity subscription agreements provide a way for individuals and businesses to support charitable organizations on an ongoing basis. By entering into such agreements, donors can not only make a positive impact on the community but also establish a deeper connection with the charity and its mission.

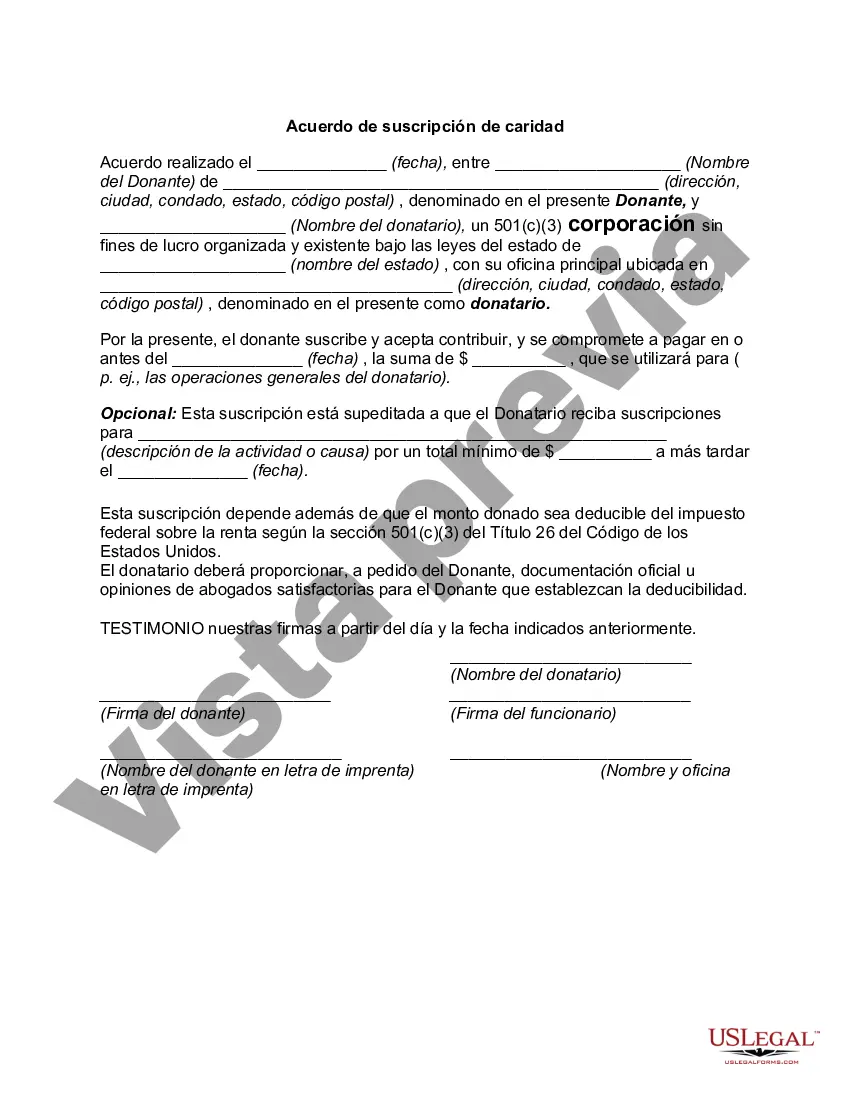

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Acuerdo de suscripción de caridad - Charity Subscription Agreement

Description

Form popularity

FAQ

No. Your EIN is the only number issued to your organization by the federal government. When your nonprofit's 501(c)(3) status is approved by the IRS, you will receive a written notice, known as a letter of determination.

After your articles of incorporation have been filed and you sign corporate bylaws, your nonprofit is official, but you will still need to obtain the licenses and permits that all new businesses must have to operate.

Florida charges a $35 filing fee for nonprofit Articles of Incorporation. You also must file a registered agent designation, and this costs $35. The IRS charges a $400 application fee if your organization's annual revenues are less than $10,000. Otherwise, the fee is $850.

Florida Statutes All charities soliciting within the state of Florida (excluding religious, educational, political and governmental agencies) are required to register and file financial information with the Florida Department of Agriculture and Consumer Services (FDACS).

Prospective donors should contact the FDACS toll-free hotline at 1-800-HELP-FLA (435-7352) or use our online Check-A-Charity tool to verify registration and financial information.

If you solicit money, help, support, or an opinion from someone, you ask them for it.

To verify a nonprofit's 501C3 status, go to the IRS Select Check website and search their name or Employer Identification Number. You can also check the IRS's Revocation database to make sure the nonprofit's status hasn't been revoked.

How to Form a Florida Nonprofit Corporation Choose directors for your nonprofit. Choose a name for your nonprofit. Appoint a registered agent. File Florida nonprofit Articles of Incorporation. Prepare nonprofit bylaws. Hold a meeting of your board of directors. Obtain an employer identification number (EIN).

Charitable organizations or sponsors intending to solicit contributions from the public in Florida must annually register with the Division of Consumer Services.

Prospective donors should contact the FDACS toll-free hotline at 1-800-HELP-FLA (435-7352) or use our online Check-A-Charity tool to verify registration and financial information.