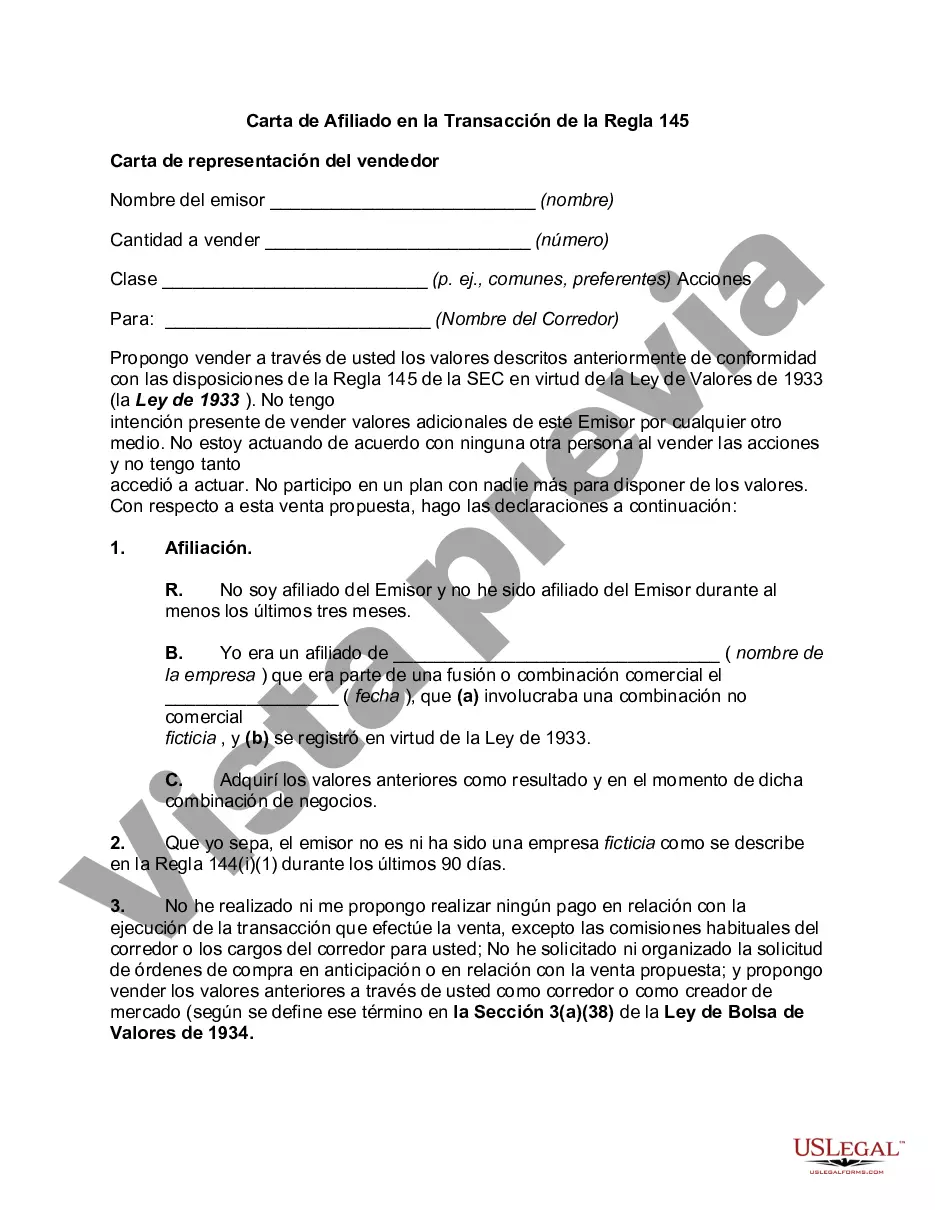

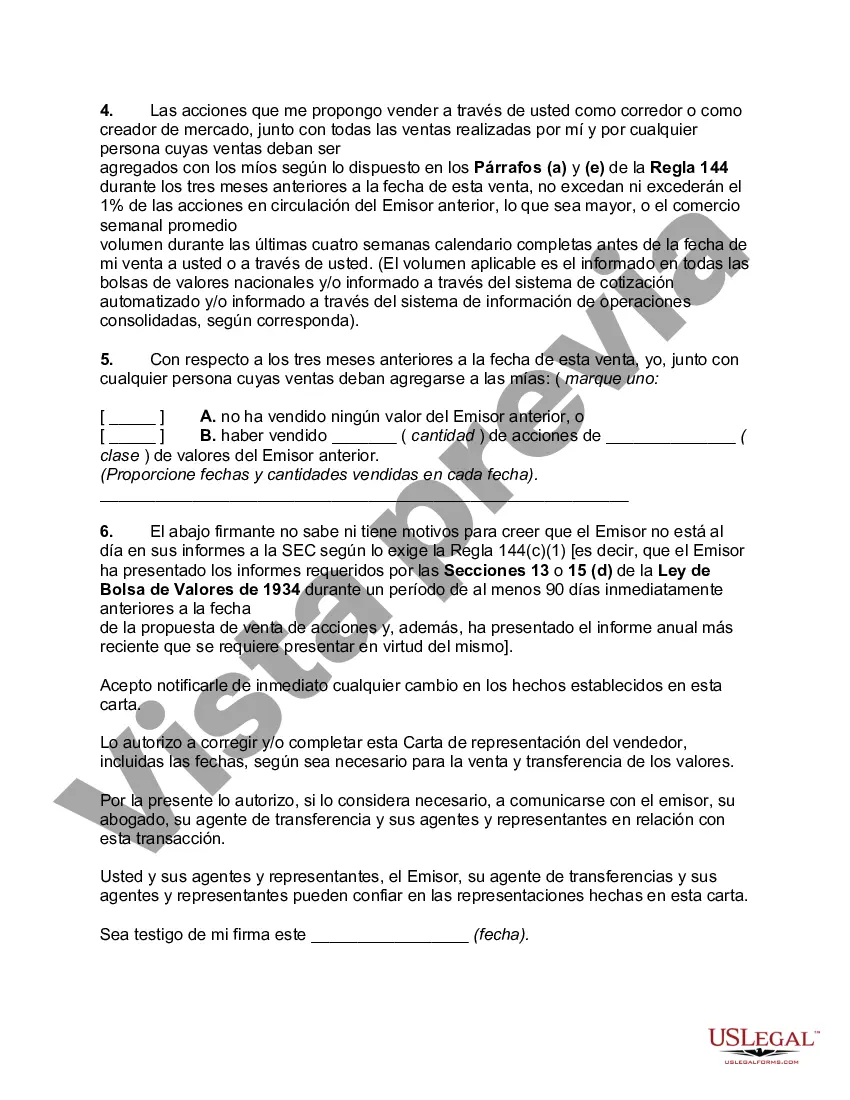

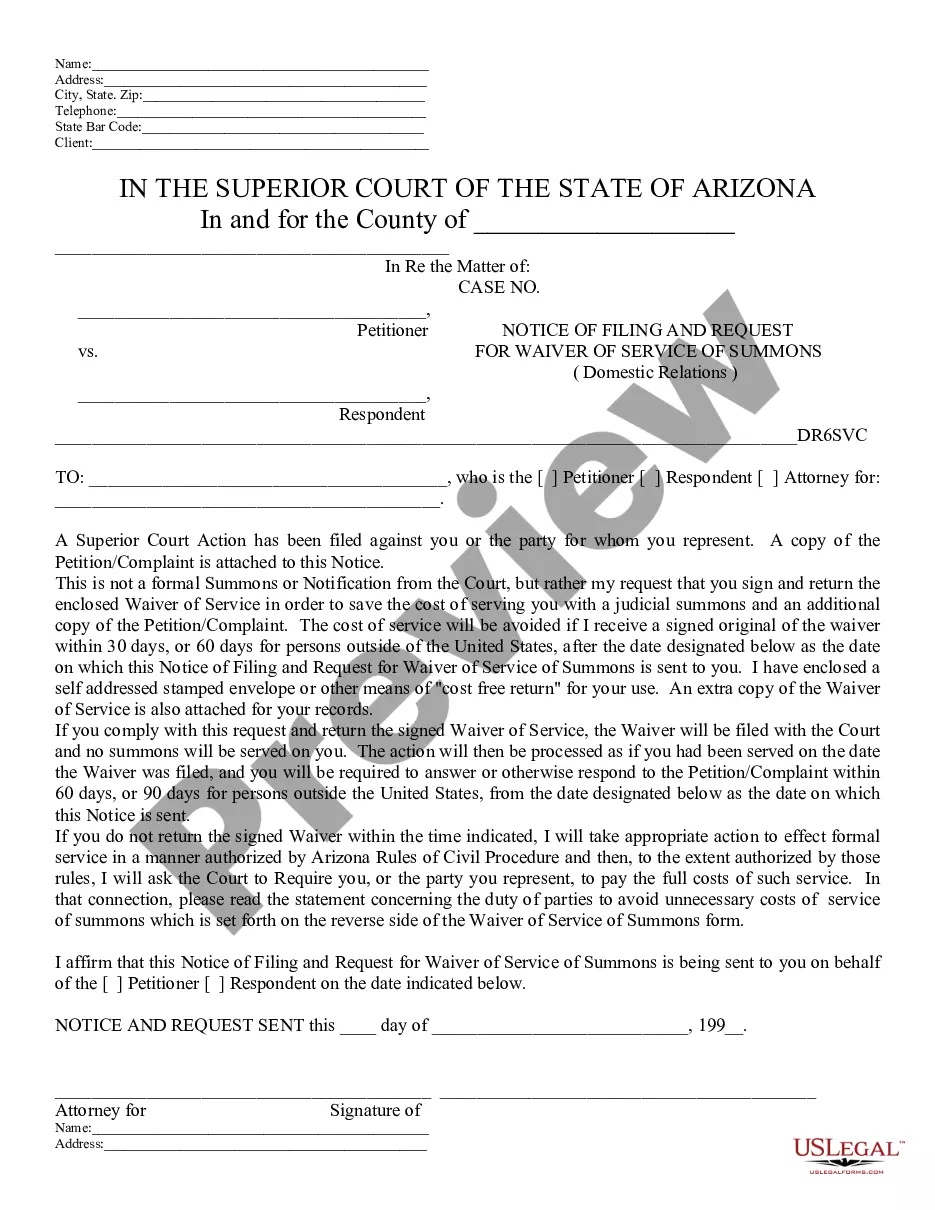

Maricopa, Arizona Affiliate Letter in Rule 145 Transaction: A Comprehensive Overview In the business world, various legal processes and procedures govern mergers, acquisitions, and the sale of securities. Rule 145 of the Securities Act is an important regulation that addresses situations where affiliates of one company exchange securities with another company. Affiliates, in this context, typically refer to individuals or entities that have a significant ownership interest or control over a company. Within the framework of Rule 145, a crucial document known as the Maricopa Arizona Affiliate Letter is often required during transactions involving affiliates of a company based in Maricopa, Arizona. This letter serves as a formal declaration and acknowledgment of a person or entity's status as an affiliate, as well as their compliance with the regulations set forth by Rule 145. The Maricopa Arizona Affiliate Letter in Rule 145 Transaction contains key information about the affiliate, including their name, address, ownership percentage, and any other essential details to establish their affiliation. It also verifies that the affiliate has reviewed and understood the terms and conditions specified in Rule 145, and affirms their intention to comply with all relevant regulations throughout the transaction process. It is essential to note that the Maricopa Arizona Affiliate Letter in Rule 145 Transaction may have different variations depending on the specific circumstances and types of affiliates involved. Some common types of Maricopa Arizona Affiliate Letters in Rule 145 Transactions include: 1. Individual Affiliate Letter: This type of letter is used when an individual holds a significant ownership stake in the company and participates in the transaction as an affiliate. It includes personal identifying information, such as the individual's legal name, address, and social security number. 2. Corporate Affiliate Letter: When a corporate entity qualifies as an affiliate, a corporate affiliate letter is necessary. This letter provides information about the company, including its name, address, tax identification number, and the names and titles of the authorized representatives signing the letter. 3. Institutional Affiliate Letter: In cases where institutional investors, such as banks, investment funds, or insurance companies, qualify as affiliates, an institutional affiliate letter is required. This letter typically includes the legal name of the institution, its address, and the names and titles of the authorized individuals representing the institution. These are just a few examples of the potential variations of the Maricopa Arizona Affiliate Letter in Rule 145 Transaction. The content and format of the letter may vary depending on the unique circumstances of the transaction and the specific requirements set by regulatory bodies. Overall, the Maricopa Arizona Affiliate Letter in Rule 145 Transaction serves as a critical component in ensuring compliance and transparency during security transactions involving affiliates. It provides a standardized procedure for affiliates to declare their status and intention to follow the regulations outlined in Rule 145, ultimately safeguarding the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Carta de Afiliado en la Transacción de la Regla 145 - Affiliate Letter in Rule 145 Transaction

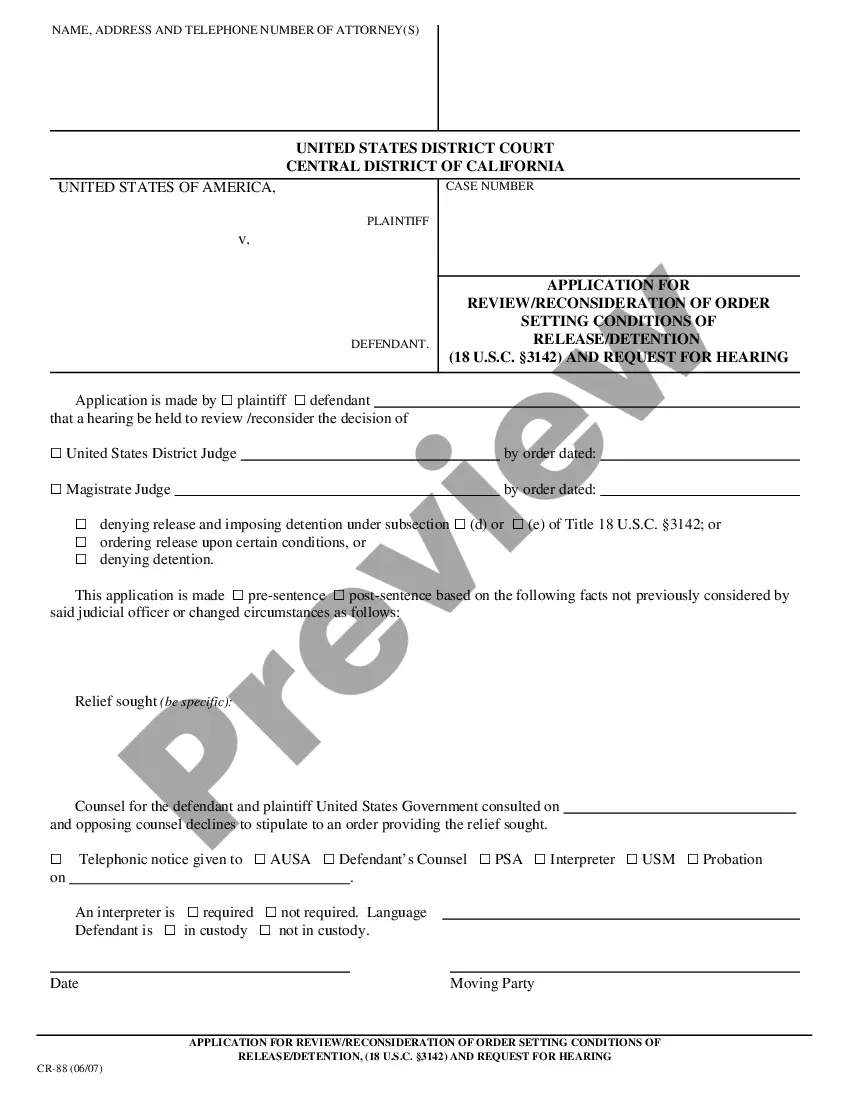

Description

How to fill out Maricopa Arizona Carta De Afiliado En La Transacción De La Regla 145?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Maricopa Affiliate Letter in Rule 145 Transaction is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to obtain the Maricopa Affiliate Letter in Rule 145 Transaction. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Affiliate Letter in Rule 145 Transaction in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!