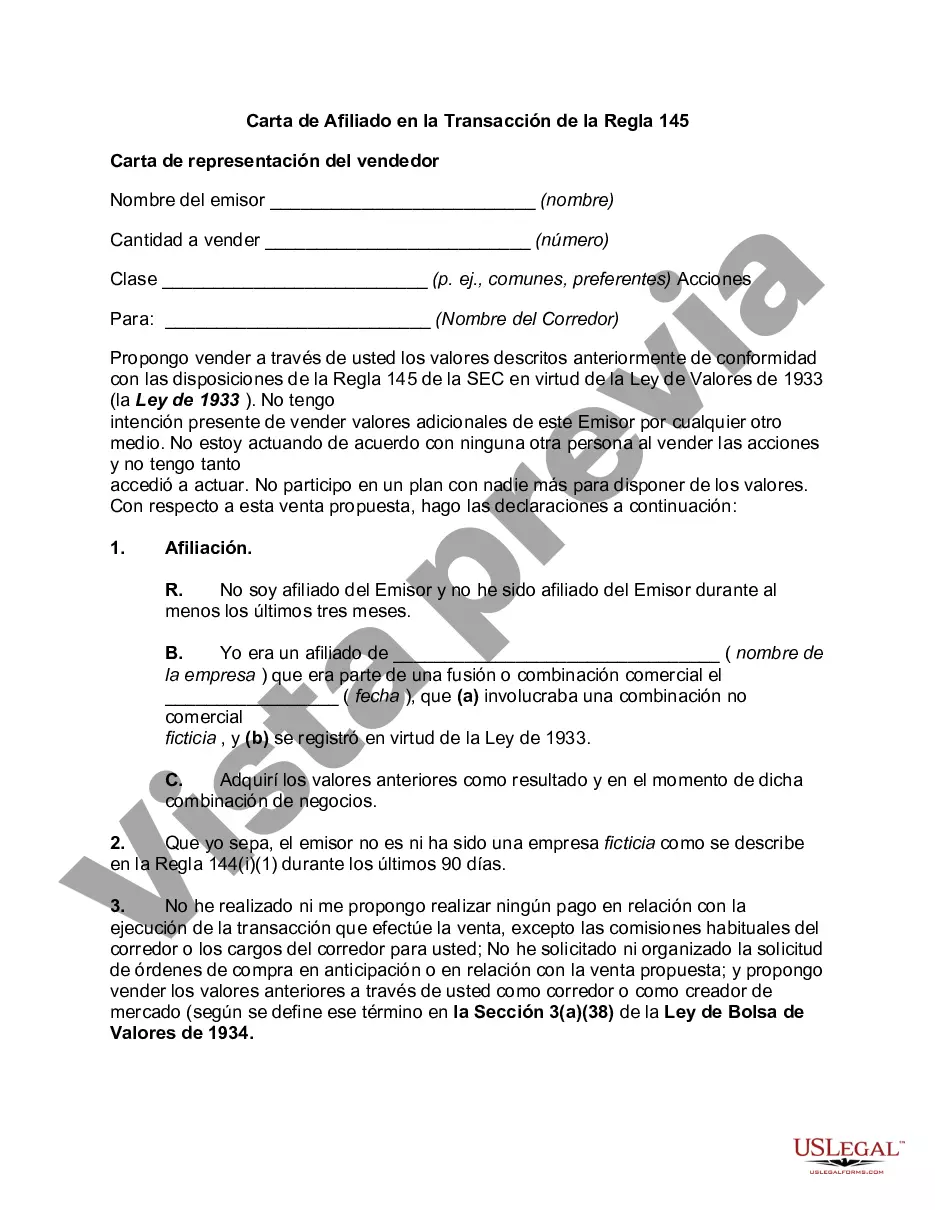

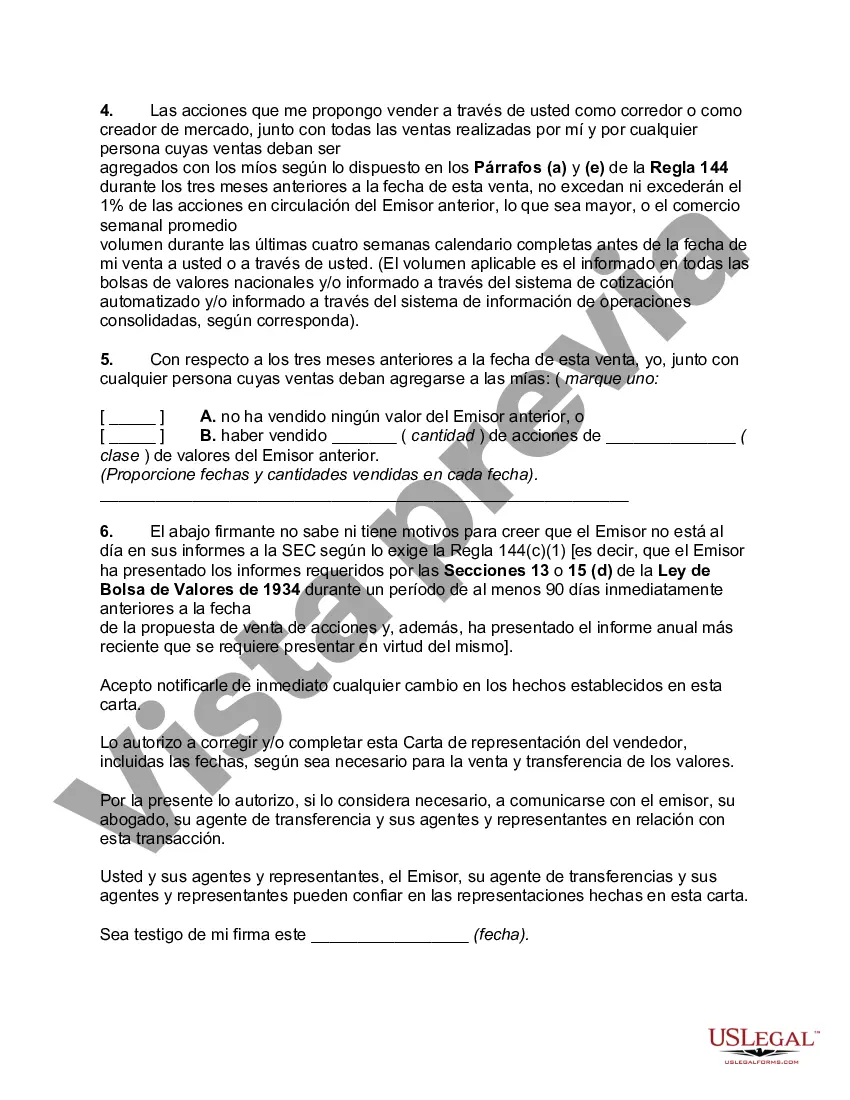

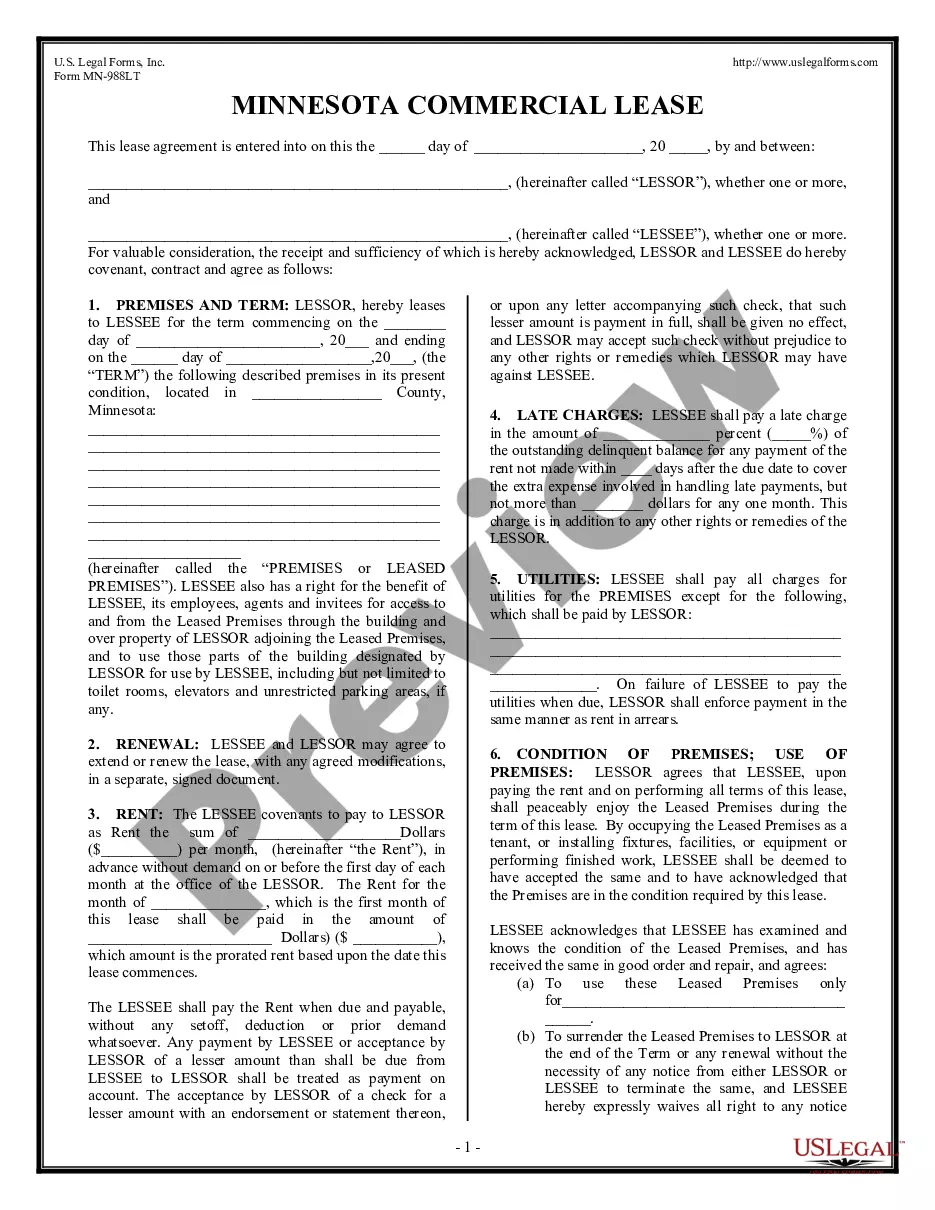

Nassau New York Affiliate Letter in Rule 145 Transaction is a legal document that plays a crucial role in certain corporate transactions involving the reorganization of affiliated companies. This detailed description will provide insights about the purpose, significance, and types of Nassau New York Affiliate Letter in Rule 145 Transaction, utilizing relevant keywords. The Nassau New York Affiliate Letter in Rule 145 Transaction primarily serves as a notice from an affiliate to the acquiring company or parent company, conveying the intention to participate in a reorganization or merger. Rule 145, established by the Securities and Exchange Commission (SEC), regulates the registration requirements for business combinations, mergers, and acquisitions involving affiliates. It aims to ensure transparency and protect the interests of shareholders. Affiliates, in this context, refer to entities that have a close relationship with the acquiring or parent company, usually through direct or indirect control or ownership. These affiliates often hold stock or securities of the company involved in the transaction. There are different types of Nassau New York Affiliate Letter in Rule 145 Transaction, based on the specific circumstances and requirements of the transaction: 1. Nassau New York Affiliate Letter in Rule 145 Transaction — Merger: This type of letter is used when two or more affiliated companies decide to merge into a single entity. It enables affiliates to express their consent and willingness to be part of the merger process. 2. Nassau New York Affiliate Letter in Rule 145 Transaction — Acquisition: If the transaction involves the acquiring company purchasing a majority or all of the assets or shares of an affiliate, an acquisition-type letter is utilized. It allows affiliates to communicate their approval and intention to participate in the acquisition. 3. Nassau New York Affiliate Letter in Rule 145 Transaction — Spin-off: In cases where an affiliated company wants to separate from the acquiring or parent company, a spin-off letter is employed. The spin-off type letter outlines the affiliate's intent to establish itself as an independent entity post-transaction. These Nassau New York Affiliate Letters play a vital role in complying with SEC regulations by providing clear and formal acknowledgment from the relevant affiliates. By addressing the interests and specific transaction details, these letters ensure transparency, minimize legal ambiguities, and maintain the integrity of the reorganization process. To summarize, the Nassau New York Affiliate Letter in Rule 145 Transaction is a key document required in corporate reorganization transactions involving affiliates. Through different types of letters tailored to specific transactions such as mergers, acquisitions, and spin-offs, these letters enable affiliates to express their consent, participation, and intent. This ensures compliance with SEC regulations, fosters transparency, and safeguards shareholders' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Carta de Afiliado en la Transacción de la Regla 145 - Affiliate Letter in Rule 145 Transaction

Description

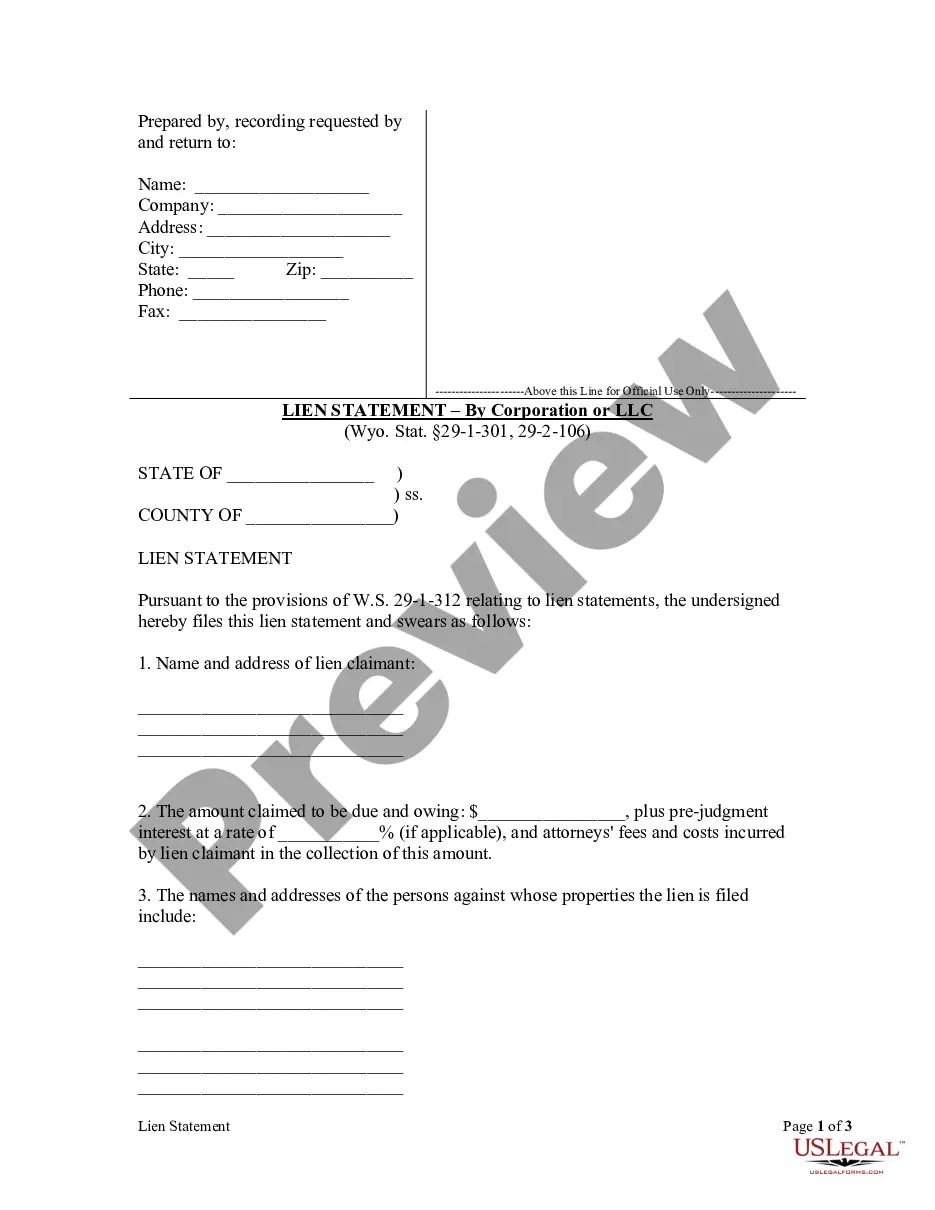

How to fill out Nassau New York Carta De Afiliado En La Transacción De La Regla 145?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Nassau Affiliate Letter in Rule 145 Transaction, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Nassau Affiliate Letter in Rule 145 Transaction from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Nassau Affiliate Letter in Rule 145 Transaction:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!