Suffolk New York Affiliate Letter in Rule 145 Transaction is a legal document that plays a crucial role in certain investment transactions. Specifically, this letter is used when a company located in Suffolk County, New York, seeks to spin off or restructure its business units and wants to offer shares or securities to its affiliates under Rule 145 of the Securities Act. Rule 145 Transaction refers to a provision within the Securities Act of 1933, as amended, which governs the sale of securities in connection with certain mergers, acquisitions, or other business combinations. This rule states that if a company offers securities to its affiliates in exchange for their assets or equity interests, it must comply with specific disclosure and registration requirements. One important requirement is the submission of an Affiliate Letter to the Securities and Exchange Commission (SEC), providing detailed information on the transaction. The Suffolk New York Affiliate Letter in Rule 145 Transaction serves as a formal notification to the SEC, signaling that a company based in Suffolk County plans to engage in a Rule 145 Transaction. It includes comprehensive information about the company, its affiliates, the nature of the transaction, and the proposed exchange of securities. The letter ensures transparency and allows the SEC to assess the fairness and legality of the proposed exchange. Different types of Suffolk New York Affiliate Letters in Rule 145 Transactions may vary depending on the specific circumstances and characteristics of the transaction. These may include spin-offs, divestitures, exchanges of subsidiary stocks, and reorganizations involving corporate subsidiaries or segments. Each type of letter will contain unique details relevant to that particular transaction, such as the number of shares offered, the valuation of assets being exchanged, and the financial impact on the company and its affiliates. In summary, the Suffolk New York Affiliate Letter in Rule 145 Transaction is an essential component of any transaction involving the offering of securities to affiliates. It ensures compliance with applicable securities regulations and provides the SEC with the necessary information to evaluate the fairness and legality of the proposed exchange.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Carta de Afiliado en la Transacción de la Regla 145 - Affiliate Letter in Rule 145 Transaction

Description

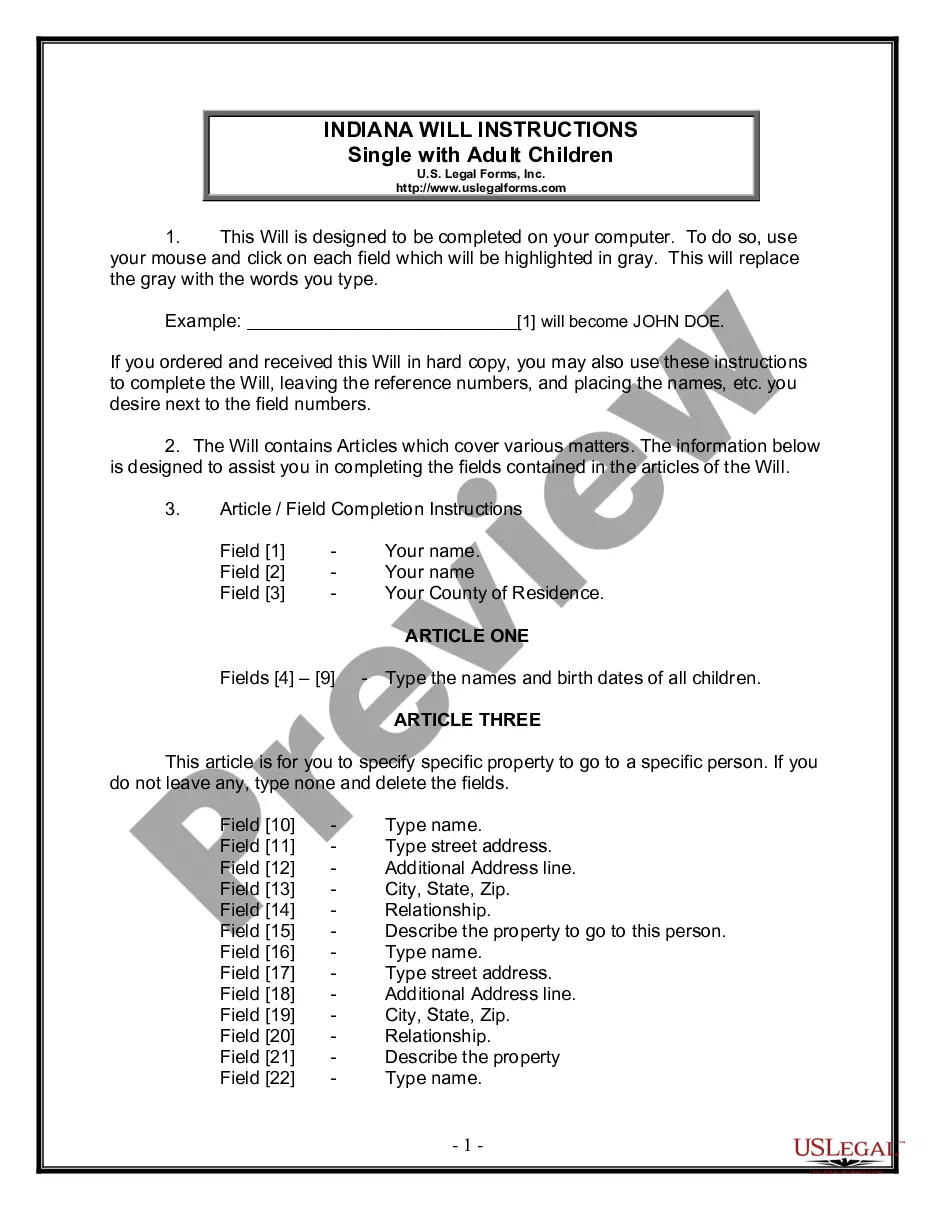

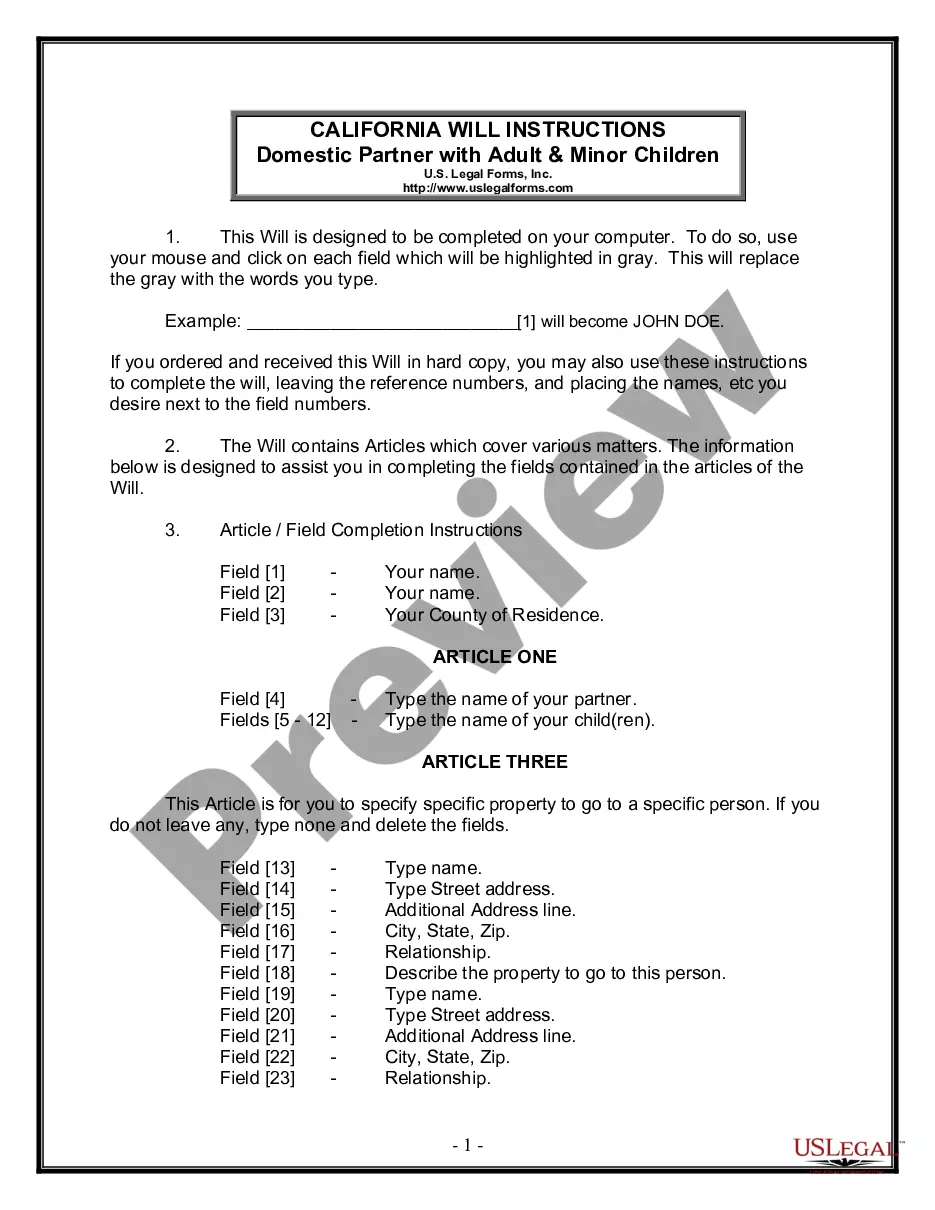

How to fill out Suffolk New York Carta De Afiliado En La Transacción De La Regla 145?

Do you need to quickly create a legally-binding Suffolk Affiliate Letter in Rule 145 Transaction or maybe any other document to handle your own or corporate matters? You can select one of the two options: hire a professional to draft a legal document for you or draft it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including Suffolk Affiliate Letter in Rule 145 Transaction and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, double-check if the Suffolk Affiliate Letter in Rule 145 Transaction is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Suffolk Affiliate Letter in Rule 145 Transaction template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!