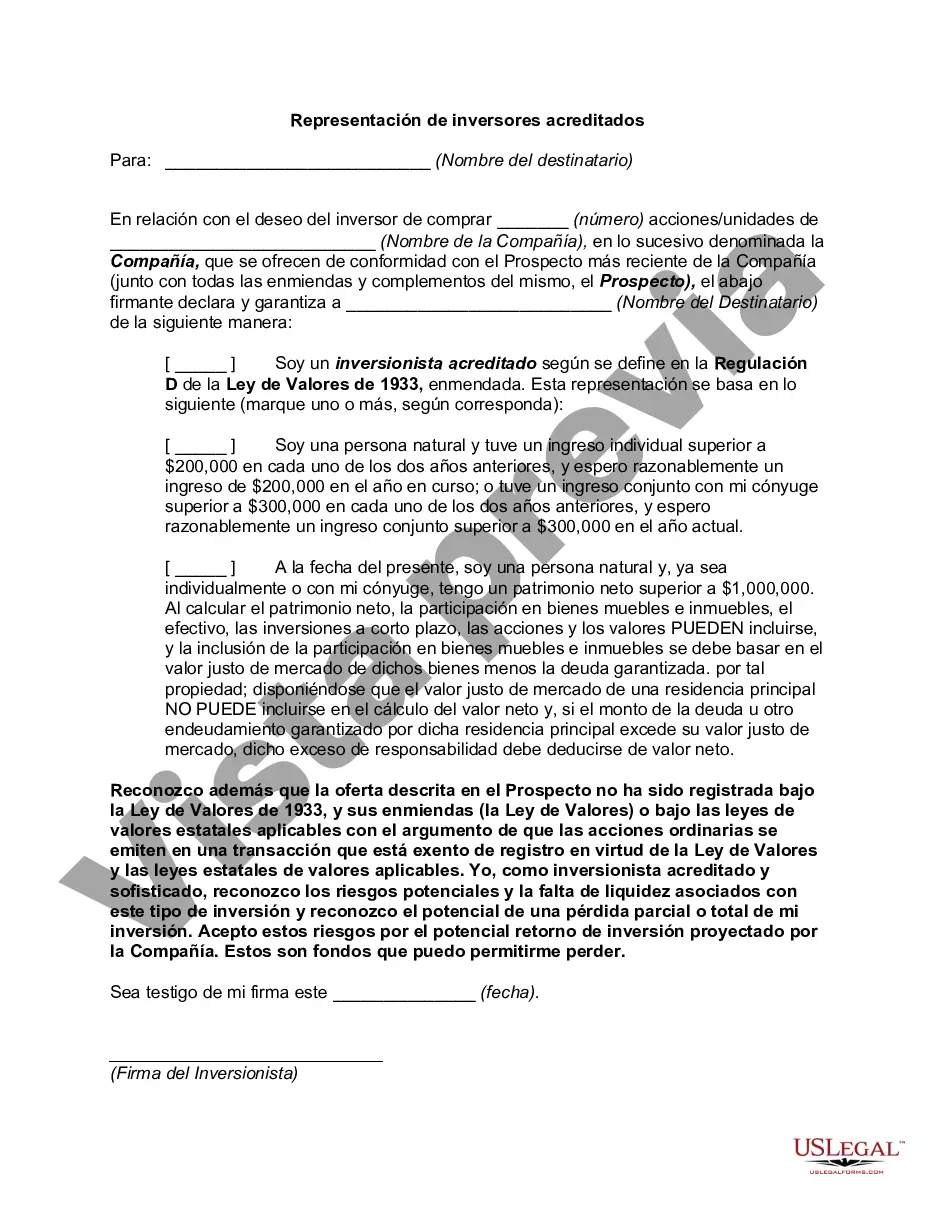

Houston Texas Accredited Investor Representation Letter is a legal document that outlines the rights and responsibilities of an accredited investor in Houston, Texas. An accredited investor refers to an individual or entity that meets certain financial criteria and is eligible to participate in private placements of securities. This document serves as proof of the investor's status and establishes the terms and conditions for their representation. The Houston Texas Accredited Investor Representation Letter is typically drafted by an attorney or a financial advisor who specializes in securities law. It is tailored to the specific needs and requirements of the investor, ensuring compliance with both state and federal securities regulations. The letter provides a detailed description of the investor's financial qualifications, their investment objectives, and their understanding of the potential risks associated with private placements. Some relevant keywords related to the Houston Texas Accredited Investor Representation Letter include: 1. Accredited investor: Refers to an individual or entity that meets specific income, net worth, or professional requirements set by securities laws. 2. Representation letter: A legal document that outlines the terms and conditions of an accredited investor's representation in private placements. 3. Private placements: The offering of securities to a select group of investors, excluding the public, often involving businesses seeking capital for growth or new ventures. 4. Securities regulations: Laws and regulations governing the issuance, trading, and sale of securities to protect investors and ensure fairness and transparency in financial markets. 5. Securities law attorney: A legal professional who specializes in advising clients on securities laws, regulations, and compliance. 6. Financial advisor: A professional who provides guidance and advice on investment strategies, financial planning, and wealth management. 7. Investment objectives: The specific goals an investor aims to achieve through their investment activities, such as capital appreciation, income generation, or risk mitigation. 8. Risks associated with private placements: Potential uncertainties and hazards that may arise from investing in private offerings, including liquidity, lack of transparency, and higher levels of investment risk compared to public offerings. 9. Compliance: Ensuring adherence to applicable securities laws and regulations to avoid legal consequences and protect both investors and issuers. Types of Houston Texas Accredited Investor Representation Letters may vary depending on the specific industry or investment vehicle involved. Examples include: — Real Estate Accredited Investor Representation Letter: Tailored for accredited investors seeking to invest in real estate projects or development opportunities in Houston, Texas. — Venture Capital Accredited Investor Representation Letter: Designed for accredited investors interested in participating in venture capital funds or startups based in Houston, Texas. — Hedge Fund Accredited Investor Representation Letter: Created for accredited investors looking to invest in hedge funds or similar alternative investment vehicles located in Houston, Texas. — Private Equity Accredited Investor Representation Letter: Specifically drafted for accredited investors considering investments in private equity firms or funds operating in Houston, Texas. It's important to consult with a qualified attorney or financial advisor to ensure the accuracy and completeness of the Houston Texas Accredited Investor Representation Letter, as requirements and regulations may vary based on individual circumstances and investment opportunities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Carta de representación del inversor acreditado - Accredited Investor Representation Letter

Description

How to fill out Houston Texas Carta De Representación Del Inversor Acreditado?

If you need to get a trustworthy legal document provider to obtain the Houston Accredited Investor Representation Letter, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it easy to locate and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to search or browse Houston Accredited Investor Representation Letter, either by a keyword or by the state/county the form is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Houston Accredited Investor Representation Letter template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less expensive and more affordable. Set up your first company, organize your advance care planning, create a real estate agreement, or execute the Houston Accredited Investor Representation Letter - all from the comfort of your home.

Join US Legal Forms now!