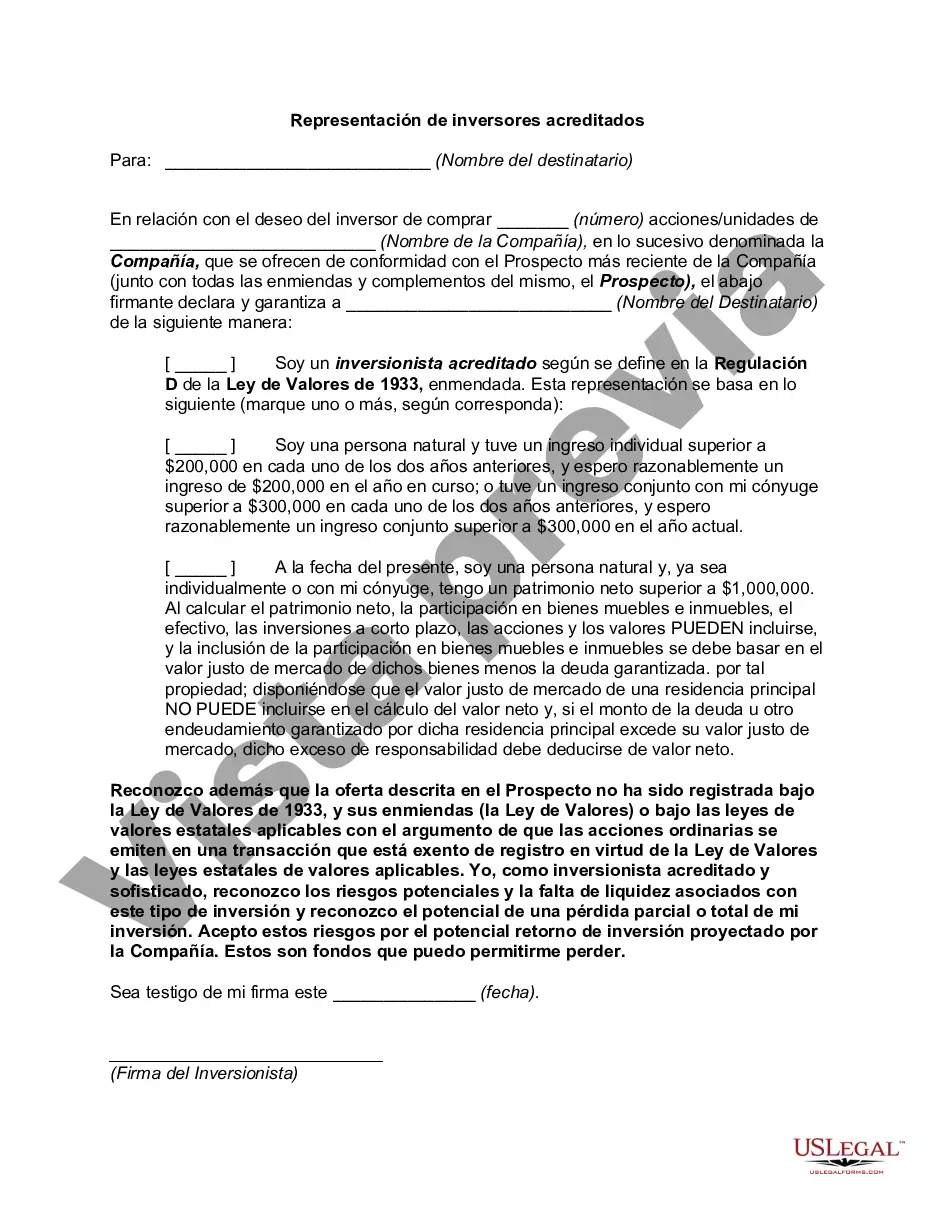

The Oakland Michigan Accredited Investor Representation Letter is a legal document designed to provide representation and protection for accredited investors in Oakland, Michigan. This letter serves as a comprehensive agreement between accredited investors and their designated representatives, ensuring their interests are safeguarded during investment transactions. Accredited Investor Representation Letters are critical documentation required when engaging in various investment opportunities, such as private placements, venture capital investments, hedge funds, and other private investment vehicles. They outline the terms and conditions that govern the relationship between the accredited investor and their representative, often an attorney or a financial advisor. These letters embody the regulatory requirements set forth by the U.S. Securities and Exchange Commission (SEC) and state authorities, confirming the accredited investor's eligibility to participate in certain investment opportunities. By signing this letter, the accredited investor certifies compliance with the criteria established by the SEC, which typically involves meeting minimum income or net worth thresholds. The Oakland Michigan Accredited Investor Representation Letter typically includes key components such as: 1. Investor Identification: The letter begins by identifying the investor, including their name, contact information, and any relevant identification numbers or business affiliations. 2. Accredited Investor Certification: This section confirms that the investor meets the SEC's accredited investor criteria, providing details on their income, net worth, or other qualifying factors. 3. Representation by an Authorized Agent: The letter acknowledges that the investor has engaged a representative to act on their behalf during investment transactions. The representative is typically an attorney, financial advisor, or another authorized professional. 4. Agent's Duties and Scope: The letter outlines the representative's responsibilities, including advising the investor, conducting due diligence on investment opportunities, negotiating terms, and ensuring compliance with applicable regulations. 5. Limitations of Liability: This section clarifies the extent of the representative's liability and indemnifies them from certain actions or decisions made by the investor themselves. 6. Termination and Governing Law: The letter establishes the conditions for termination of the representation agreement and specifies the laws that govern the agreement, often referring to Michigan state law. Different variations of Oakland Michigan Accredited Investor Representation Letters may exist depending on the specific requirements, preferences, or industry focus. For example, some letters may cater specifically to real estate investments, while others may cover a broader range of investment opportunities within Oakland, Michigan. Overall, the Oakland Michigan Accredited Investor Representation Letter acts as a vital tool in protecting the interests of accredited investors and ensuring compliance with regulatory standards. It serves as a formal agreement that establishes a relationship of trust and transparency between the investor and their representative, enabling them to navigate the complex world of investment opportunities with confidence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Carta de representación del inversor acreditado - Accredited Investor Representation Letter

Description

How to fill out Oakland Michigan Carta De Representación Del Inversor Acreditado?

If you need to find a trustworthy legal paperwork provider to obtain the Oakland Accredited Investor Representation Letter, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support make it easy to find and execute different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Oakland Accredited Investor Representation Letter, either by a keyword or by the state/county the document is created for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Oakland Accredited Investor Representation Letter template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate agreement, or complete the Oakland Accredited Investor Representation Letter - all from the comfort of your sofa.

Sign up for US Legal Forms now!