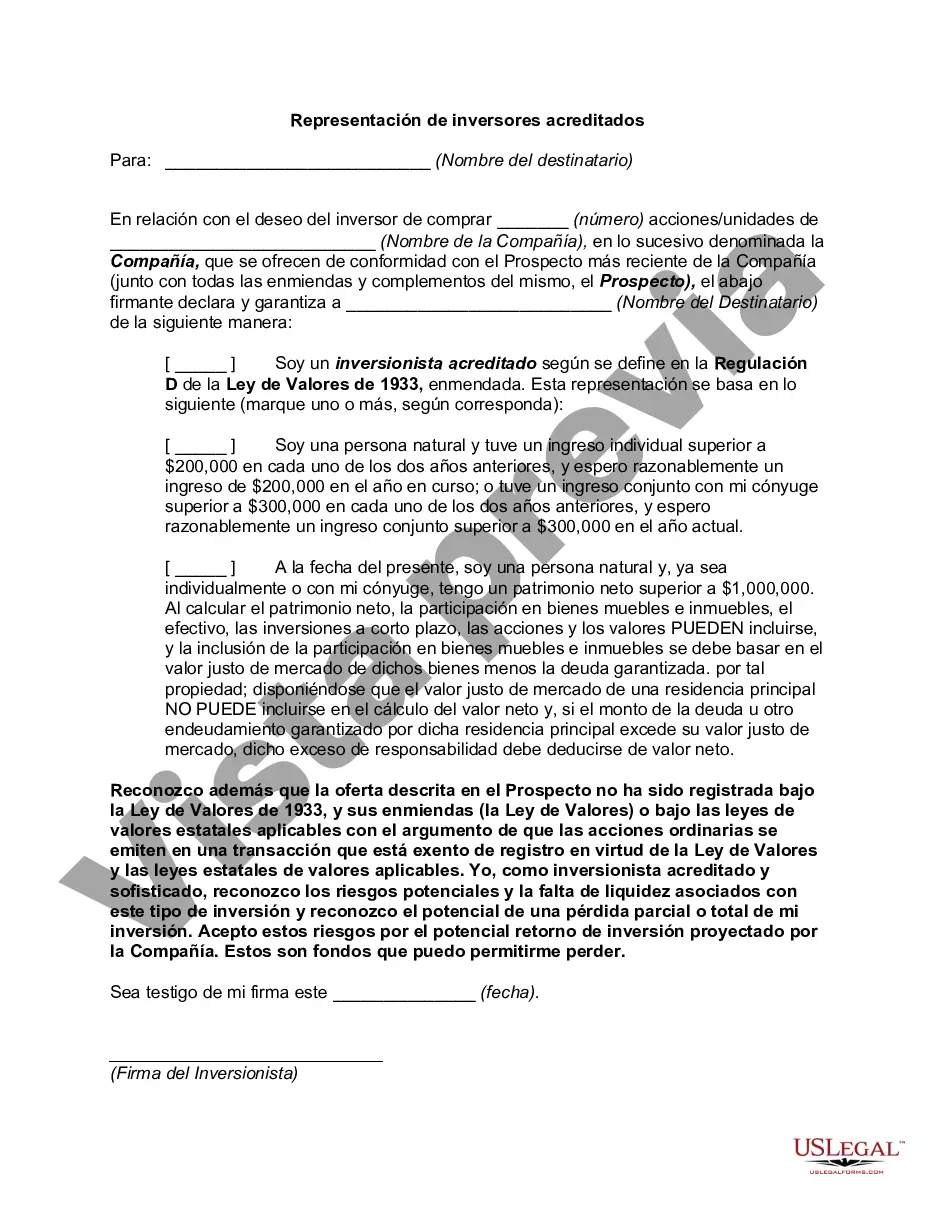

Riverside California Accredited Investor Representation Letter serves as a legal document that outlines the representation of an accredited investor in the Riverside, California region. Accredited investors are individuals or entities who meet certain financial criteria and are deemed to have sufficient knowledge and experience in investing to handle higher-risk opportunities. The purpose of the Riverside California Accredited Investor Representation Letter is to establish a formal agreement between the accredited investor and their chosen representative, typically a financial advisor or attorney. The letter emphasizes the importance of adhering to legal and regulatory obligations while informing the investor about their rights and responsibilities. The content of the Riverside California Accredited Investor Representation Letter may vary based on the specific needs and preferences of the parties involved. However, it generally includes the following relevant keywords: 1. Accredited Investor: The letter confirms that the investor meets the requirements specified by the Securities and Exchange Commission (SEC) to be considered an accredited investor. 2. Representation: The letter outlines the scope of representation provided by the chosen representative, including tasks such as investment advisory, legal counsel, or any other related services. 3. Legal and Regulatory Compliance: The letter discusses the importance of complying with federal and state securities laws, ensuring adherence to relevant regulations such as the Securities Act of 1933 and the Securities Exchange Act of 1934. 4. Duties and Responsibilities: The letter describes the duties and responsibilities of the representative towards the accredited investor, including the obligation to act in the investor's best interest, provide accurate information, and exercise due diligence. 5. Disclosure of Risks: The letter may include a section outlining the risks associated with investing and acknowledges that the representative has provided appropriate information to enable the accredited investor to make informed decisions. 6. Confidentiality: The letter highlights the importance of maintaining the confidentiality of the investor's personal and financial information and the need for the representative to obtain the investor's consent for any disclosure. Types of Riverside California Accredited Investor Representation Letters may include: 1. Financial Advisor Representation Letter: This type of letter involves a financial advisor or investment professional representing an accredited investor for investment management and advisory services. 2. Attorney Representation Letter: In this case, an attorney acts as the accredited investor's representative during legal proceedings or transactions involving securities or investments. 3. Business Entity Representation Letter: When a business entity, such as a corporation or partnership, acts as an accredited investor, the representation letter may be tailored to address the specific needs of the entity and its compliance requirements. In all cases, the Riverside California Accredited Investor Representation Letter serves as a crucial agreement that ensures proper communication, transparency, and compliance between the accredited investor and their representative in the dynamic and evolving landscape of investment opportunities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Carta de representación del inversor acreditado - Accredited Investor Representation Letter

Description

How to fill out Riverside California Carta De Representación Del Inversor Acreditado?

Creating documents, like Riverside Accredited Investor Representation Letter, to take care of your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for different cases and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Riverside Accredited Investor Representation Letter template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before getting Riverside Accredited Investor Representation Letter:

- Make sure that your template is compliant with your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Riverside Accredited Investor Representation Letter isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start utilizing our service and get the document.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!