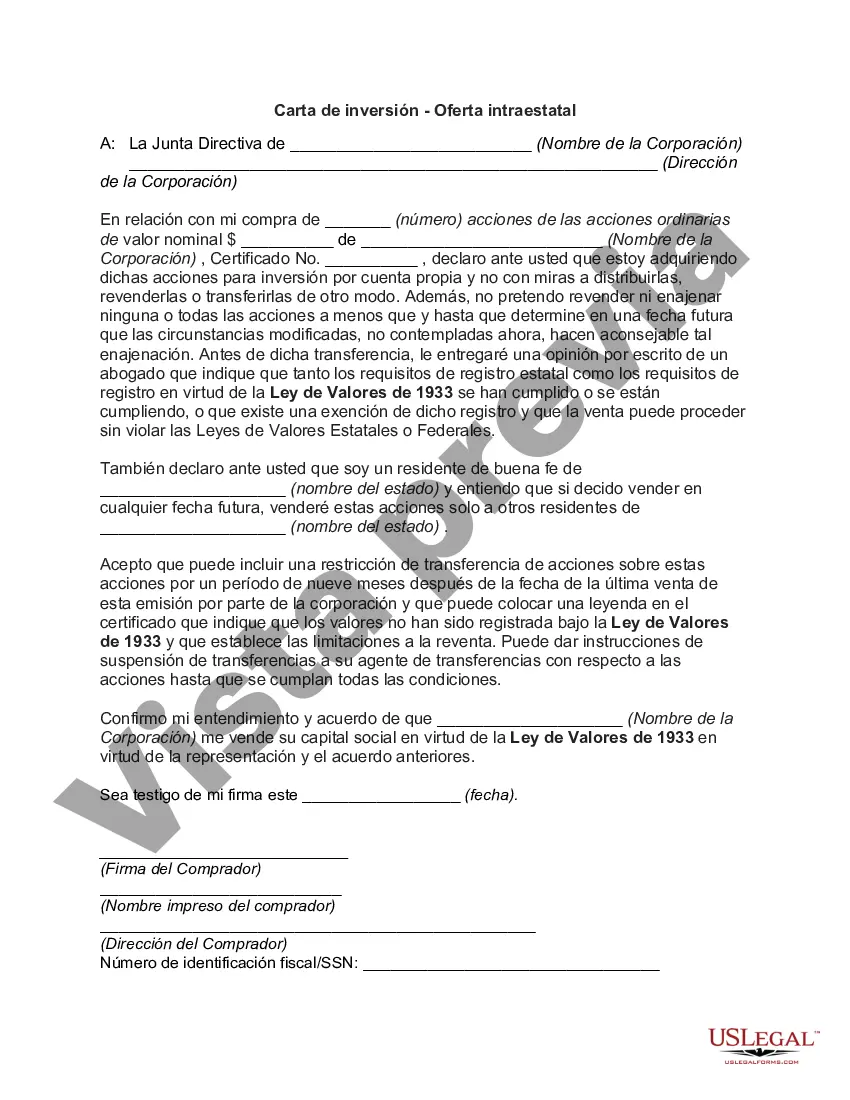

Chicago Illinois Investment Letter — Intrastate Offering is a legal document that allows Illinois-based businesses to raise funds from individual investors within the state. This investment tool is regulated by the Illinois Secretary of State's office and is designed to promote economic growth within Chicago and the state of Illinois as a whole. The Chicago Illinois Investment Letter — Intrastate Offering is designed to provide opportunities for local businesses to access capital from individuals residing in the state. By utilizing this letter, businesses can issue securities, such as stocks or bonds, to accredited and non-accredited investors in their community. There are several types of Chicago Illinois Investment Letter — Intrastate Offerings, each catering to specific requirements and objectives. These types include: 1. Equity Offerings: This type of offering allows businesses to sell shares of their company to raise capital. Investors who purchase these shares become partial owners of the business and may participate in any potential future profits or losses. 2. Debt Offerings: Businesses can issue bonds or other debt instruments to investors through this offering. Investors who participate in debt offerings receive fixed interest payments over a specified period of time. At the end of the term, the principal amount is repaid to the investors. 3. Real Estate Offerings: This type of offering is specific to real estate projects within Chicago and Illinois. Businesses looking to develop or invest in real estate can raise funds from investors who are interested in supporting local property ventures. 4. Renewable Energy Offerings: Businesses involved in the renewable energy sector, such as solar or wind farms, can raise funds through this offering. Investors can support the growth of renewable energy projects within Chicago and Illinois, thus contributing to the region's sustainable development. Businesses seeking to conduct a Chicago Illinois Investment Letter — Intrastate Offering must comply with specific regulations, including providing detailed financial disclosures, business plans, and marketing materials to potential investors. This ensures that investors receive accurate and transparent information to make informed investment decisions. Overall, the Chicago Illinois Investment Letter — Intrastate Offering provides a legal and regulated framework for local businesses to connect with investors, fostering economic growth, job creation, and community development within Chicago and across the state of Illinois.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Carta de inversión - Oferta intraestatal - Investment Letter - Intrastate Offering

Description

How to fill out Chicago Illinois Carta De Inversión - Oferta Intraestatal?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Chicago Investment Letter - Intrastate Offering, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Chicago Investment Letter - Intrastate Offering from the My Forms tab.

For new users, it's necessary to make some more steps to get the Chicago Investment Letter - Intrastate Offering:

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!