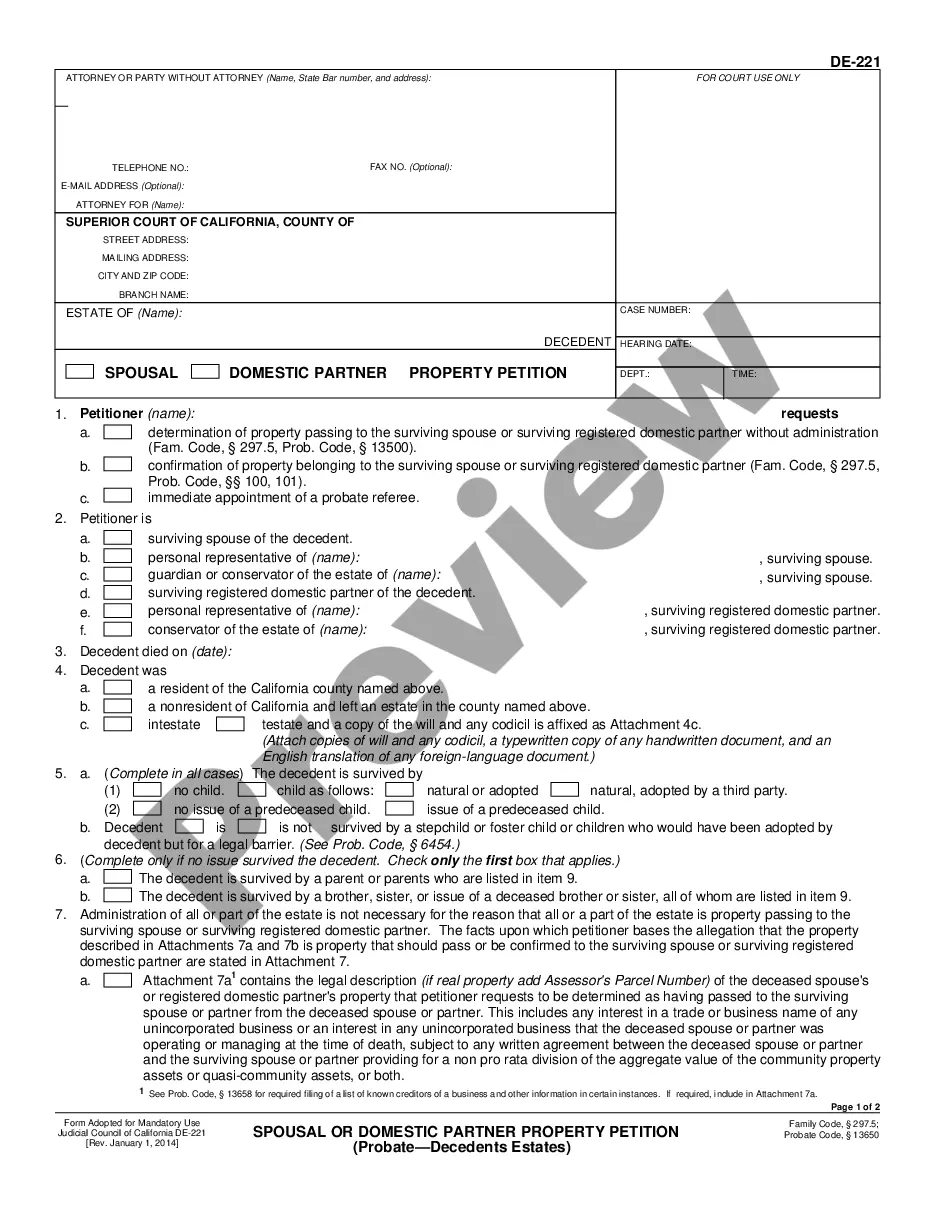

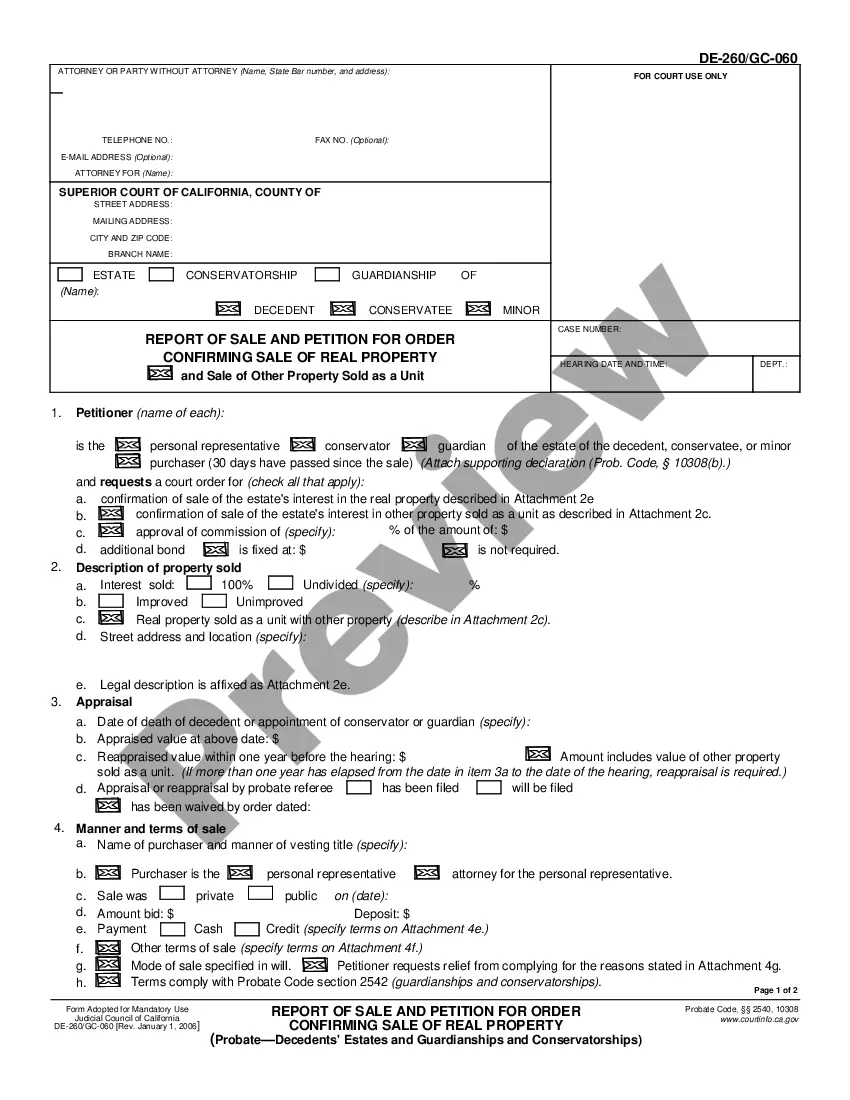

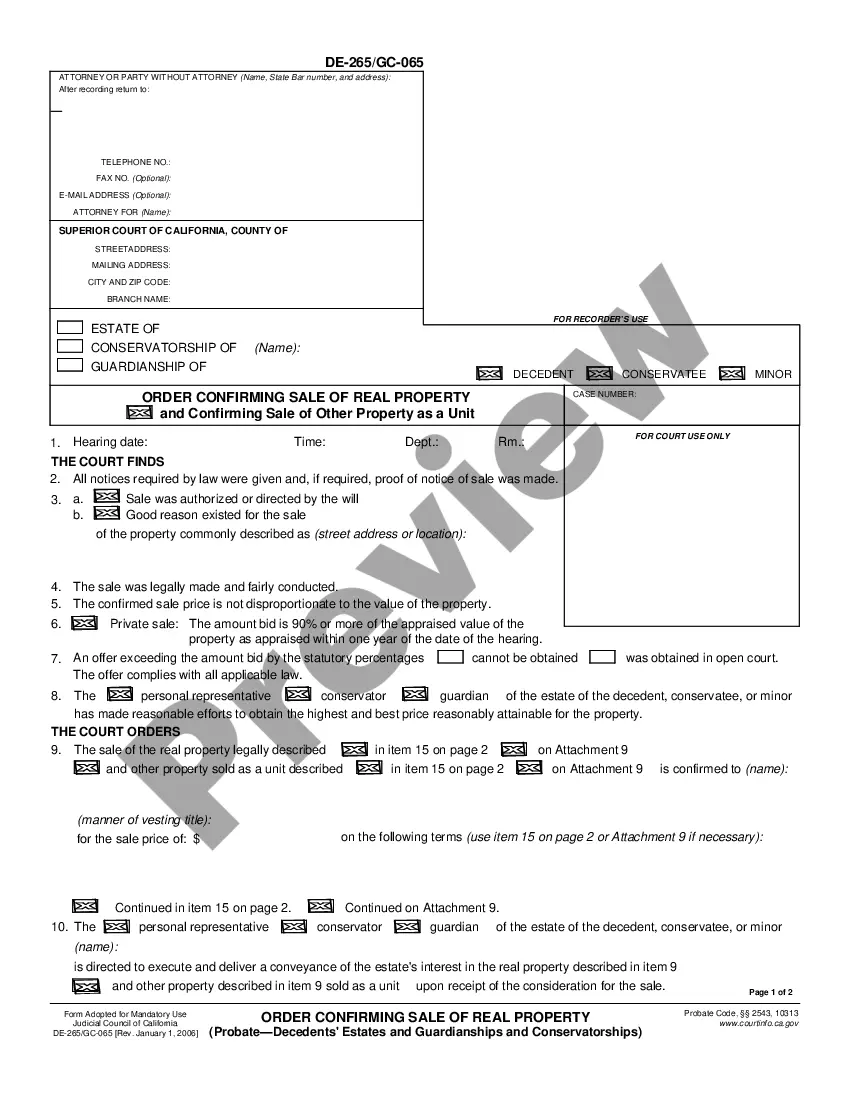

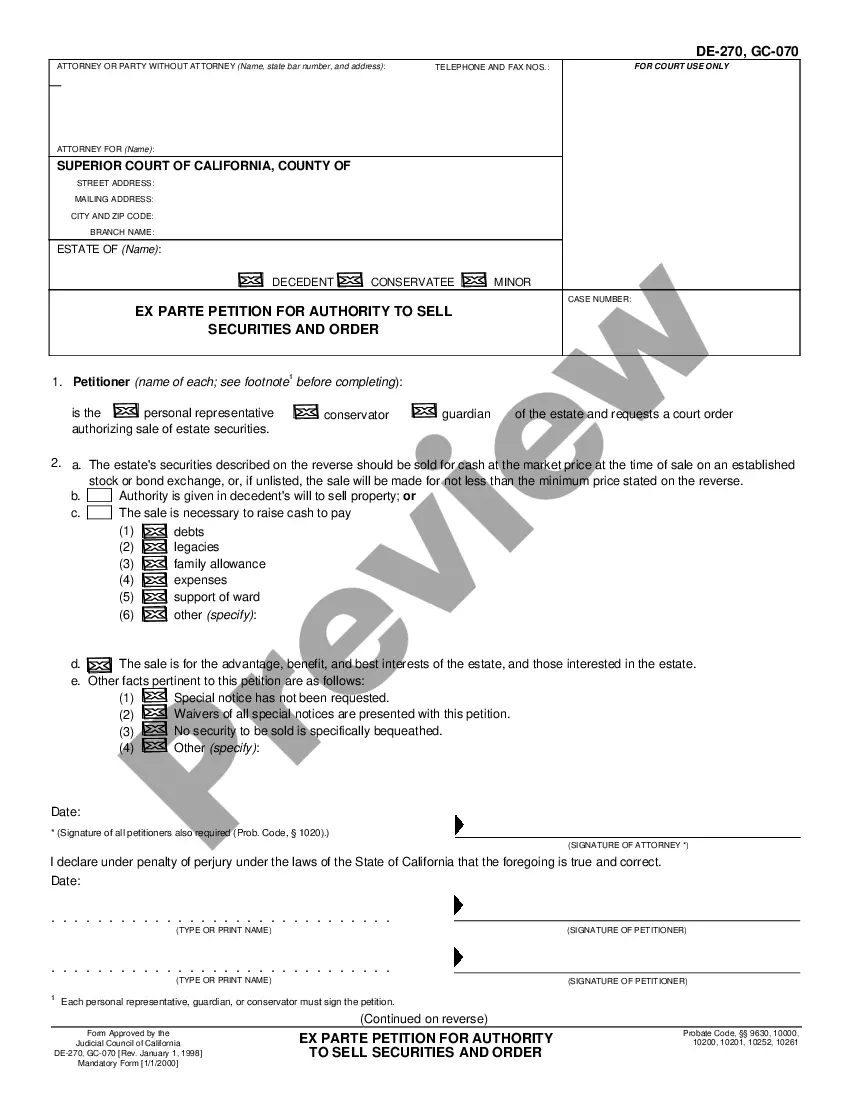

Riverside California Rule 144 Sellers Representation Letter Non-Affiliate is a legal document used in the context of securities transactions in the state of California. This letter is primarily relevant for sellers who are not affiliated with the company whose securities they are selling, as specified by Rule 144 of the Securities and Exchange Commission (SEC). In essence, Rule 144 governs the resale of restricted securities (securities acquired through private transactions) and provides certain exemptions from the registration requirements of the Securities Act of 1933. Sellers who are considered non-affiliates, meaning they do not have any direct or indirect control or significant influence over the issuing company, may use this representation letter to assert their compliance with Rule 144 when selling restricted securities. The Riverside California Rule 144 Sellers Representation Letter Non-Affiliate is designed to gather necessary information and declarations from the seller regarding their affiliation status, as well as their compliance with other conditions specified by Rule 144. It is essential for sellers to provide accurate and complete information to ensure compliance with securities laws and avoid potential legal issues. While there may not be different types of Riverside California Rule 144 Sellers Representation Letter Non-Affiliate specifically, variations of this representation letter may exist depending on the specific requirements set by the issuing company or legal counsel involved. Sellers must ensure they use the correct version of this letter, specific to their situation and the jurisdiction in which they are conducting the securities' transaction. Key relevant keywords for this topic may include: Riverside California, Rule 144, Seller's Representation Letter Non-Affiliate, securities transactions, restricted securities, Securities Act of 1933, Securities and Exchange Commission (SEC), affiliation status, compliance, legal document, exemptions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Regla 144 Carta de Representación del Vendedor No Afiliado - Rule 144 Seller's Representation Letter Non-Affiliate

Description

How to fill out Riverside California Regla 144 Carta De Representación Del Vendedor No Afiliado?

Draftwing forms, like Riverside Rule 144 Seller's Representation Letter Non-Affiliate, to manage your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for different cases and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Riverside Rule 144 Seller's Representation Letter Non-Affiliate template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before getting Riverside Rule 144 Seller's Representation Letter Non-Affiliate:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Riverside Rule 144 Seller's Representation Letter Non-Affiliate isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start using our service and get the document.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!