Title: Suffolk New York Notice of Special Stockholders' Meeting to Consider Recapitalization Keywords: Suffolk New York, special stockholders' meeting, recapitalization, detailed description: The Suffolk New York Notice of Special Stockholders' Meeting to Consider Recapitalization serves as an official announcement of an upcoming meeting organized by a company in Suffolk, New York. The purpose of this meeting is to discuss and seek stockholders' approval for a recapitalization plan. Recapitalization refers to the restructuring of a company's capital structure, often involving the issuance of new securities or changing the existing allocation of debt and equity. The process aims to improve the financial stability, flexibility, and overall value of the organization. This Notice is an essential means of disseminating information to stockholders, allowing them to participate actively in key decision-making processes that can significantly impact their investment. The Notice provides stockholders with details about the Special Stockholders' Meeting, including the date, time, and location, ensuring they have ample time to make necessary arrangements and participate in the event. Additionally, it outlines the agenda for the meeting, which typically includes a comprehensive discussion and voting on the proposed recapitalization plan. The recapitalization plan can take various forms, depending on the needs and goals of the company. Some potential types of Suffolk New York Notices of Special Stockholders' Meetings to Consider Recapitalization include: 1. Debt-to-Equity Swap Recapitalization: This involves converting a portion of the company's debt into equity, which can help reduce financial leverage and enhance the balance sheet. It typically benefits both the company by alleviating financial burdens and stockholders by bolstering the value and potential growth of their investments. 2. Stock Split Recapitalization: Here, the company increases the number of shares outstanding by splitting existing shares into a greater quantity. This strategy aims to make the stock more affordable and accessible to a wider range of investors, potentially increasing liquidity and market participation. 3. Reverse Stock Split Recapitalization: In contrast to a stock split, a reverse stock split involves consolidating existing shares to decrease the quantity. This method is often employed to raise the per-share value of the stock, which can attract specific investors or meet certain exchange listing requirements. 4. Convertible Debt Recapitalization: This involves issuing bonds or other debt instruments that can be converted into equity at a later date. Convertible debt recapitalization enables companies to meet immediate funding requirements while providing an option to convert debt into equity if certain conditions are met, offering flexibility and potential benefits to both stockholders and the organization. It is crucial for stockholders to review the accompanying materials related to the recapitalization plan before attending the meeting. Such materials typically include a detailed explanation of the proposed plan, potential impact on the company's financials, and the rationale behind the decision. Stockholders are encouraged to engage actively during the meeting, participate in discussions, ask questions, and cast their votes on the proposed recapitalization plan. Their input and decisions play a significant role in shaping the future direction and financial structure of the company. By providing a detailed description of the Suffolk New York Notice of Special Stockholders' Meeting to Consider Recapitalization, this content aims to inform and prepare stockholders for this significant event, enabling them to make well-informed decisions aligned with their investment interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Aviso de Junta Extraordinaria de Accionistas para Considerar Recapitalización - Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

How to fill out Suffolk New York Aviso De Junta Extraordinaria De Accionistas Para Considerar Recapitalización?

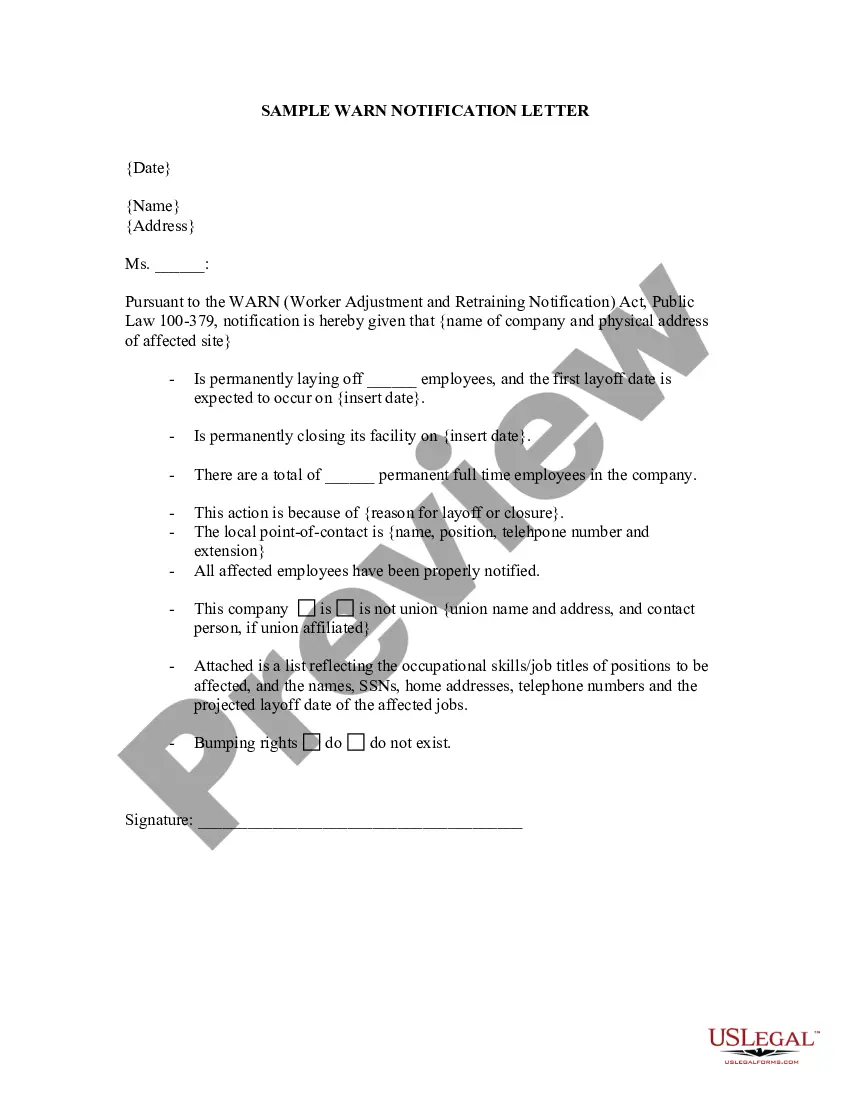

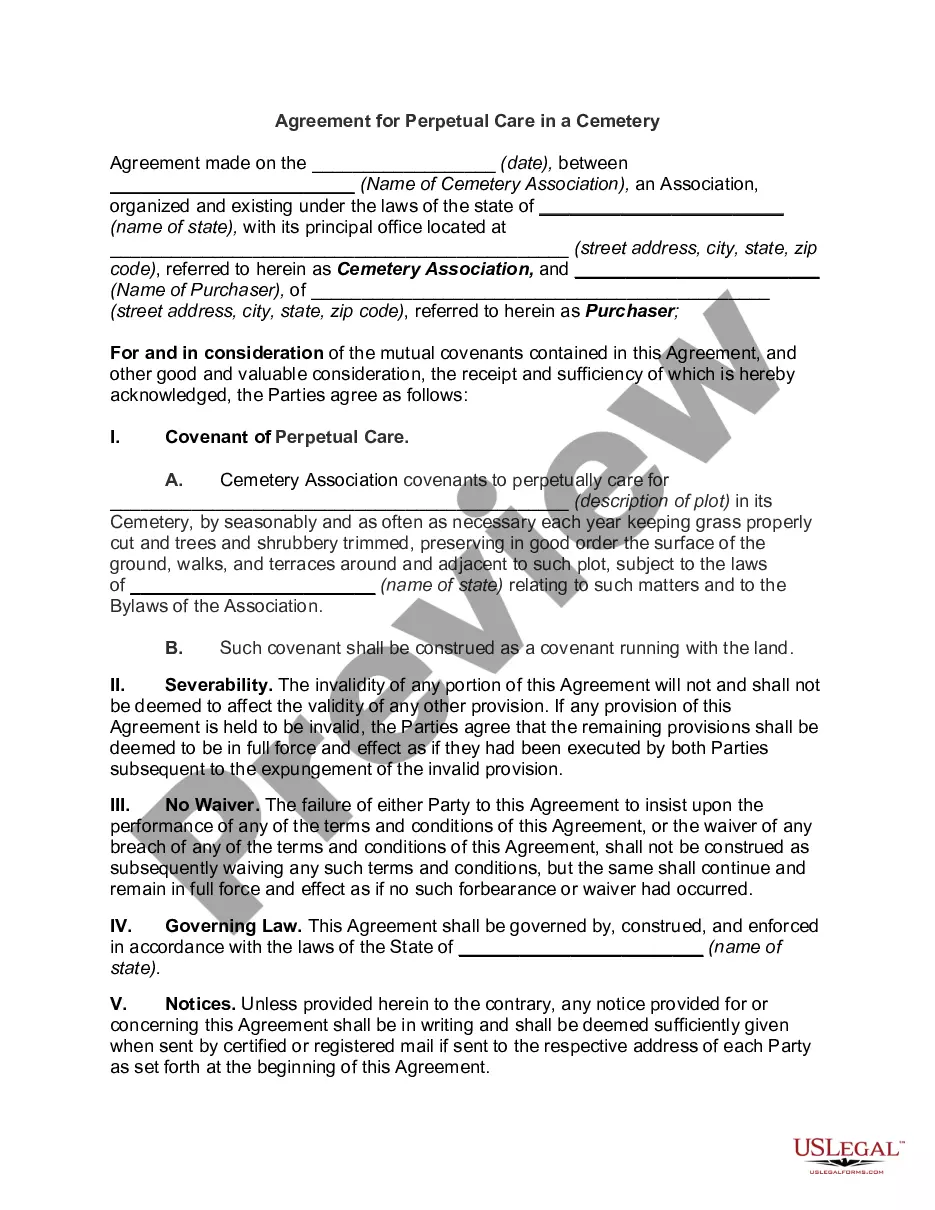

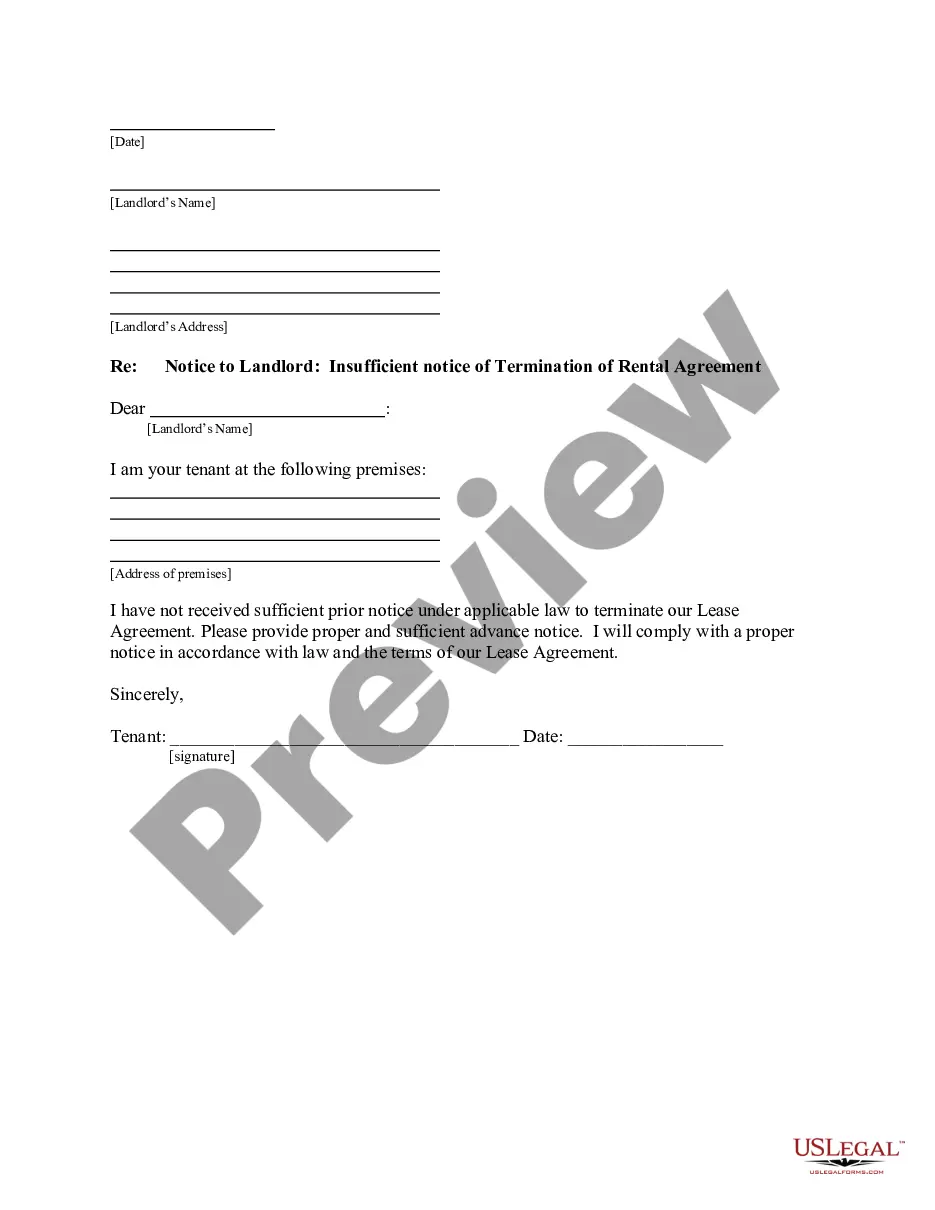

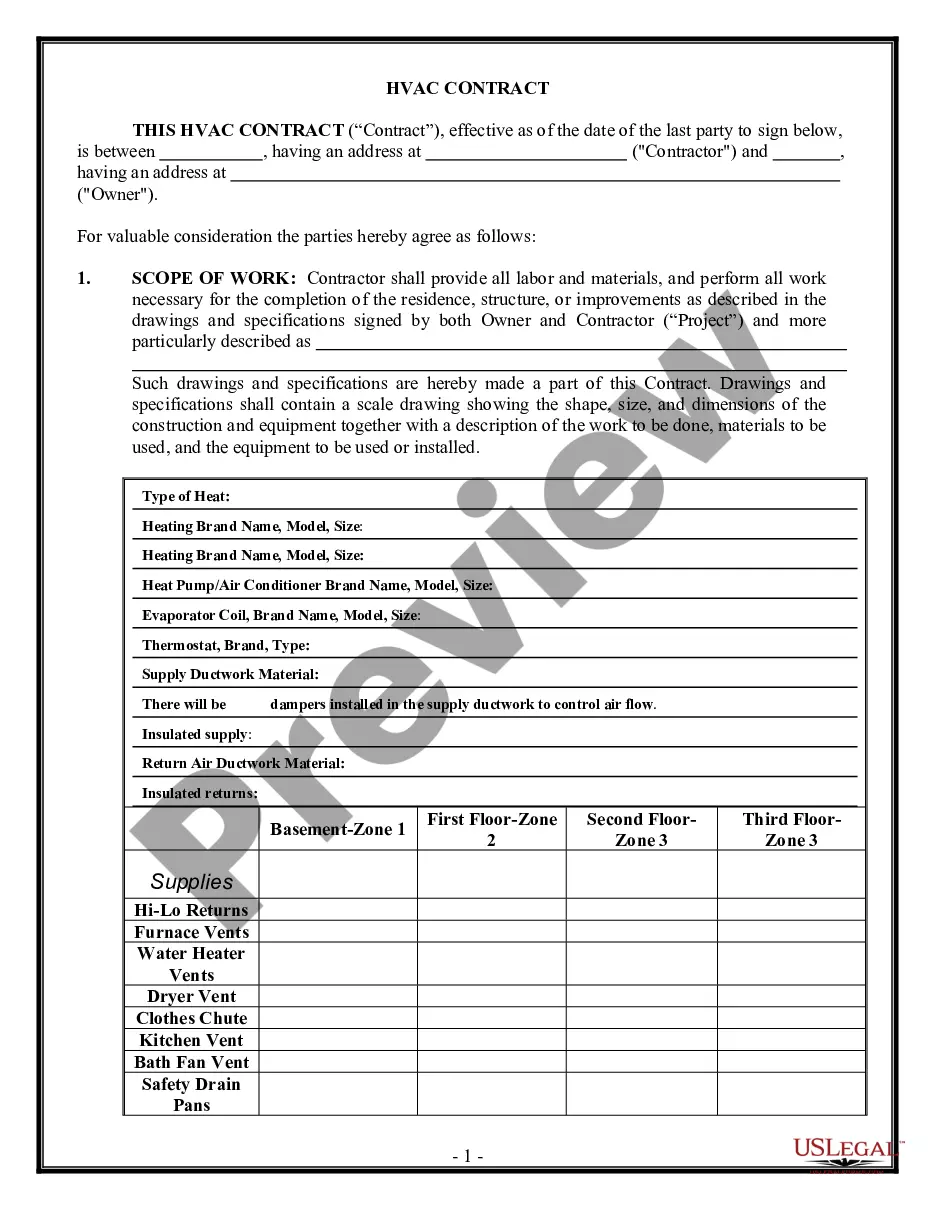

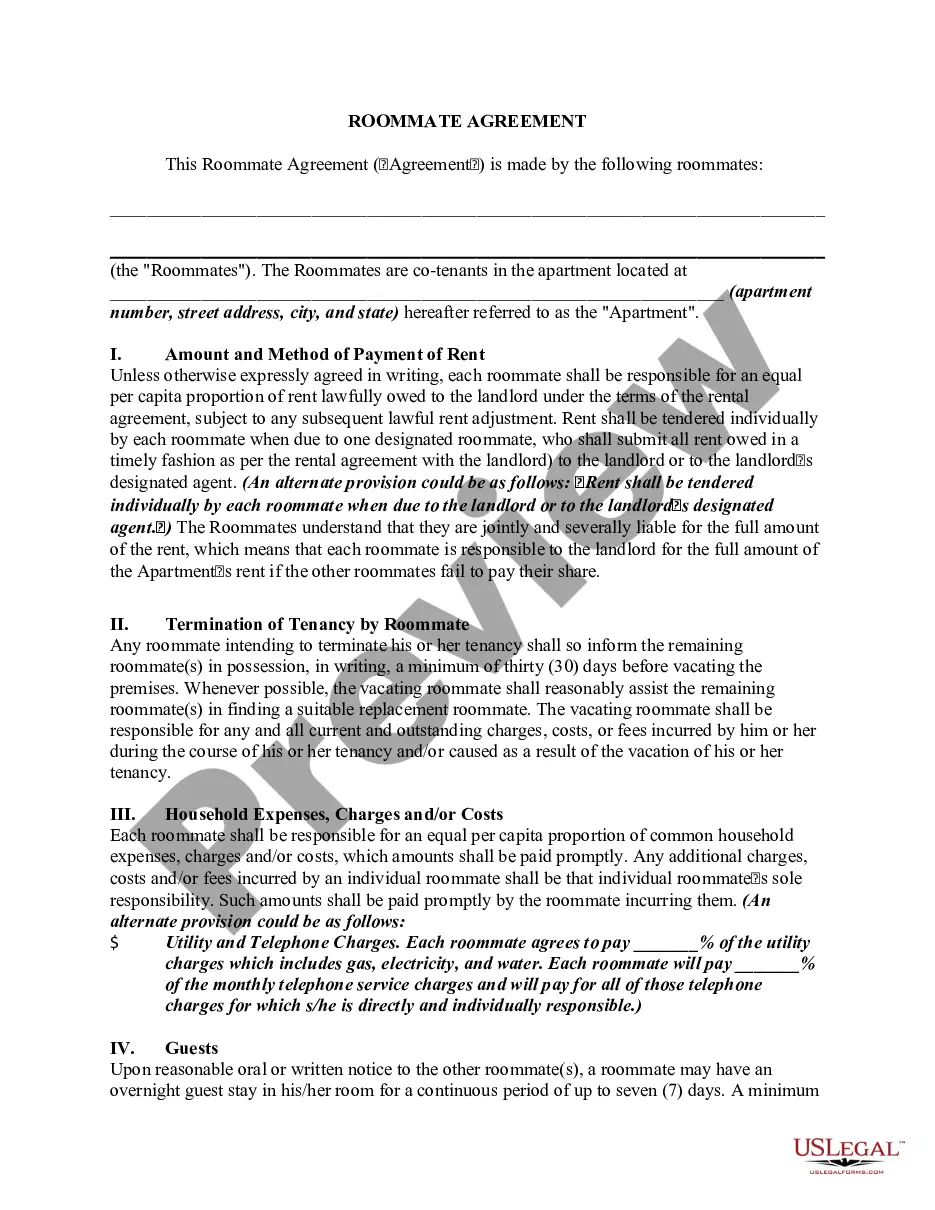

If you need to get a reliable legal document provider to find the Suffolk Notice of Special Stockholders' Meeting to Consider Recapitalization, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning resources, and dedicated support make it easy to locate and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Suffolk Notice of Special Stockholders' Meeting to Consider Recapitalization, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Suffolk Notice of Special Stockholders' Meeting to Consider Recapitalization template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first business, organize your advance care planning, create a real estate contract, or complete the Suffolk Notice of Special Stockholders' Meeting to Consider Recapitalization - all from the comfort of your sofa.

Join US Legal Forms now!