Keywords: Kings New York, Defined-Benefit Pension Plan, Trust Agreement, types The Kings New York Defined-Benefit Pension Plan and Trust Agreement is a comprehensive retirement plan offered by Kings New York, a company based in New York. This plan ensures that employees have a secure financial future by providing them with a consistent income stream during their retirement years. This plan is structured as a defined-benefit pension, which means that the amount of retirement income is predetermined based on factors such as salary history, years of service, and age at retirement. It offers an attractive alternative to defined-contribution plans, where the retirement income is dependent on employee and employer contributions and investment returns. The Kings New York Defined-Benefit Pension Plan and Trust Agreement is designed to provide employees with a secure and predictable source of income upon retirement. It is managed by a trust agreement, which acts as a legal framework for the administration and distribution of pension benefits. There may be different types of Kings New York Defined-Benefit Pension Plan and Trust Agreements available. These may include variations based on employee groups, such as unionized and non-unionized staff. Each type of plan may have specific provisions tailored to the unique needs and circumstances of eligible employees. Employees who participate in the Kings New York Defined-Benefit Pension Plan and Trust Agreement contribute a percentage of their salary throughout their employment. The employer may also make contributions to the plan on behalf of the employee. These contributions are then invested by professional fund managers, with the goal of maximizing investment returns to meet future pension obligations. Under the Kings New York Defined-Benefit Pension Plan and Trust Agreement, employees are guaranteed a specific amount of retirement income based on a predetermined formula. This formula typically takes into account factors such as the employee's average salary during the final years of employment and the number of years of service. Upon reaching the retirement age specified by the plan, employees are eligible to receive retirement benefits for the rest of their lives. The Kings New York Defined-Benefit Pension Plan and Trust Agreement may also offer additional provisions, such as survivor benefits for the employee's spouse or dependents. In summary, the Kings New York Defined-Benefit Pension Plan and Trust Agreement is a retirement plan offered by Kings New York, which provides employees with a predictable and secure income during their retirement years. This plan is managed through a trust agreement and may have different variations based on employee groups. Participating employees contribute a portion of their salary, and the employer may also contribute. The plan guarantees a specific retirement income based on predetermined factors, and additional provisions may be included.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Plan de Pensiones de Beneficio Definido y Contrato de Fideicomiso - Defined-Benefit Pension Plan and Trust Agreement

Description

How to fill out Kings New York Plan De Pensiones De Beneficio Definido Y Contrato De Fideicomiso?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Kings Defined-Benefit Pension Plan and Trust Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Kings Defined-Benefit Pension Plan and Trust Agreement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Kings Defined-Benefit Pension Plan and Trust Agreement:

- Look through the page and verify there is a sample for your region.

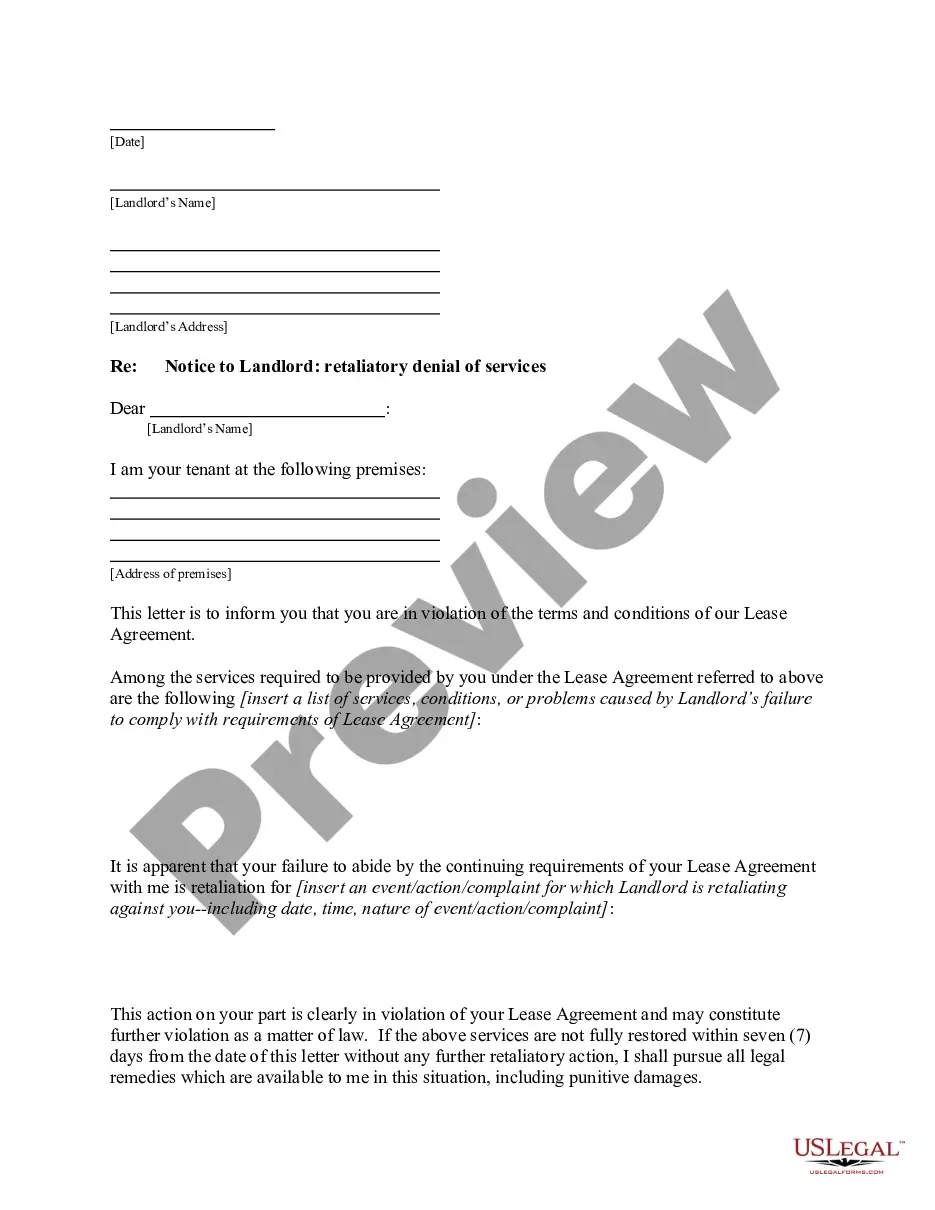

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Kings Defined-Benefit Pension Plan and Trust Agreement and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!