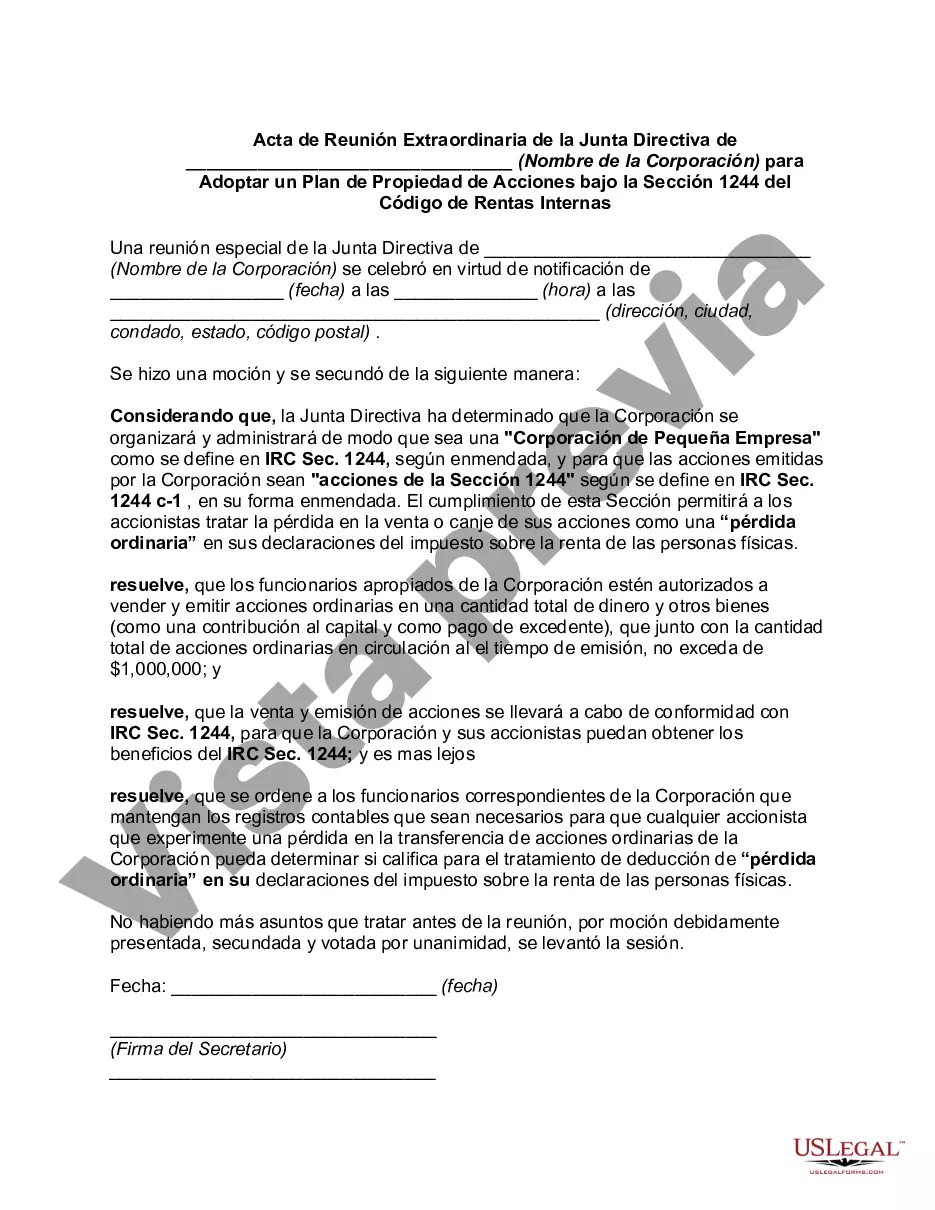

Chicago, Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code Keywords: Chicago, Illinois, Special Meeting, Board of Directors, Stock Ownership Plan, Section 1244, Internal Revenue Code Minutes of the Special Meeting of the Board of Directors (Name of Corporation) Date: [Enter Date] Location: [Enter Location] I. Call to Order The special meeting of the Board of Directors of (Name of Corporation) was called to order by [Chairperson's Name] at [Enter Time]. II. Roll Call The following members of the Board of Directors were present: 1. [Director's Name] 2. [Director's Name] 3. [Director's Name] ... [Provide a complete list of the directors present] III. Purpose of the Meeting The Chairperson introduced the purpose of the meeting, which was to discuss and adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. IV. Presentation of Stock Ownership Plan [Enter Name and Position of Presenter], [Enter Company's Name], presented an overview of the proposed Stock Ownership Plan. The plan outlined the benefits, structure, and goals of the plan, emphasizing compliance with Section 1244 of the Internal Revenue Code. V. Discussion The Board of Directors engaged in a comprehensive discussion regarding the Stock Ownership Plan, focusing on the potential impact on shareholders, tax implications, and alignment with the company's long-term growth objectives. Various questions were raised, and concerns were addressed by the presenter. VI. Resolution to Adopt the Stock Ownership Plan After thorough deliberation, the Board of Directors unanimously agreed to adopt the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The resolution reads as follows: "Resolved, that the Board of Directors of (Name of Corporation) hereby approves the adoption of the Stock Ownership Plan as presented, in accordance with Section 1244 of the Internal Revenue Code." VII. Adjournment With no further business to discuss, the meeting was adjourned at [Enter Time]. Approved by: [Signature of Chairperson] [Printed Name of Chairperson] [Date] [Signature of Secretary] [Printed Name of Secretary] [Date] Types of Chicago, Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code: 1. Regular Special Meeting: A regular special meeting called by the Board of Directors to discuss and adopt the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. This typically occurs during the standard course of business. 2. Emergency Special Meeting: An emergency special meeting triggered by unforeseen circumstances, where prompt action is necessary to address urgent matters related to the adoption of the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. 3. Annual General Meeting: A yearly gathering of the Board of Directors to review the overall performance of the company and subsequent adoption of the Stock Ownership Plan, conforming to Section 1244 of the Internal Revenue Code.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Chicago Illinois Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

If you need to get a trustworthy legal paperwork provider to find the Chicago Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it easy to find and complete different documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Chicago Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, either by a keyword or by the state/county the document is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Chicago Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate agreement, or complete the Chicago Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code - all from the comfort of your home.

Sign up for US Legal Forms now!