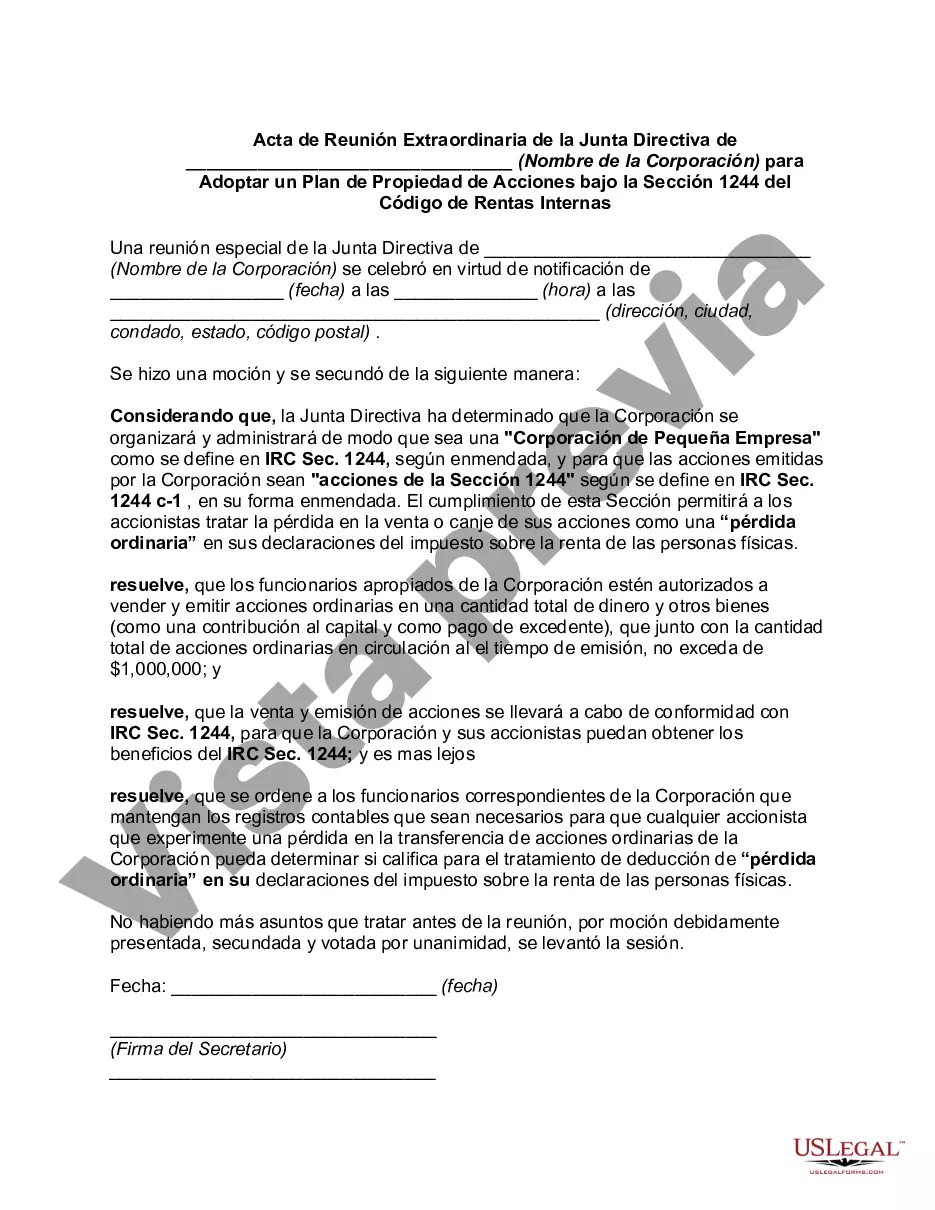

Cuyahoga County, Ohio, is located in the northeastern part of the state and is the most populous county in Ohio. Its county seat is Cleveland, a major city known for its industrial history and vibrant cultural scene. Cuyahoga County, often referred to as simply Cuyahoga, is home to a diverse population and offers a rich mix of urban, suburban, and rural areas. The Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code are formal records that document the board's decision to implement a stock ownership plan under a specific section of the Internal Revenue Code. The stock ownership plan is designed to provide certain tax advantages for shareholders of the corporation. Section 1244 of the Internal Revenue Code allows individuals to treat losses from the sale or exchange of their stock as ordinary losses, rather than capital losses, providing potential tax benefits. By adopting this plan, the corporation aims to incentivize stock ownership and encourage investment in its business. The minutes will typically contain the date, time, and location of the meeting, as well as a list of attendees, including the members of the board of directors. The minutes will also include a detailed description of the discussions that took place during the meeting, including any presentations or reports provided by company officials or consultants. The minutes may cover topics such as the reasons for adopting the stock ownership plan, the specific provisions of the plan, and the potential impact on the corporation and its shareholders. The board may discuss the eligibility criteria for participation, the allocation of stock, voting rights, transfer restrictions, and any other relevant details. Various types of Cuyahoga Ohio Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code can be named based on the specific corporation or industry. For example, the minutes could be generated for a manufacturing company, a technology startup, a healthcare organization, or any other type of corporation seeking to implement a stock ownership plan. In conclusion, the Cuyahoga Ohio Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code serve as important documentation of the board's decision to implement a stock ownership plan with potential tax advantages for the corporation and its shareholders. These minutes outline the key discussions and decisions made during the meeting, providing a comprehensive record of the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Cuyahoga Ohio Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

If you need to find a reliable legal paperwork supplier to find the Cuyahoga Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support team make it easy to locate and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to look for or browse Cuyahoga Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, either by a keyword or by the state/county the form is intended for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Cuyahoga Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less costly and more affordable. Set up your first business, organize your advance care planning, draft a real estate agreement, or complete the Cuyahoga Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code - all from the comfort of your home.

Join US Legal Forms now!