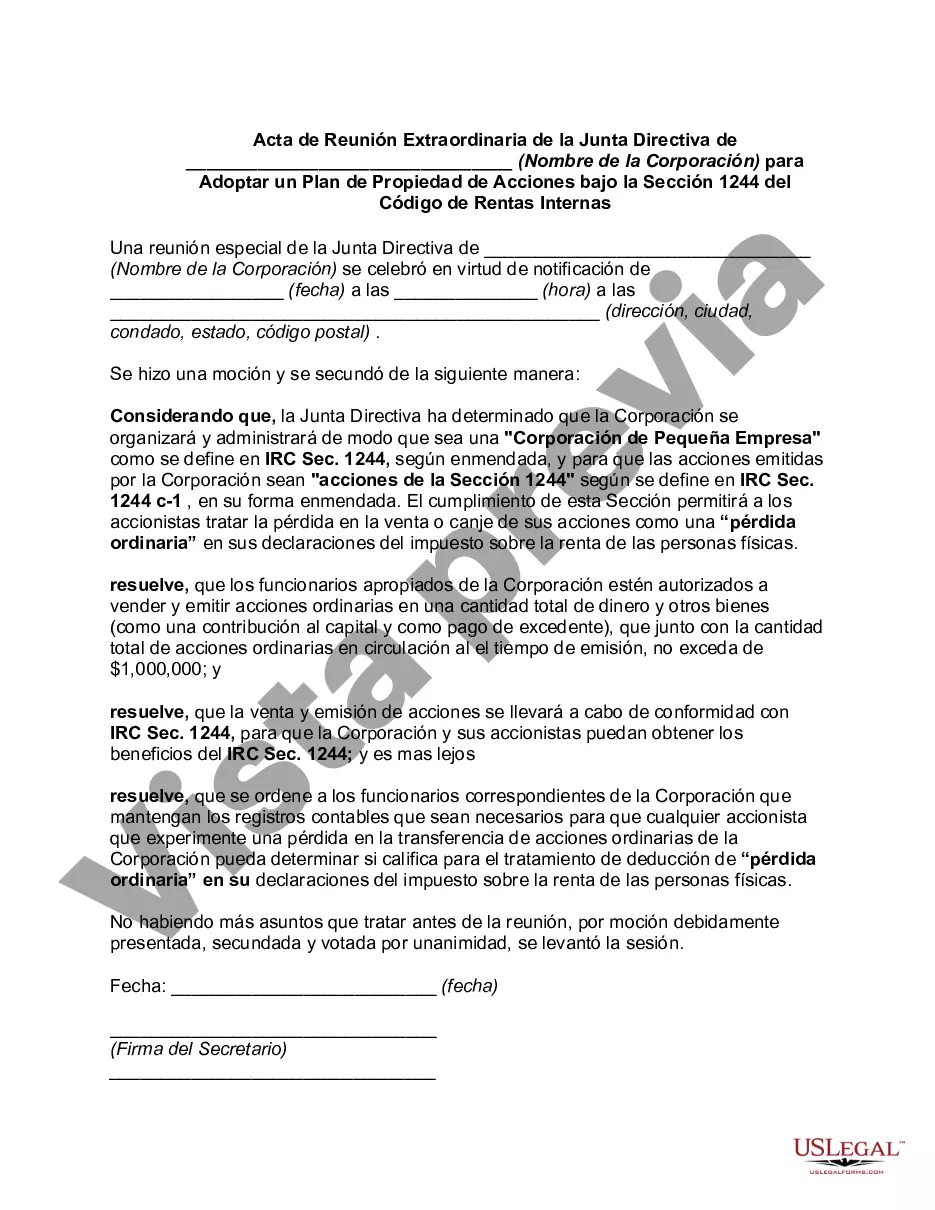

Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code Date: [Date of the meeting] Time: [Time of the meeting] Location: [Location of the meeting] Attendees: 1. [Name of Director] 2. [Name of Director] 3. [Name of Director] 4. [Name of Director] Agenda: 1. Call to Order 2. Roll Call 3. Approval of Agenda 4. Adoption of Stock Ownership Plan 5. Discussion on Section 1244 of the Internal Revenue Code 6. Voting on Stock Ownership Plan adoption 7. Any Other Business 8. Adjournment Meeting Proceedings: 1. Call to Order The meeting was called to order at [Time] by [Name of Director], the Chairman of the Board of Directors. 2. Roll Call All directors were present, as listed in the attendees section. 3. Approval of Agenda The agenda for the meeting was presented and approved without any modifications. 4. Adoption of Stock Ownership Plan The purpose of this special meeting was to discuss and subsequently adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code for (Name of Corporation). The Board of Directors reviewed the proposed plan, which aims to provide tax benefits to shareholders who invest in qualifying small business stock, as defined by the IRC Section 1244 guidelines. 5. Discussion on Section 1244 of the Internal Revenue Code The Board members engaged in a comprehensive discussion regarding the provisions and requirements of Section 1244 of the Internal Revenue Code. This section allows individuals to deduct the losses incurred from the sale or abandonment of small business stock as ordinary losses, subject to certain limitations outlined in the code. 6. Voting on Stock Ownership Plan adoption After careful consideration and discussion, the Board unanimously voted in favor of adopting the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The plan will be effective as of [Effective Date]. 7. Any Other Business No other business was brought up for discussion. 8. Adjournment With no further matters to discuss, the meeting was adjourned at [Time] by [Name of Director], the Chairman of the Board of Directors. These Minutes are hereby certified as a true and accurate record of the proceedings of the Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code. __________________________ [Name of Corporate Secretary] Types of Houston Texas Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code: 1. Initial Meeting: This type of meeting is called when the Stock Ownership Plan is proposed for the first time, seeking to establish the plan under Section 1244 of the Internal Revenue Code. 2. Annual Meeting: An annual special meeting is held to review the existing Stock Ownership Plan and make amendments or renew it in conformity with the changes in regulations or business requirements. 3. Amendment Meeting: This meeting type is organized when amendments or modifications need to be made to the existing Stock Ownership Plan under Section 1244 of the Internal Revenue Code. 4. Renewal Meeting: When the Stock Ownership Plan expires or needs to be renewed after a specific period, such as every five years, a renewal meeting is convened to discuss and adopt a renewed plan under Section 1244 of the Internal Revenue Code.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Houston Texas Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Houston Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Houston Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Houston Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code:

- Take a look at the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!