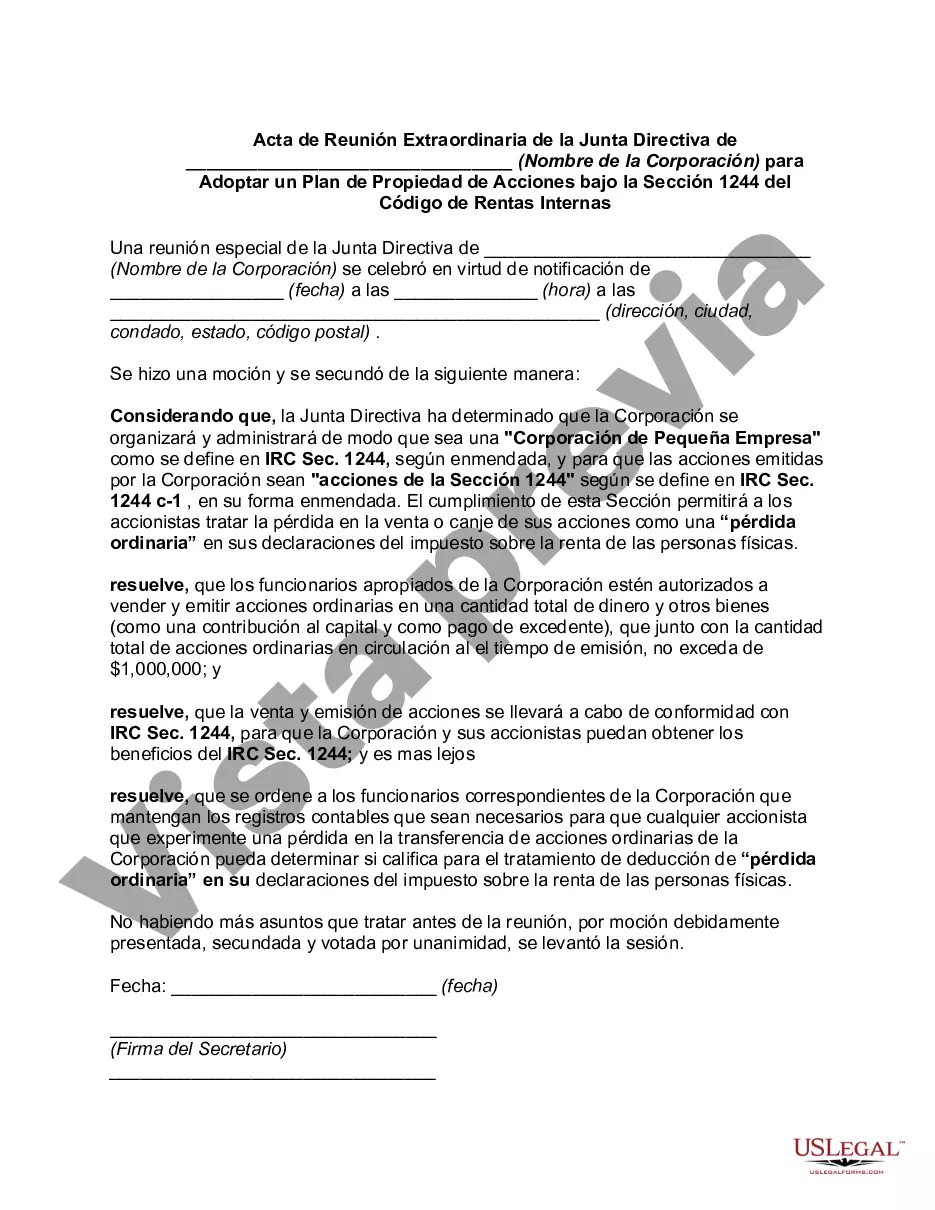

Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code: Phoenix Arizona Overview and Types Introduction: In the vibrant city of Phoenix, Arizona, the Board of Directors of (Name of Corporation) conducted a Special Meeting to consider and adopt a Stock Ownership Plan in accordance with Section 1244 of the Internal Revenue Code. This detailed description provides insight into the purpose, process, and benefits of such a plan in the context of Phoenix, Arizona. Purpose: The purpose of this Special Meeting was to discuss and formally adopt a Stock Ownership Plan. This plan allows for the issuance of shares of stock to various individuals, including employees, officers, or key stakeholders. Implementing this plan under Section 1244 of the Internal Revenue Code has specific benefits, such as tax advantages and potential loss deductions for qualifying stockholders. Stock Ownership Plan Types: 1. Employee Stock Ownership Plan (ESOP): SopsPs are a popular type of Stock Ownership Plan offered by corporations to their employees. — They ensure that employees can acquire shares of the corporation's stock, fostering employee ownership and motivation. SopsPs often provide retirement benefits and can align employee interests with corporate success. 2. Director Stock Ownership Plan: — Directed towards members of the Board of Directors, this plan aims to promote their commitment and long-term dedication to the corporation. — Directors may receive stock options or restricted stock units (RSS), enhancing their involvement and accountability. — These plans encourage decision-making with the company's best interests in mind, as directors have a personal stake in its success. 3. Executive Stock Ownership Plan: — Specifically designed for executives and high-level management, this plan serves as an incentive for exceptional performance and retention. — Executives may receive stock grants, stock options, or performance-based equity, ensuring alignment with shareholder interests. — Such plans aim for long-term commitment, encouraging executives to contribute to the corporation's growth and profitability. Process of Adoption: During the Special Meeting, the Board of Directors discussed the details and benefits of the proposed Stock Ownership Plan. Relevant considerations included the objectives of the plan, eligibility criteria, valuation guidelines, vesting schedules, and potential tax implications under Section 1244 of the Internal Revenue Code. The board reviewed and approved the drafted plan, incorporating provisions suitable for the corporation's unique needs. After thorough examination and discussions, a majority vote was cast, formalizing the adoption of the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. Conclusion: The adoption of a Stock Ownership Plan under Section 1244 of the Internal Revenue Code by the Board of Directors of (Name of Corporation) in Phoenix, Arizona, represents a significant step towards aligning the interests of all stakeholders and fostering long-term commitment to the corporation's success. By providing the aforementioned plan types, including the Employee Stock Ownership Plan (ESOP), Director Stock Ownership Plan, and Executive Stock Ownership Plan, this corporation can gain numerous benefits and harness the collective drive of individuals invested in its prosperity.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Phoenix Arizona Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life scenario, finding a Phoenix Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Phoenix Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Phoenix Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Phoenix Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!