San Diego, California: Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code The following are the minutes of the special meeting of the Board of Directors of (Name of Corporation) held at (Location) on (Date) regarding the adoption of a stock ownership plan under Section 1244 of the Internal Revenue Code. Attendees: 1. [Director's Name] 2. [Director's Name] 3. [Director's Name] 4. [Director's Name] 5. [Director's Name] Agenda: 1. Call to Order: The meeting was called to order by [Director's Name] at [Time]. Quorum declared with the presence of [Number] directors constituting a majority of the Board. 2. Approval of Agenda: The agenda for the meeting was presented and approved without modifications. 3. Purpose of the Meeting: The purpose of the meeting was to discuss and consider the adoption of a stock ownership plan under Section 1244 of the Internal Revenue Code. 4. Presentation and Discussion: [Name], [Title or Designation], presented a detailed overview of the proposed stock ownership plan. The plan aims to provide certain tax benefits to shareholders under Section 1244 of the Internal Revenue Code, which allows a portion of the loss from the sale or disposition of stock in a small business corporation to be treated as an ordinary loss rather than a capital loss. The presentation included aspects such as eligibility criteria, benefits, limitations, and potential tax advantages for existing and future shareholders of the corporation. The plan was designed to incentivize and reward long-term shareholders while attracting new investors. The Board engaged in a detailed discussion, addressing various concerns, potential impact on the corporation's financials, and compliance with regulatory requirements. 5. Resolution to Adopt the Stock Ownership Plan: Upon thorough consideration and discussion, a motion was made by [Director's Name] and seconded by [Director's Name] to adopt the stock ownership plan under Section 1244 of the Internal Revenue Code. Resolution: The Board of Directors hereby approves the adoption of the stock ownership plan under Section 1244 of the Internal Revenue Code, as presented, effective [Date]. Vote: In favor: [Director's Name], [Director's Name], [Director's Name], [Director's Name] Opposed: [Director's Name] Motion carried with a majority vote. 6. Adjournment: There being no further business to address, the meeting was adjourned at [Time]. __________________________ [Director's Name] Chairman of the Board __________________________ [Secretary's Name] Secretary Different Types of San Diego, California: Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code may include: 1. Regular Meeting Minutes: These minutes document the proceedings of the regularly scheduled meetings of the Board of Directors, excluding special or emergency meetings. 2. Annual Meeting Minutes: These minutes are specific to the annual meeting of the Board of Directors, which typically addresses matters such as election of officers, financial statements, and the overall business strategy. 3. Emergency Meeting Minutes: These minutes are prepared when the Board of Directors convenes on short notice to address urgent matters requiring immediate attention. It is essential to tailor the minutes to the specific type of meeting held and include all relevant details and discussions to accurately reflect the nature and outcome of the meeting.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out San Diego California Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

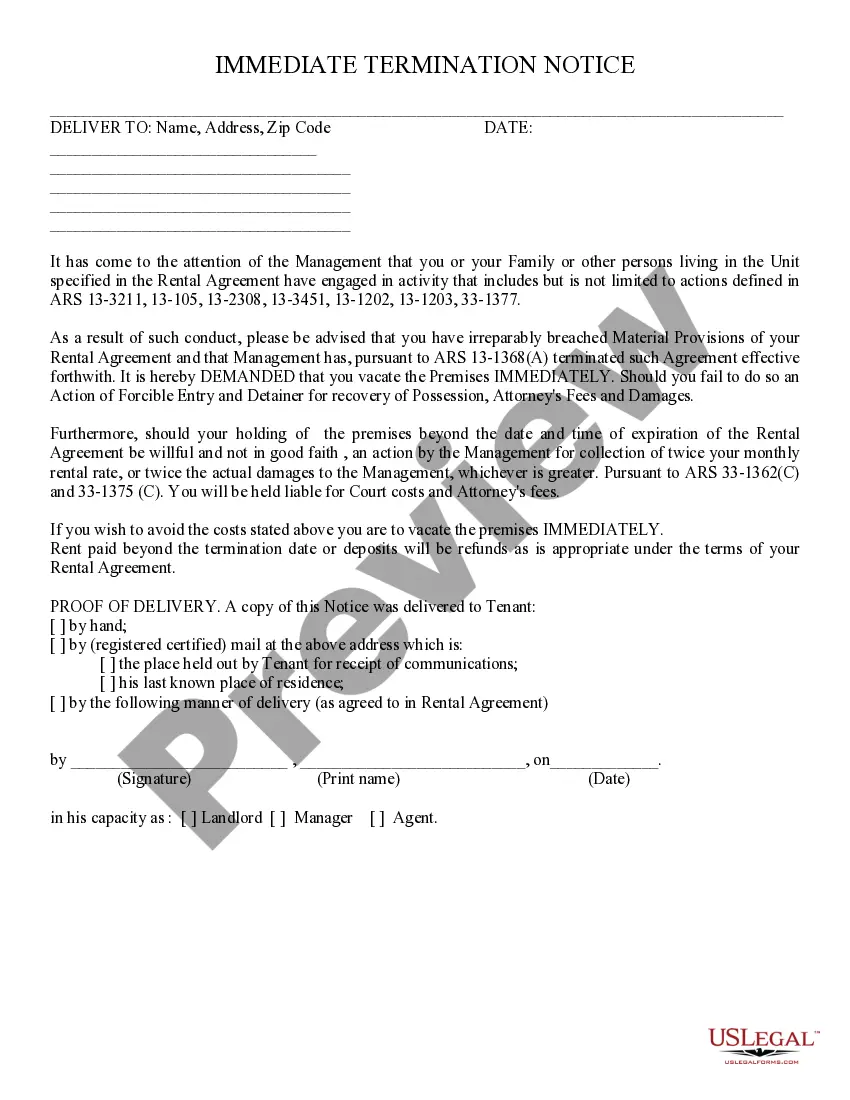

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life scenario, finding a San Diego Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code meeting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the San Diego Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your San Diego Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Diego Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!