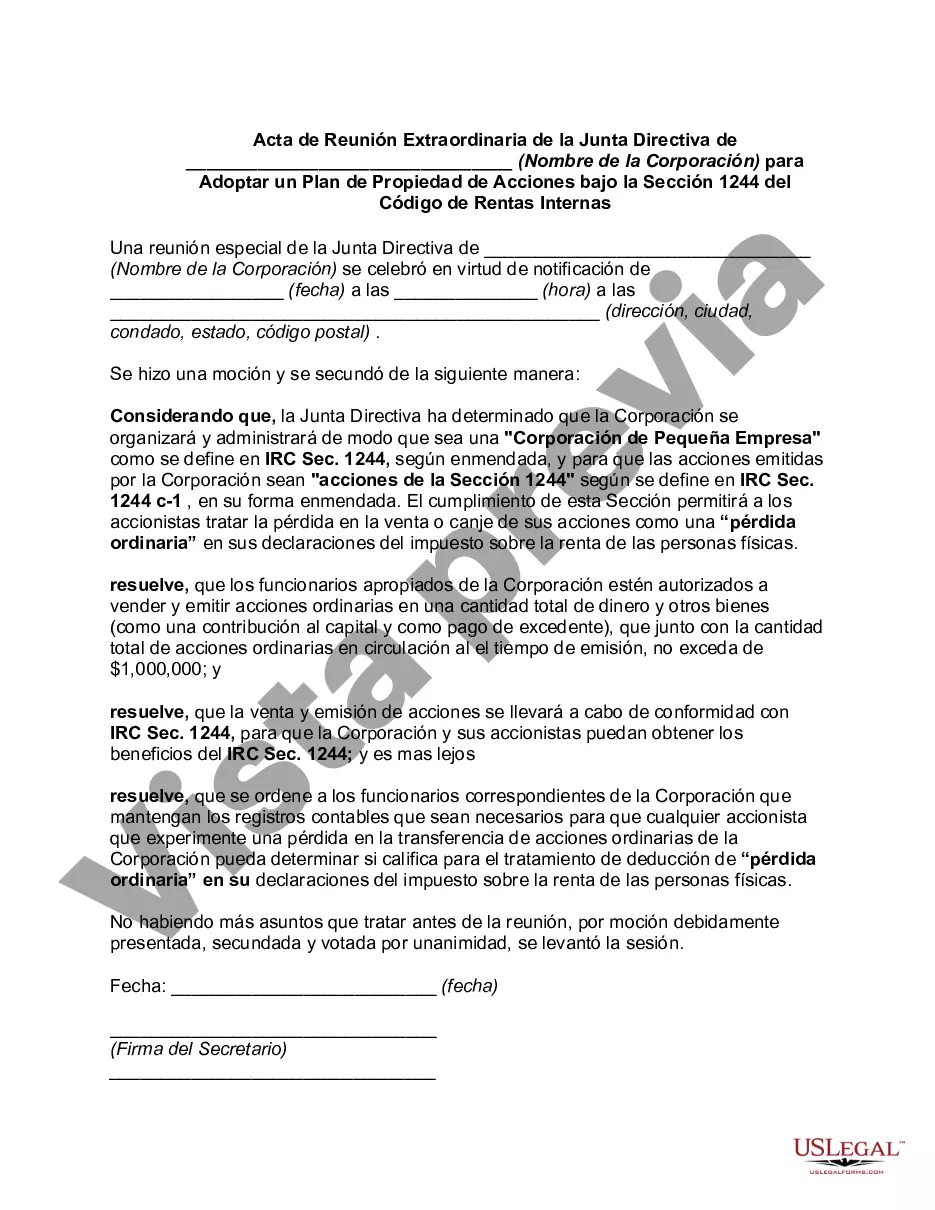

Travis Texas Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code provide a detailed account of a significant meeting held by the board of directors to discuss and implement a stock ownership plan. The minutes document the proceedings, decisions, and resolutions discussed during the meeting, ensuring legal compliance and transparency. This specialized meeting serves as a means for the board of directors to adopt a stock ownership plan under Section 1244 of the Internal Revenue Code. Section 1244 of the code offers tax benefits to shareholders if the corporation's stock meets specific criteria. The plan aims to promote employee ownership and incentivize long-term commitment by offering favorable tax treatment to eligible participants who hold qualified stock. The minutes outline the key areas discussed during the meeting: 1. Call to Order: The chairperson calls the meeting to order and verifies the presence of a quorum. 2. Approval of Agenda: The board approves the agenda, ensuring all key topics related to the adoption of the stock ownership plan are included. 3. Introduction and Background: The purpose and potential benefits of adopting a stock ownership plan under Section 1244 of the Internal Revenue Code are explained. The board considers the necessity and alignment of the plan with the corporation's strategic objectives and long-term goals. 4. Presentations and Discussions: Detailed presentations on the proposed stock ownership plan, its structure, eligibility criteria, benefits, and tax implications are provided by the executive team or consultants hired for this purpose. Board members actively participate in discussions, ask relevant questions, and seek clarifications. 5. Legal and Regulatory Review: The corporation's legal counsel or a tax specialist reviews the legal and regulatory requirements associated with a stock ownership plan under Section 1244 of the Internal Revenue Code. Compliance matters, including potential challenges, are thoroughly assessed and discussed by the board. 6. Resolutions: The board of directors votes on various resolutions, including the adoption of the stock ownership plan, approval of necessary legal documentation, designation of plan administrators, and any additional steps required for implementation. 7. Next Steps: The timeline, milestones, and responsibilities for the successful implementation of the stock ownership plan are discussed and decided upon by the board. It is important to note that the name of the corporation is not provided; therefore, the specific types of Travis Texas Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code cannot be identified without additional information. The minutes mentioned above are a generalized outline applicable to any corporation looking to adopt a stock ownership plan under Section 1244 of the Internal Revenue Code.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Travis Texas Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

Do you need to quickly draft a legally-binding Travis Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code or probably any other document to take control of your personal or business matters? You can go with two options: hire a legal advisor to draft a legal document for you or create it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you receive neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Travis Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, double-check if the Travis Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Travis Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Moreover, the paperwork we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!