The Allegheny Pennsylvania Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legally binding contract that outlines the specific terms and conditions governing the distribution of dividends among shareholders in a close corporation located in Allegheny, Pennsylvania. This specialized agreement helps establish a fair and efficient system for sharing company profits among shareholders. The shareholders' agreement is an essential document for close corporations as it ensures clarity and avoids potential disputes regarding the allocation of dividends. It outlines the rights and responsibilities of each shareholder, creating a framework within which the distribution of dividends can be managed. In Allegheny, Pennsylvania, there may be different variations of these shareholders' agreement, each tailored to meet the unique needs and preferences of the close corporation and its shareholders. These variations can include: 1. Proportional Allocation Agreement: This type of agreement distributes dividends among shareholders proportionally based on their ownership percentage in the corporation. For example, if a shareholder owns 30% of the company's shares, they will receive 30% of the dividends. 2. Preferred Allocated Dividends Agreement: In some cases, shareholders may have different classes of shares with varying entitlements. This agreement determines a specific allocation of dividends exclusively for preferred shareholders, providing them with priority over common shareholders. 3. Performance-based Allocation Agreement: This agreement incorporates performance metrics or specific criteria to determine how dividends are allocated among shareholders. Dividends may be distributed based on factors such as individual shareholder contributions, financial performance, or achievement of predetermined targets. 4. Fixed Allocation Agreement: In this type of agreement, a predetermined fixed amount or percentage is allocated to each shareholder as dividends. This ensures a predictable and consistent distribution, regardless of changes in shareholding or performance. 5. Combine Proportional and Fixed Allocation Agreement: This agreement combines elements of both proportional and fixed allocation. It may allocate a fixed amount or percentage of dividends to each shareholder while also distributing remaining dividends proportionally among shareholders based on their ownership percentage. These are just a few examples of the different types of Allegheny Pennsylvania Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation. The specific terms of the agreement will ultimately depend on the preferences and circumstances of the close corporation and its shareholders. It is essential to consult legal professionals specializing in corporate law to ensure the agreement is properly drafted and meets all legal requirements and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Pacto de Accionistas con Asignación Especial de Dividendos entre Accionistas en Sociedad Anónima Cerrada - Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Allegheny Pennsylvania Pacto De Accionistas Con Asignación Especial De Dividendos Entre Accionistas En Sociedad Anónima Cerrada?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Allegheny Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Allegheny Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Allegheny Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

- Ensure you have opened the correct page with your localised form.

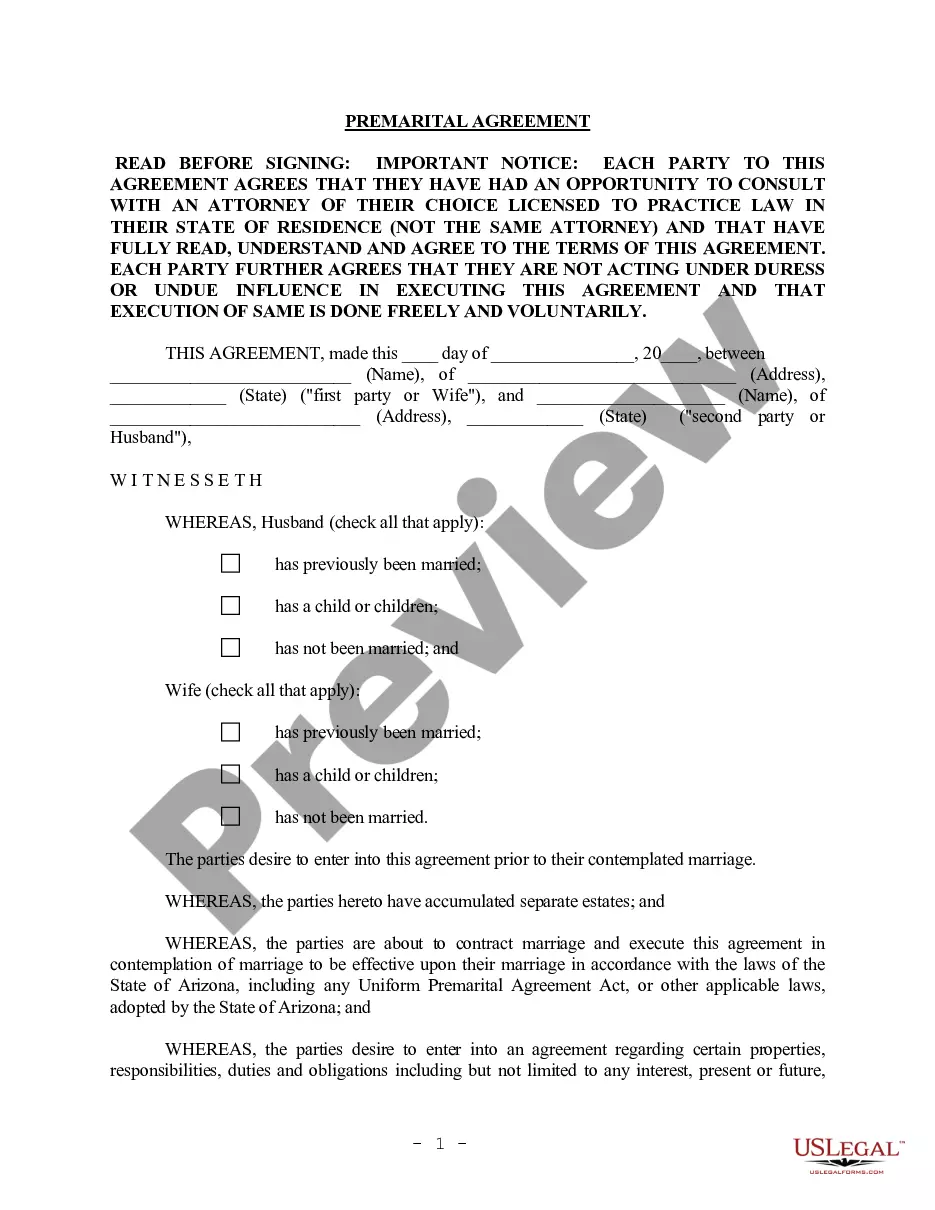

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Allegheny Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Existen dos tipos de acciones atendiendo a su tipologia. Acciones ordinarias: Otorgan a su poseedor el derecho a voto en las asambleas. Las asambleas anuales se denominan asambleas ordinarias.Acciones preferentes: Confiere a su titular un privilegio extra con respecto a las ordinarias, generalmente de tipo economico.

En las sociedades anonimas cerradas sus acciones no se transan en la bolsa de valores y la negociacion de sus acciones opera en transacciones privadas en un mercado privado.

La transferencia de acciones en este tipo de sociedades se realiza simplemente mediante un documento privado. Puede ser una compra venta o cualquier otra modalidad para transferir propiedades como una donacion por ejemplo. La entrega del Certificado de Acciones sera necesario en caso de haberse emitido los mismos.

Estas son la sociedad anonima cerrada (SAC) y la sociedad anonima abierta (SAA); instituciones de las que nos ocuparemos en las siguientes pagi- nas.

La Sociedad Anonima (S.A), es un tipo de Sociedad Mercantil Capitalista nacida para las grandes acumulaciones de capital. La Sociedad Anonima ordinaria tiene dos figuras especiales en el Peru: la sociedad anonima cerrada y la sociedad anonima abierta.

Partes sociales bastara con el consentimiento de los socios que representen la mayoria del capital social, excepto cuando los estatutos dispongan una proporcion mayor. la asamblea de socios, como organo supremo de la sociedad, esta facultado para consentir en las cesiones de las partes sociales (art.

El articulo 215 LGS expresamente dice: La transmision de las acciones nominativas (2026) debe notificarse por escrito a la sociedad emisora (2026) Surte efecto contra la sociedad y los terceros desde su inscripcion.

Tipos de empresa (Razon Social o Denominacion) Cantidad de Accionistas / SociosSociedad Anonima (S.A.)Minimo: 2 Maximo: ilimitadoSociedad Anonima cerrada (S.A.C.)Minimo: 2 Maximo: 20Sociedad Comercial de Responsabilidad Limitada (S.R.L.)Minimo: 2 Maximo: 202 more rows ?

3.1 Las sociedades anonimas En el ano investigado, el numero de empresas constituidas como sociedades anonimas ascendio a 241 mil 205, esta cifra represento un incremento de 8,7% respecto al ano anterior.

Transmision de acciones o participaciones antes de la inscripcion. Merc. Enajenacion de una, varias o todas las acciones de una sociedad anonima o comanditaria por acciones o de las participaciones sociales realizadas antes de la toma de razon de la sociedad en el Registro Mercantil o del aumento de capital.