Fairfax Virginia Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legal document that outlines the specific rights and obligations of shareholders in a privately held close corporation located in Fairfax, Virginia. This agreement is crucial for governing the internal workings, decision-making processes, and profit distribution methods among the shareholders. In a close corporation, which is typically a small business owned by a limited number of shareholders, the shareholders' agreement plays a significant role in establishing clear guidelines for profit allocation. This agreement allows the shareholders to customize the distribution of dividends based on various factors such as investment amounts, contribution to the company's success, or any other mutually agreed-upon criteria. The Fairfax Virginia Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation takes into account the unique needs and objectives of each particular company. It offers flexibility in designing dividend allocation methods that align with the shareholders' interests while maintaining fairness and equity. There are different types of Fairfax Virginia Shareholders' Agreements with Special Allocation of Dividends among Shareholders in a Close Corporation, including: 1. Proportional Ownership Agreement: This agreement distributes dividends based on the shareholders' proportional ownership in the company. For example, if a shareholder owns 40% of the company's shares, they will receive 40% of the declared dividends. 2. Performance-Based Agreement: This type of agreement allocates dividends based on the individual or group performance of the shareholders. It often includes specific performance metrics, such as revenue targets or profitability goals, to determine the share of dividends each shareholder receives. 3. Preferential Dividend Agreement: This agreement prioritizes certain shareholders to receive a higher dividend distribution compared to others. It may be based on specific circumstances, such as a shareholder's seniority, involvement in the company's management, or initial investment amount. 4. Fixed Rate Dividend Agreement: This type of agreement establishes a fixed dividend rate for each shareholder. It ensures that shareholders receive a predetermined percentage of profits as dividends regardless of individual circumstances or performance. 5. Hybrid Dividend Allocation Agreement: This agreement combines elements from different dividend allocation methods mentioned above. It allows for a more complex and customized distribution of dividends based on a combination of factors like ownership percentage, performance, and preferential treatment. It is important to note that the Fairfax Virginia Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation should be drafted by legal professionals well-versed in corporate law. Furthermore, it should also comply with the relevant local, state, and federal laws and regulations to ensure its enforceability and validity.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Pacto de Accionistas con Asignación Especial de Dividendos entre Accionistas en Sociedad Anónima Cerrada - Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Fairfax Virginia Pacto De Accionistas Con Asignación Especial De Dividendos Entre Accionistas En Sociedad Anónima Cerrada?

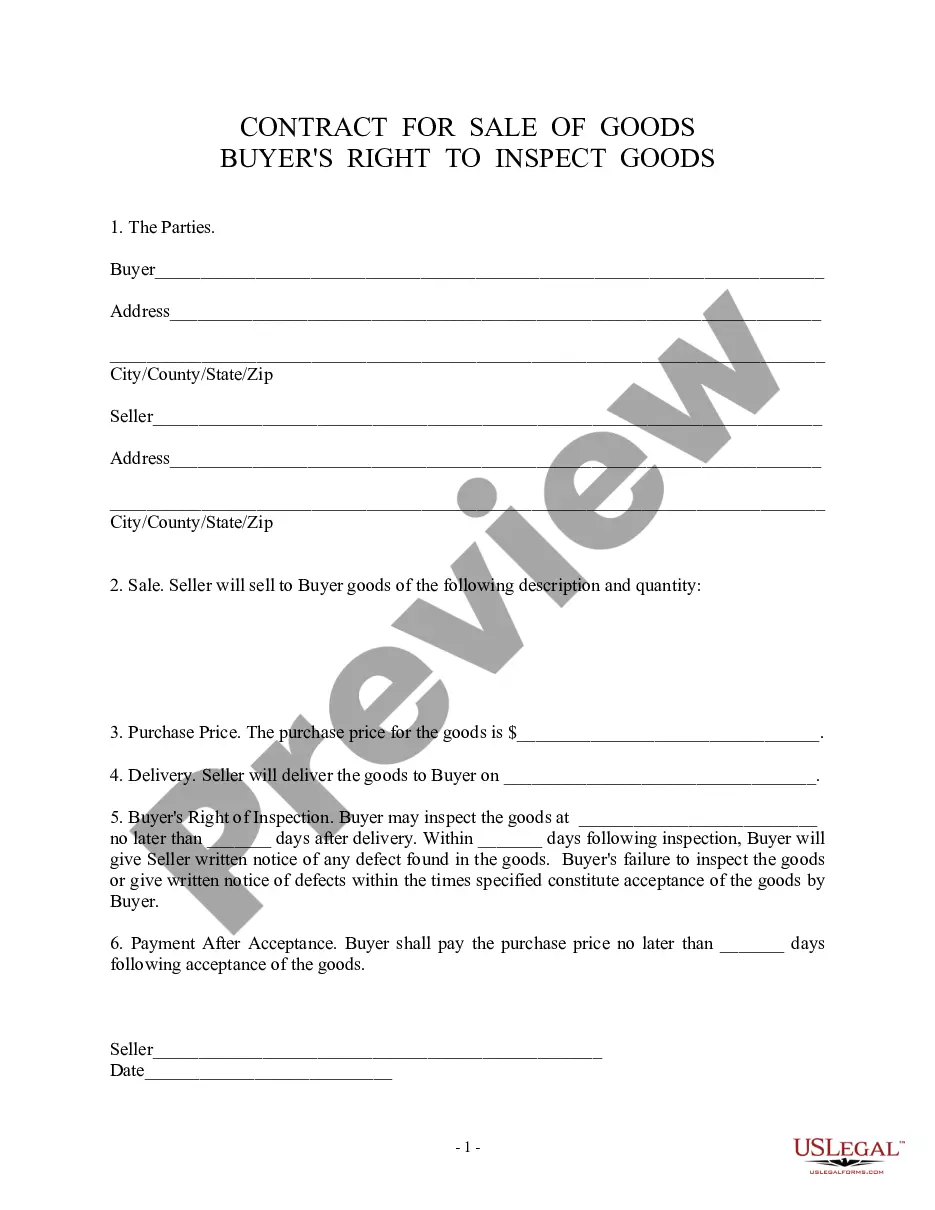

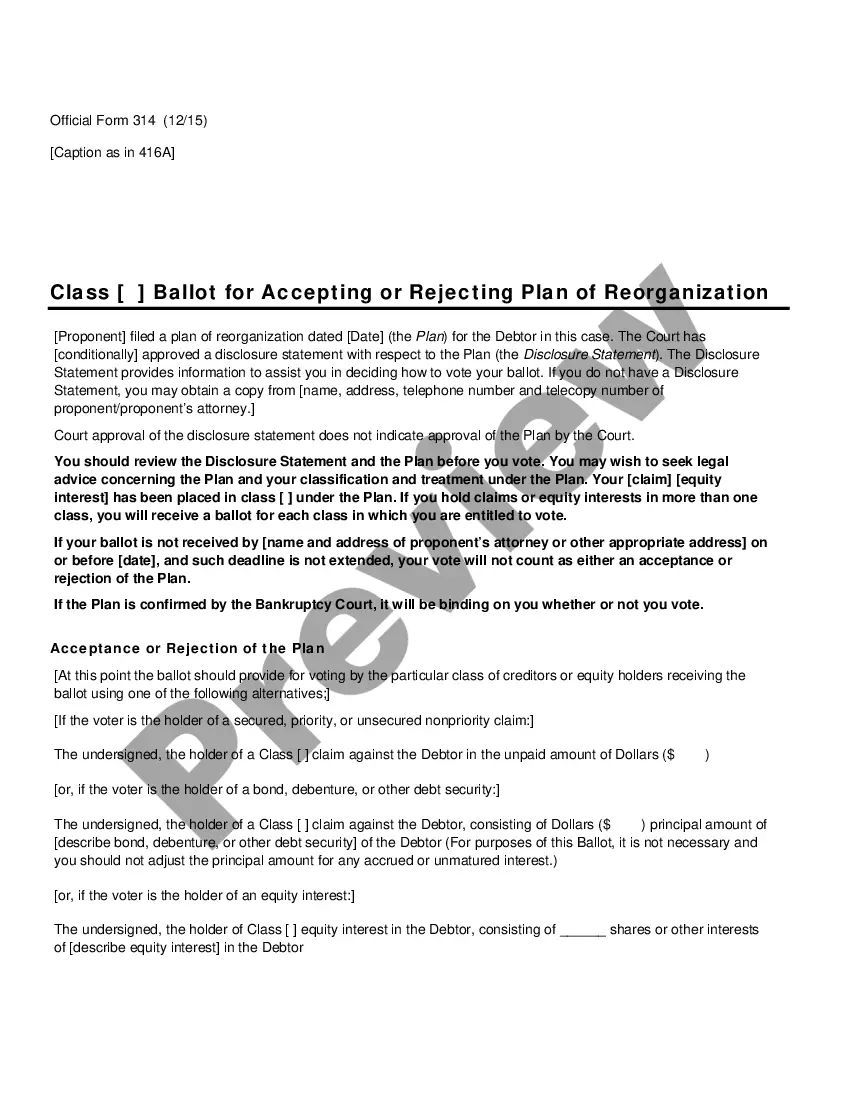

If you need to get a reliable legal form supplier to find the Fairfax Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to locate and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Fairfax Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Fairfax Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less costly and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or execute the Fairfax Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation - all from the convenience of your home.

Sign up for US Legal Forms now!