Franklin Ohio Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legal document that outlines the specific rights and responsibilities of shareholders in a close corporation based in Franklin, Ohio. This agreement deals specifically with the allocation of dividends among the shareholders in the corporation. The main purpose of this agreement is to establish a framework for the fair distribution of dividends based on certain predetermined criteria. It aims to protect the rights of shareholders and ensure that the allocation of dividends is done in a transparent and equitable manner. There may be different types of Franklin Ohio Shareholders' Agreements with Special Allocation of Dividends among Shareholders in a Close Corporation, depending on the specific needs and requirements of the shareholders involved. Some potential types of such agreements could include: 1. Percentage-based Allocation Agreement: This type of agreement specifies that dividends will be allocated to shareholders based on their percentage ownership in the corporation. For example, if a shareholder owns 30% of the company, they would receive 30% of the total dividend payout. 2. Preferred Shareholder Agreement: This type of agreement grants certain shareholders, usually those holding preferred shares, priority in the allocation of dividends. Preferred shareholders may receive their dividend payout before common shareholders or receive a fixed dividend amount regardless of the company's financial performance. 3. Performance-based Allocation Agreement: In this type of agreement, dividend allocation is based on the performance or contribution of each shareholder to the corporation. It may involve certain benchmarks or metrics to determine how dividends will be distributed. For instance, shareholders who actively contribute to the growth of the business or achieve specific targets may receive a higher allocation of dividends. 4. Proportional Investment Agreement: This agreement ties the allocation of dividends to the amount of capital invested by each shareholder. Shareholders who have made larger investments in the corporation would receive a proportional share of the dividend payout. 5. Board-approved Allocation Agreement: This type of agreement empowers the board of directors to determine the allocation of dividends among shareholders, based on their judgment and consideration of various factors. The board may consider financial performance, business strategies, and other relevant factors to decide on the dividend allocation. It is important for shareholders in a close corporation to have a detailed and well-drafted Shareholders' Agreement with a specific focus on the allocation of dividends. This agreement helps to avoid any conflicts or disputes among the shareholders and provides clarity and transparency in the process of dividend distribution.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Pacto de Accionistas con Asignación Especial de Dividendos entre Accionistas en Sociedad Anónima Cerrada - Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

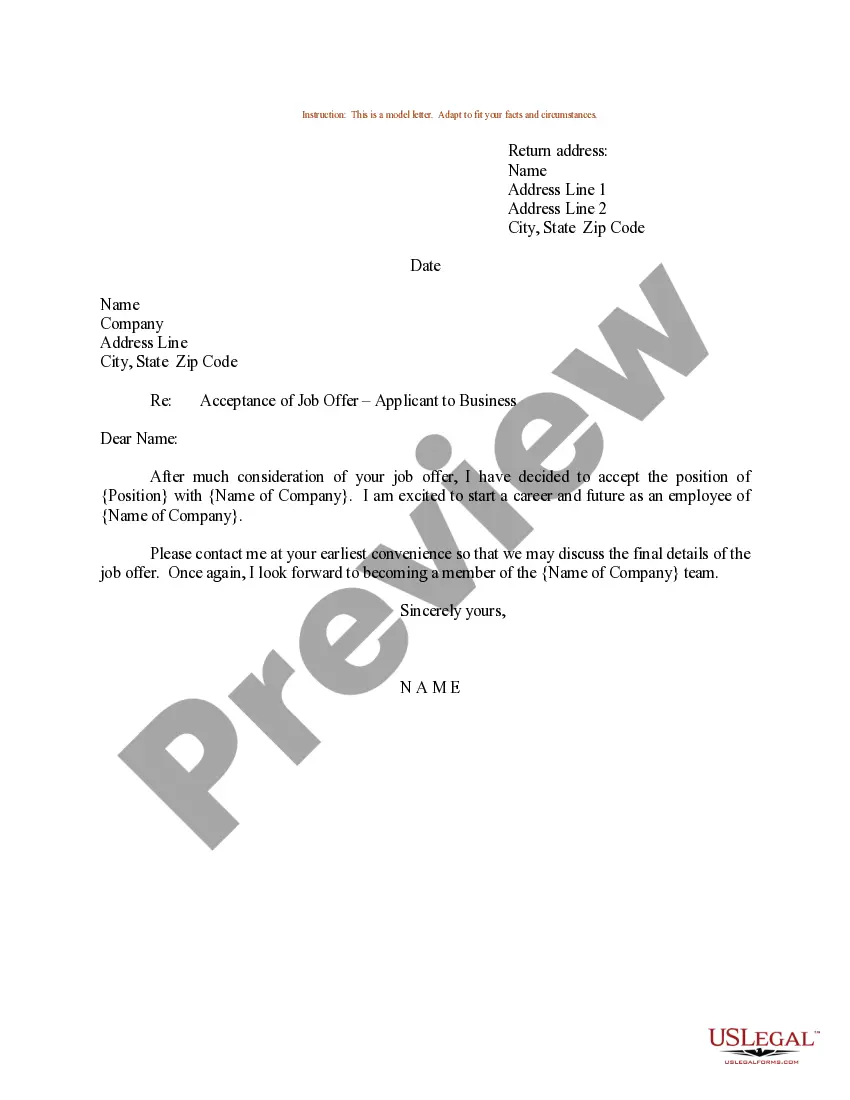

How to fill out Franklin Ohio Pacto De Accionistas Con Asignación Especial De Dividendos Entre Accionistas En Sociedad Anónima Cerrada?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the Franklin Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Franklin Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Franklin Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

- Make sure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Franklin Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!