Middlesex Massachusetts Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legally binding contract designed to outline the distribution of dividends among shareholders in a close corporation based in Middlesex, Massachusetts. This agreement ensures a fair and transparent process for dividing profits among the company's owners and promotes unity and mutual understanding within the corporation. Within the Middlesex Massachusetts Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, there may be different types based on specific conditions and preferences. These variations can include: 1. Proportionate Allocation: This type of agreement distributes dividends among shareholders based on their percentage ownership in the close corporation. For example, if a shareholder owns 30% of the company, they will receive 30% of the distributed dividends. 2. Preferred Allocation: In some cases, shareholders may have different classes of shares, such as preferred shares. This type of agreement outlines that preferred shareholders receive their dividends before common shareholders, ensuring a guaranteed return on their investment. 3. Fixed Allocation: A fixed allocation agreement specifies a predetermined dividend amount or percentage for each shareholder, regardless of their ownership percentage. This allocation method provides stability and predictability for shareholders, especially in cases where ownership percentages change over time. 4. Performance-Based Allocation: This agreement type considers specific performance criteria, such as meeting sales targets or achieving predetermined goals. Shareholders who contribute significantly to the growth and success of the corporation may receive a higher allocation of dividends as recognition for their efforts. 5. Voting Power Allocation: This variation takes into account both ownership percentage and voting power of the shareholders. Shareholders with higher voting power may be entitled to a higher allocation of dividends, giving them more control and influence within the close corporation. It is crucial for shareholders and the corporation to consult legal professionals experienced in corporate law to draft a tailored Middlesex Massachusetts Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation that aligns with the unique needs and dynamics of their specific business. Such an agreement ensures fairness, transparency, and a clear understanding of how dividends will be allocated among shareholders, ultimately promoting a cooperative and harmonious environment within the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Pacto de Accionistas con Asignación Especial de Dividendos entre Accionistas en Sociedad Anónima Cerrada - Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Middlesex Massachusetts Pacto De Accionistas Con Asignación Especial De Dividendos Entre Accionistas En Sociedad Anónima Cerrada?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Middlesex Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Middlesex Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Middlesex Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

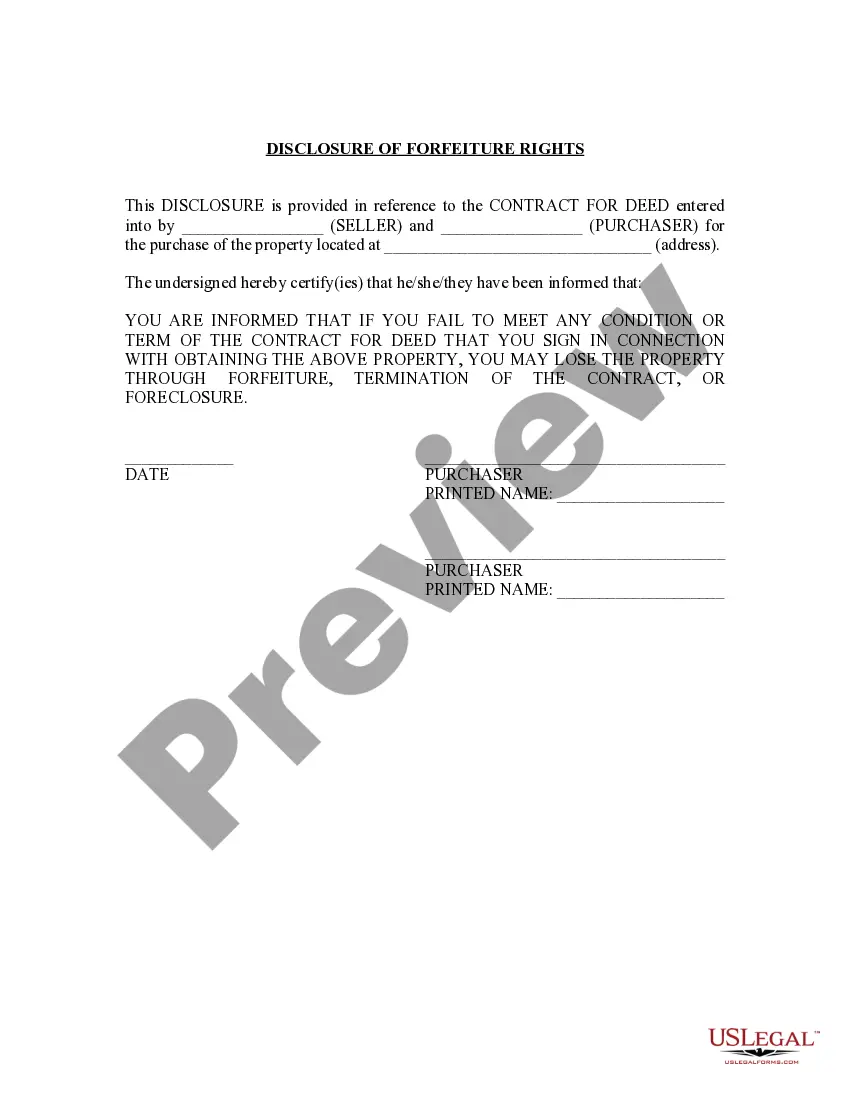

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!