Travis Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legal contract that outlines the terms and conditions regarding the allocation of dividends within a close corporation in the Travis County, Texas area. This agreement is designed to provide clear guidelines and protect the rights and interests of shareholders in the distribution of dividends. The Travis Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders may have different types, depending on the specific needs and objectives of the shareholders. Some potential types of agreements in this context could include: 1. Proportional Allocation Agreement: This type of agreement ensures that dividends are allocated to shareholders in proportion to their ownership percentage in the close corporation. It ensures fairness and transparency in the distribution process. 2. Preferred Shareholder Allocation Agreement: In some cases, certain shareholders may hold preferred shares that entitle them to receive dividends before common shareholders. This agreement outlines the specific allocation method for preferred shareholders, ensuring they receive their dividends as per their rights. 3. Performance-Based Allocation Agreement: This type of agreement incorporates performance metrics or specific criteria to determine the allocation of dividends. Shareholders who meet or exceed these criteria are entitled to a larger share of dividends, incentivizing and rewarding their contributions to the close corporation. 4. Fixed Dividend Allocation Agreement: Under this agreement, the allocation of dividends is predetermined and fixed. Each shareholder receives a predetermined amount or percentage of dividends, irrespective of their ownership percentage or other factors. 5. Hybrid Allocation Agreement: This type of agreement combines multiple allocation methods to suit the unique circumstances of the close corporation. It may incorporate elements of proportionality, preferred shareholder rights, performance-based metrics, or a fixed dividend allocation. The Travis Texas Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation seeks to provide a clear understanding of how dividends will be distributed, minimizing disputes and promoting harmony among shareholders. It typically covers aspects such as dividend declaration, timing of dividend distribution, rights of preferred shareholders (if applicable), dispute resolution procedures, and any other relevant provisions specific to the close corporation and its shareholders. Note: The information provided is for general informational purposes only and does not constitute legal advice. Consulting with a legal professional specializing in corporate law or business agreements is essential when drafting or entering into a Shareholders' Agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Pacto de Accionistas con Asignación Especial de Dividendos entre Accionistas en Sociedad Anónima Cerrada - Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Travis Texas Pacto De Accionistas Con Asignación Especial De Dividendos Entre Accionistas En Sociedad Anónima Cerrada?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Travis Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Travis Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Travis Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation:

- Examine the content of the page you’re on.

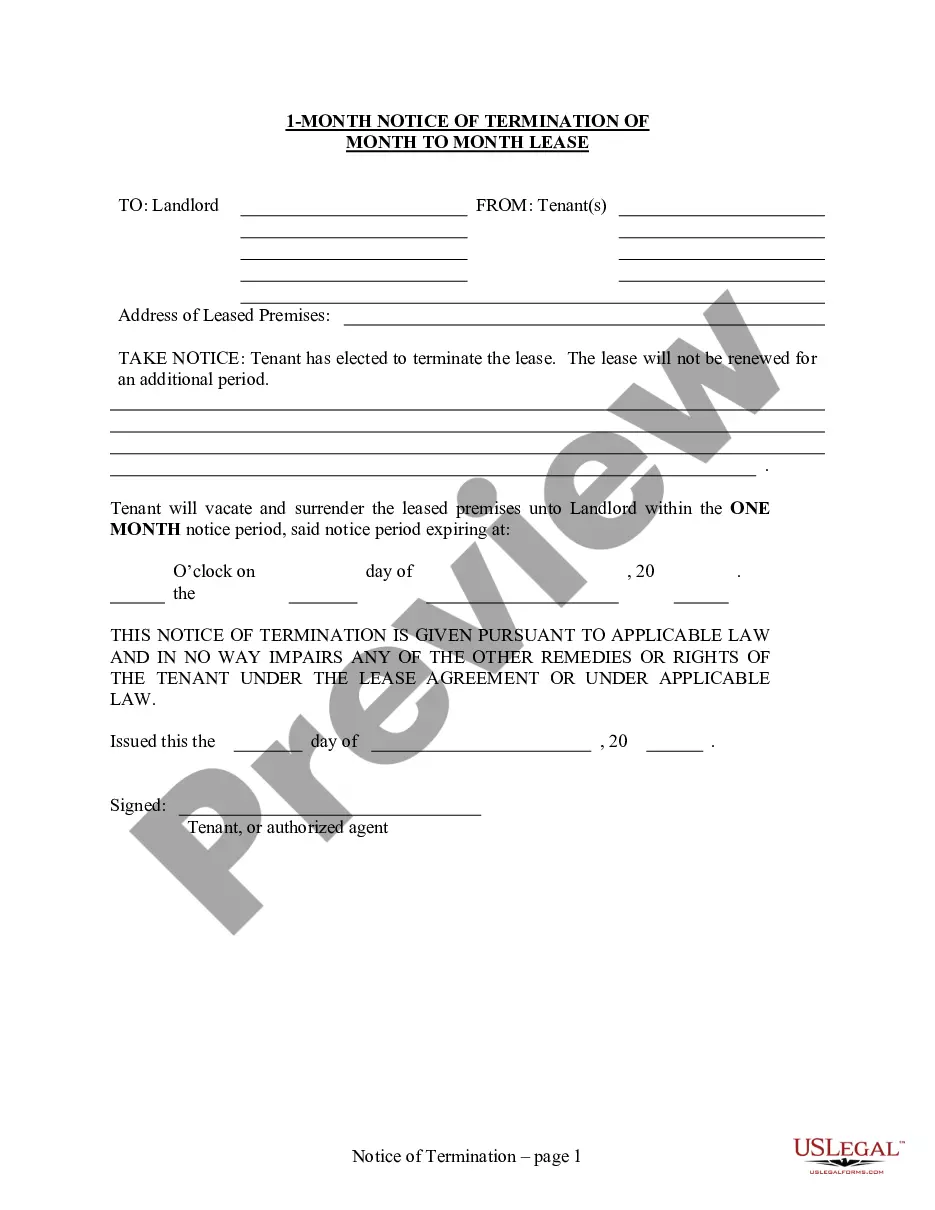

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Travis Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!