Cook Illinois Release from Liability under Guaranty is a legal document that serves as an agreement between two parties, where one party (the guarantor) agrees to assume responsibility for the obligations or liabilities of another party (the debtor). This document is commonly used in various business transactions to provide an additional layer of security and assurance to the creditor. The Cook Illinois Release from Liability under Guaranty acts as a safeguard for the creditor by offering legal recourse and financial protection should the debtor fail to fulfill their obligations. The guarantor essentially pledges to cover any debts or losses incurred by the debtor, ensuring that the creditor will receive their due payment or compensation. There are different types of Cook Illinois Release from Liability under Guaranty that may be encountered in various business scenarios. Some of these include: 1. Limited Guaranty: This form of guaranty places specific restrictions and limitations on the guarantor's liability. It outlines the scope and extent of the guarantor's obligations, providing protection for both parties involved. 2. Absolute Guaranty: In contrast to a limited guaranty, an absolute guaranty holds the guarantor fully responsible for all the debtor's obligations and liabilities. In this case, the guarantor assumes unlimited liability, ensuring maximum protection for the creditor. 3. Continuing Guaranty: A continuing guaranty remains in effect until it is specifically revoked or terminated by the guarantor. It covers ongoing or future transactions between the debtor and creditor, providing a continuous layer of protection. 4. Limited Recourse Guaranty: This type of guaranty establishes predetermined limits on the guarantor's liability. It specifies the maximum amount the guarantor is obligated to repay, minimizing their exposure. 5. Payment Guaranty: A payment guaranty focuses solely on the guarantor's commitment to paying the debtor's outstanding debts. It limits the guarantor's responsibilities to the financial aspect of the obligation, without assuming other non-payment-related obligations. 6. Performance Guaranty: Unlike a payment guaranty, a performance guaranty ensures that the guarantor not only covers the financial obligations but also guarantees the completion of the debtor's contractual duties. It safeguards against both monetary and non-monetary defaults. In conclusion, the Cook Illinois Release from Liability under Guaranty is a legal document that establishes the terms and conditions of an agreement between a guarantor and a creditor. It outlines the extent of the guarantor's liability and serves as a safeguard against a debtor's default or failure to meet obligations. The different types of Cook Illinois Release from Liability under Guaranty, namely limited guaranty, absolute guaranty, continuing guaranty, limited recourse guaranty, payment guaranty, and performance guaranty, offer flexibility and specific protections depending on the business transaction at hand.

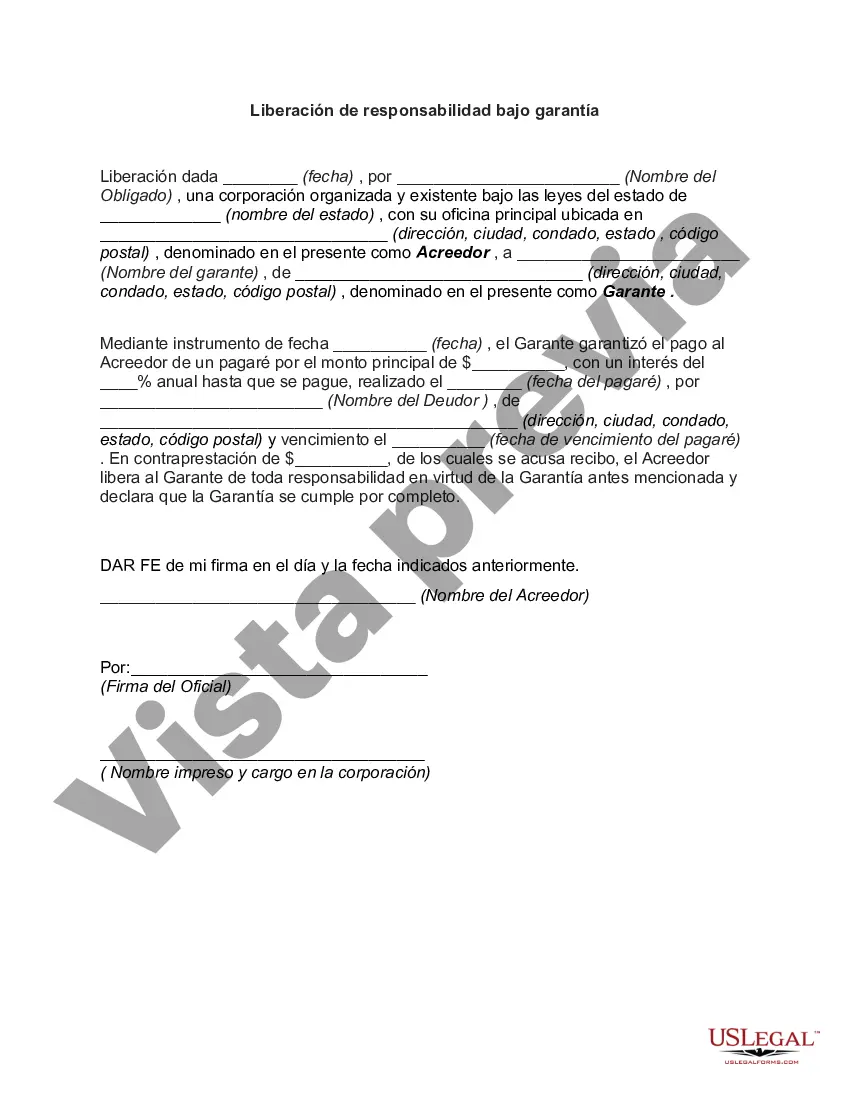

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

Description

How to fill out Cook Illinois Liberación De Responsabilidad Bajo Garantía?

Creating documents, like Cook Release from Liability under Guaranty, to manage your legal matters is a challenging and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms crafted for various cases and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Cook Release from Liability under Guaranty template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Cook Release from Liability under Guaranty:

- Make sure that your form is compliant with your state/county since the regulations for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Cook Release from Liability under Guaranty isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin utilizing our website and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!