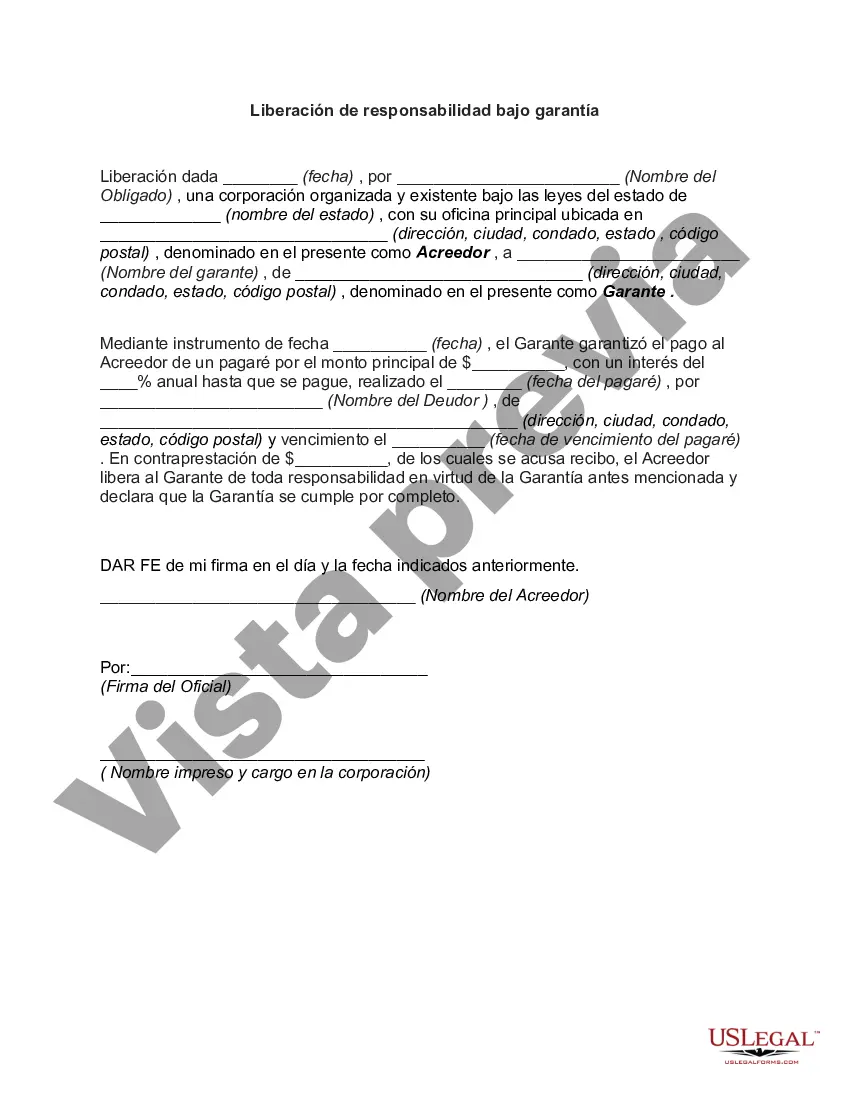

Franklin Ohio Release from Liability under Guaranty is a legal document that protects parties involved in a contractual agreement from liability. This release serves as a safeguard, ensuring that one party (the guarantor) is released from any obligations or liabilities arising from the guaranty agreement. Whether it is a commercial lease, loan, or any other contractual agreement, the Franklin Ohio Release from Liability under Guaranty acts as a shield for the guarantor. The Franklin Ohio Release from Liability under Guaranty is crucial for both the creditor and the guarantor to clarify their rights and responsibilities. It allows the guarantor to sever ties with the agreement and mitigate potential risks, while also providing the creditor with the reassurance that they will still receive certain financial guarantees. In Franklin Ohio, there may be different types of the Release from Liability under Guaranty, depending on the specific nature of the underlying agreement. Some common variations include: 1. Commercial Lease Release from Liability under Guaranty: This type of release is often used in commercial leasing agreements. It allows the guarantor, typically the tenant's principal or an entity, to be released from any obligations or liabilities related to the lease, such as rent payments or property damages. This release protects the guarantor from potential financial loss and allows them to exit the lease agreement without consequences. 2. Loan Release from Liability under Guaranty: In cases where a guarantor guarantees a loan taken by a borrower, the Franklin Ohio Release from Liability under Guaranty ensures that the guarantor is not held liable for any defaults or non-payment by the borrower. This release may be necessary if the guarantor wants to end their financial responsibility for the loan or if they no longer have confidence in the borrower's ability to repay. 3. Contractual Release from Liability under Guaranty: This type of release applies to various contractual agreements beyond leases and loans. It can encompass agreements related to services, projects, or other business transactions. The release clarifies that the guarantor is released from any liabilities arising from the specific agreement, providing them with peace of mind and the ability to sever ties without potential legal consequences. In conclusion, the Franklin Ohio Release from Liability under Guaranty plays a crucial role in protecting parties involved in contractual agreements. It allows the guarantor to separate themselves from potential liabilities and provides clarity regarding their obligations. Whether it is a commercial lease, loan, or any other type of contractual agreement, such releases ensure both parties can proceed without undue financial risk or burden.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

Description

How to fill out Franklin Ohio Liberación De Responsabilidad Bajo Garantía?

Whether you intend to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so picking a copy like Franklin Release from Liability under Guaranty is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Franklin Release from Liability under Guaranty. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Release from Liability under Guaranty in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!