Queens, New York Release from Liability under Guaranty: A Comprehensive Overview In Queens, New York, a release from liability under a guaranty is a legal document that relieves a guarantor from any future obligations or liabilities associated with a contract or agreement. This release is typically issued by the creditor or lender to the guarantor, granting them immunity from any further responsibility in the event of default or non-compliance by the borrower or principal party. Types of Queens, New York Release from Liability under Guaranty: 1. Full Release from Liability: This type of release completely absolves the guarantor from any past, present, or future obligations connected to the guaranty. It frees them from any liability in case of default, breach of contract, or potential legal disputes arising from the primary agreement. 2. Limited Release from Liability: Unlike a full release, this form of release only provides partial immunity to the guarantor. It exempts them from certain liabilities or obligations, but they may still be held responsible for specific aspects of the guaranty as outlined in the release document. 3. Conditional Release from Liability: A conditional release imposes certain conditions or requirements on the guarantor for them to be relieved from their liabilities. These conditions may include fulfilling specific obligations, making certain payments, or meeting predetermined criteria before the release takes effect. 4. Unconditional Release from Liability: Conversely, an unconditional release doesn't involve any preconditions or contingencies for the guarantor to be released from their obligations. It is a straightforward declaration whereby the guarantor is instantly and fully exempted from any liabilities associated with the guaranty, usually upon the satisfaction of the principal agreement. It is crucial to note that a release from liability under guaranty is a legally binding document that should be drafted with precision and reviewed by legal professionals to ensure compliance with applicable laws and regulations in Queens, New York. The terms of the release should clearly outline the nature and extent of the release, including specific obligations or liabilities that are released or retained by the guarantor. By obtaining a release from liability under a guaranty, the guarantor secures protection against potential financial risks and legal consequences that may arise due to the actions or non-performance of the principal party. However, it is essential for both parties involved — the creditor and the guarantor – to understand the implications and effects of such a release before executing the document. It is always recommended consulting with a qualified attorney or legal advisor who specializes in contract law or finance to ensure all necessary provisions and clauses are included in the release, catering to the unique circumstances and legal requirements of Queens, New York.

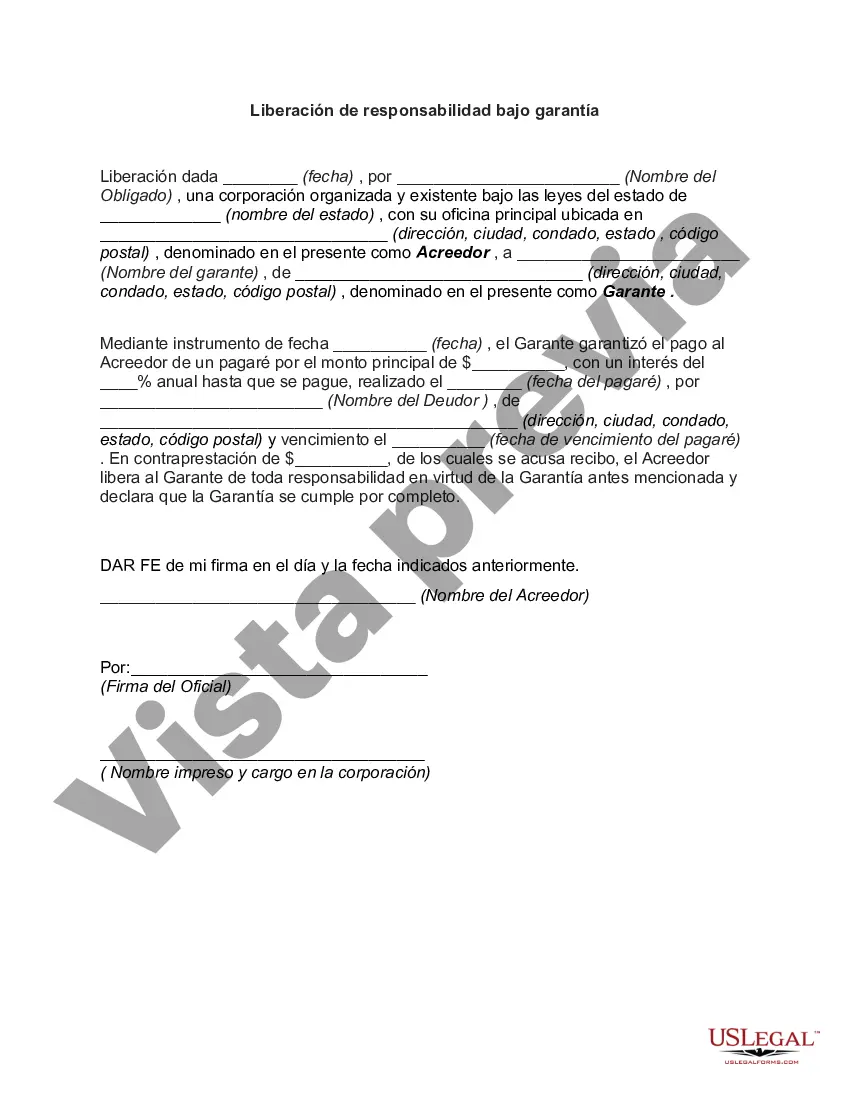

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

Description

How to fill out Queens New York Liberación De Responsabilidad Bajo Garantía?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Queens Release from Liability under Guaranty, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Queens Release from Liability under Guaranty from the My Forms tab.

For new users, it's necessary to make several more steps to get the Queens Release from Liability under Guaranty:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!