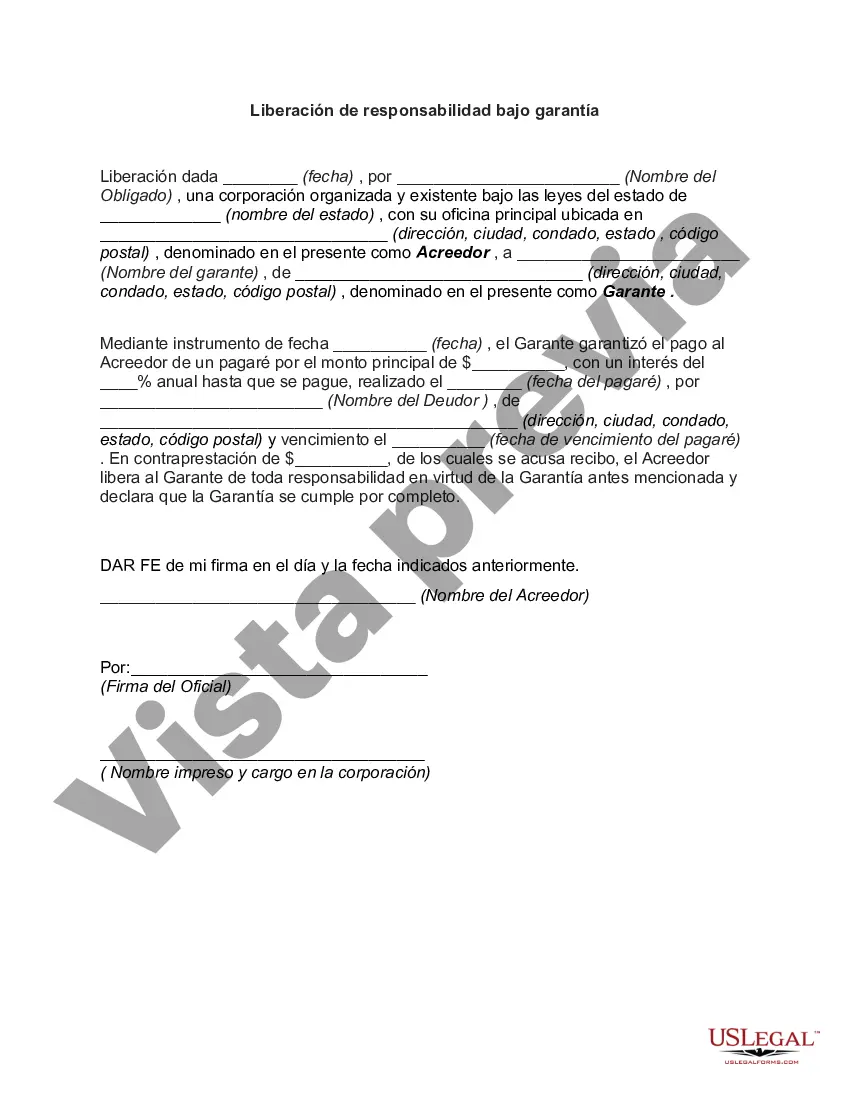

San Diego, California Release from Liability under Guaranty: A Comprehensive Overview In San Diego, California, a Release from Liability under Guaranty is an important legal document that outlines the terms and conditions under which a party is released from their obligations and responsibilities as a guarantor. This release offers protection to individuals or businesses who have acted as guarantors for loans, leases, or other contractual obligations. A release from liability under guaranty provides assurance to the guarantor that they will not be held responsible for the debts, obligations, or liabilities of another party (typically the borrower or the tenant). It relieves the guarantor of any financial or legal liabilities that may arise if the primary party fails to fulfill their contractual obligations. Key elements included in a San Diego release from liability under guaranty would typically involve the following: 1. Identification of the Parties: The document begins by clearly identifying all parties involved. This includes the guarantor, the primary party (borrower or tenant), and any relevant financial institutions or creditors. 2. Statement of the Guaranty: The document should clearly state the specific terms and conditions of the guaranty that the party being released is no longer liable for. This may include the release from mortgage payments, rental obligations, or other financial responsibilities. 3. Signature and Acknowledgment: To ensure the validity of the release, it is crucial for all parties involved to sign the document. Additionally, it is important to include an acknowledgment section that confirms the understanding and agreement of all parties involved. Types of San Diego California Release from Liability under Guaranty: 1. Loan Release: This type of release is commonly used when a guarantor has acted as a surety for a loan. Once the borrower fulfills their obligations and the loan is repaid in its entirety, the guarantor will be released from any future liabilities related to the loan. 2. Lease Release: In the case of a lease agreement, a release from liability under guaranty allows the guarantor to be released from their obligations if the tenant fulfills their lease requirements, such as timely rent payments and adherence to the terms of the lease. 3. Conditional Release: Sometimes, releases from liability may have conditions attached. These conditions may involve meeting certain milestones, providing collateral, or meeting specific financial criteria. Failure to meet these conditions can result in the release being nullified. It is essential to note that while this content provides a general understanding of a San Diego, California release from liability under guaranty, consulting with a qualified attorney is highly recommended ensuring compliance with specific local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

Description

How to fill out San Diego California Liberación De Responsabilidad Bajo Garantía?

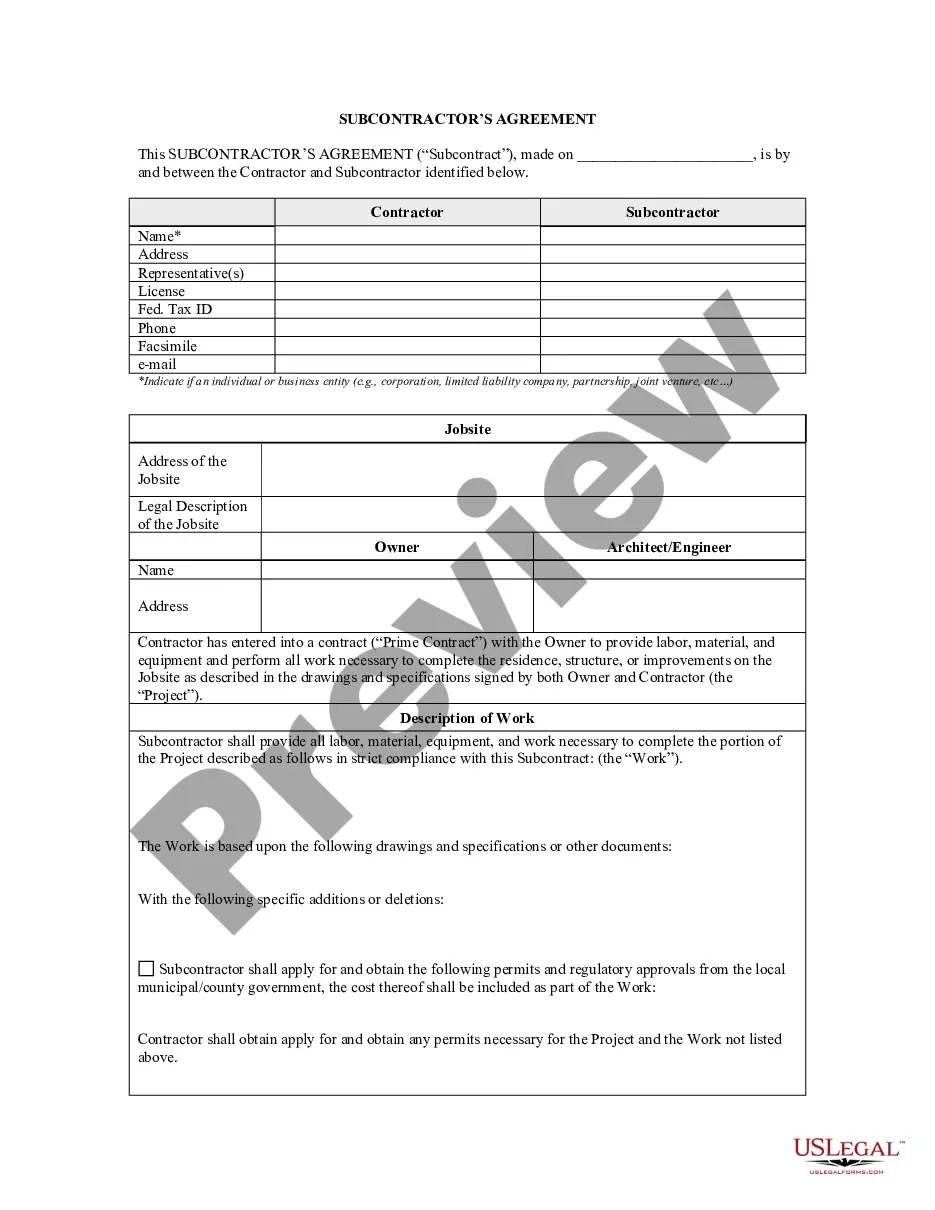

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the San Diego Release from Liability under Guaranty, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Diego Release from Liability under Guaranty from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Diego Release from Liability under Guaranty:

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!