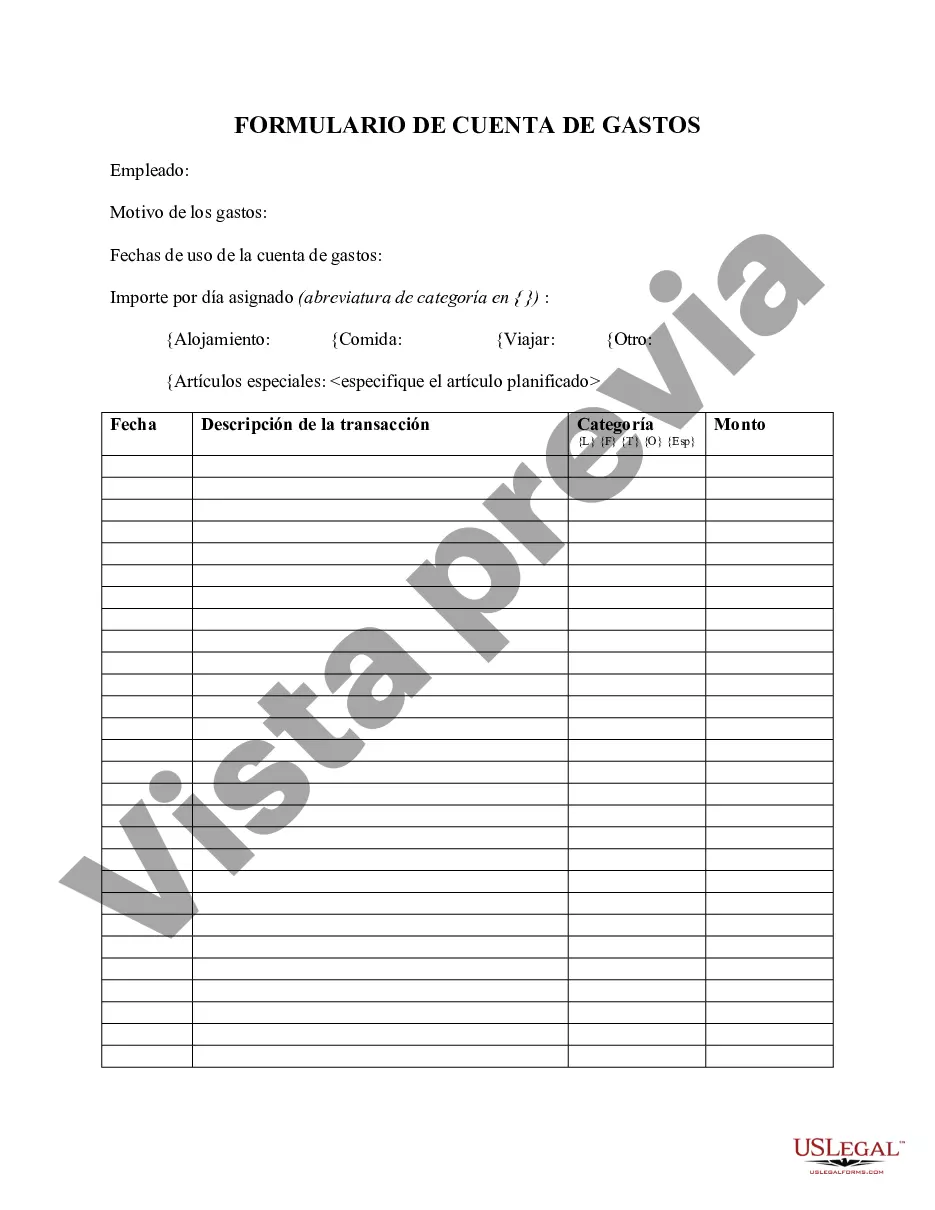

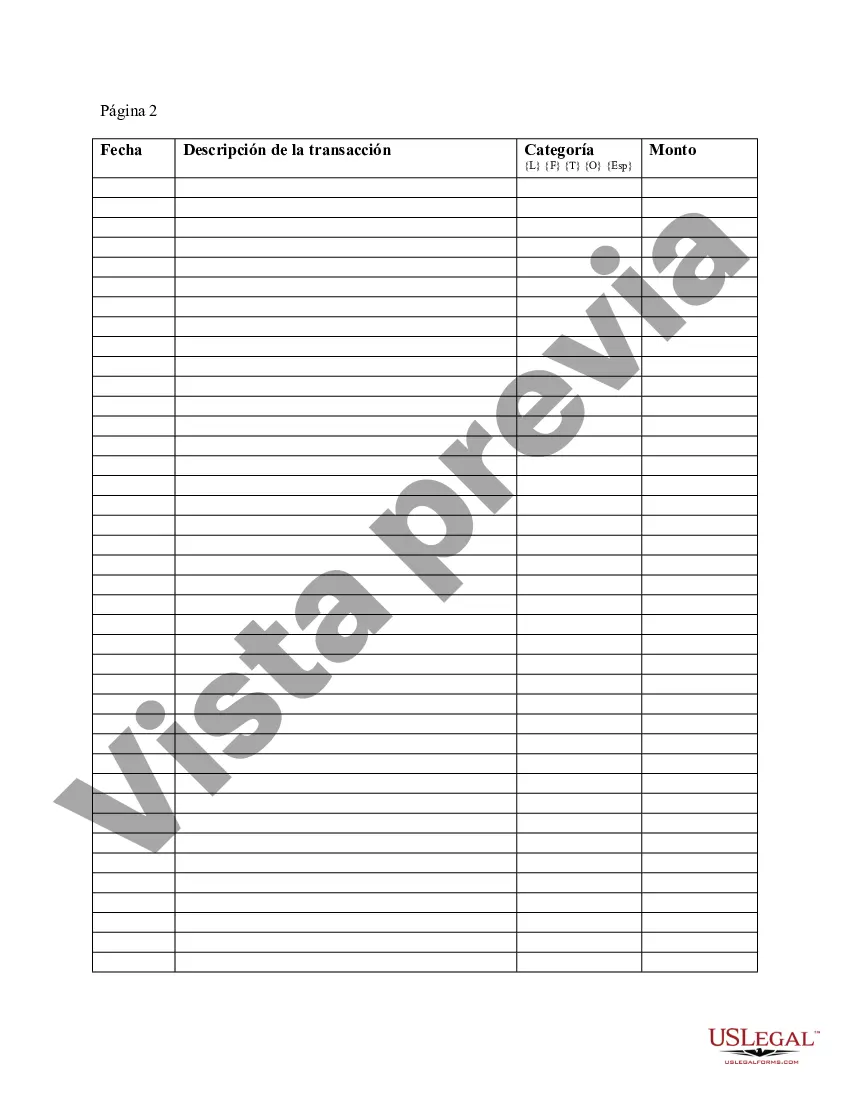

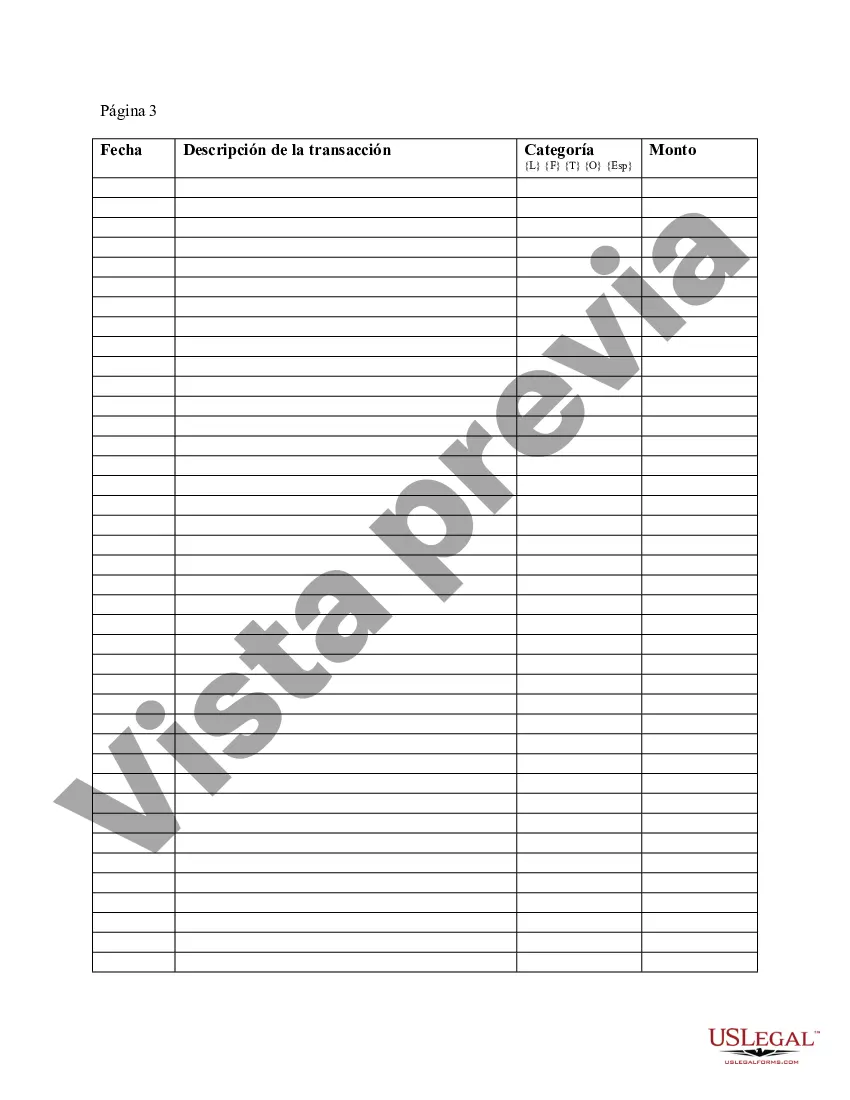

Contra Costa California Expense Account Form is a document used by individuals or employees to record and reimburse their business-related expenses incurred within the Contra Costa County, California area. This form is designed to streamline the expense reporting process and ensure accurate reimbursement for the expenses. The Contra Costa California Expense Account Form typically includes essential details such as the employee's name, department, job title, and contact information. It also requires the date of the expense, a detailed description of the expense, the amount spent, and any supporting documents like receipts or invoices. These forms usually contain specific fields for various expense categories, allowing the employee to categorize their expenses accurately. The primary purpose of using a Contra Costa California Expense Account Form is to maintain proper financial records, facilitate transparency, and ensure compliance with company policies and local tax regulations. It provides a standardized format for employees to report their expenses, making it easier for the accounting department to review and process reimbursements. In addition to the standard Contra Costa California Expense Account Form, there may be variations or specialized forms for specific types of expenses. Some common examples include: 1. Travel Expense Account Form: Used when an employee incurs expenses related to business travel within Contra Costa County or outside it. This form typically includes additional fields for recording transportation costs, accommodation expenses, meals, and other travel-related expenditures. 2. Entertainment Expense Account Form: Used when an employee has incurred expenses related to client meetings, business-related entertainment, or promotional events within Contra Costa County. This form may require the employee to provide details about the purpose of the entertainment, the attendees, and the business-related benefits gained. 3. Conference/Training Expense Account Form: Used when an employee attends professional conferences, seminars, or training sessions within Contra Costa County. This form may require details about the event, registration fees, transportation costs, and other expenses associated with attending such events. It is important to use the correct Contra Costa California Expense Account Form depending on the type of expenses incurred. This helps ensure that all relevant information is captured accurately and efficiently, enabling faster reimbursement processing and accurate financial reporting. Organizations may provide their own tailored versions of these forms or utilize standard templates that comply with industry standards and local regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Formulario de cuenta de gastos - Expense Account Form

Description

How to fill out Contra Costa California Formulario De Cuenta De Gastos?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Contra Costa Expense Account Form, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Contra Costa Expense Account Form from the My Forms tab.

For new users, it's necessary to make some more steps to get the Contra Costa Expense Account Form:

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!