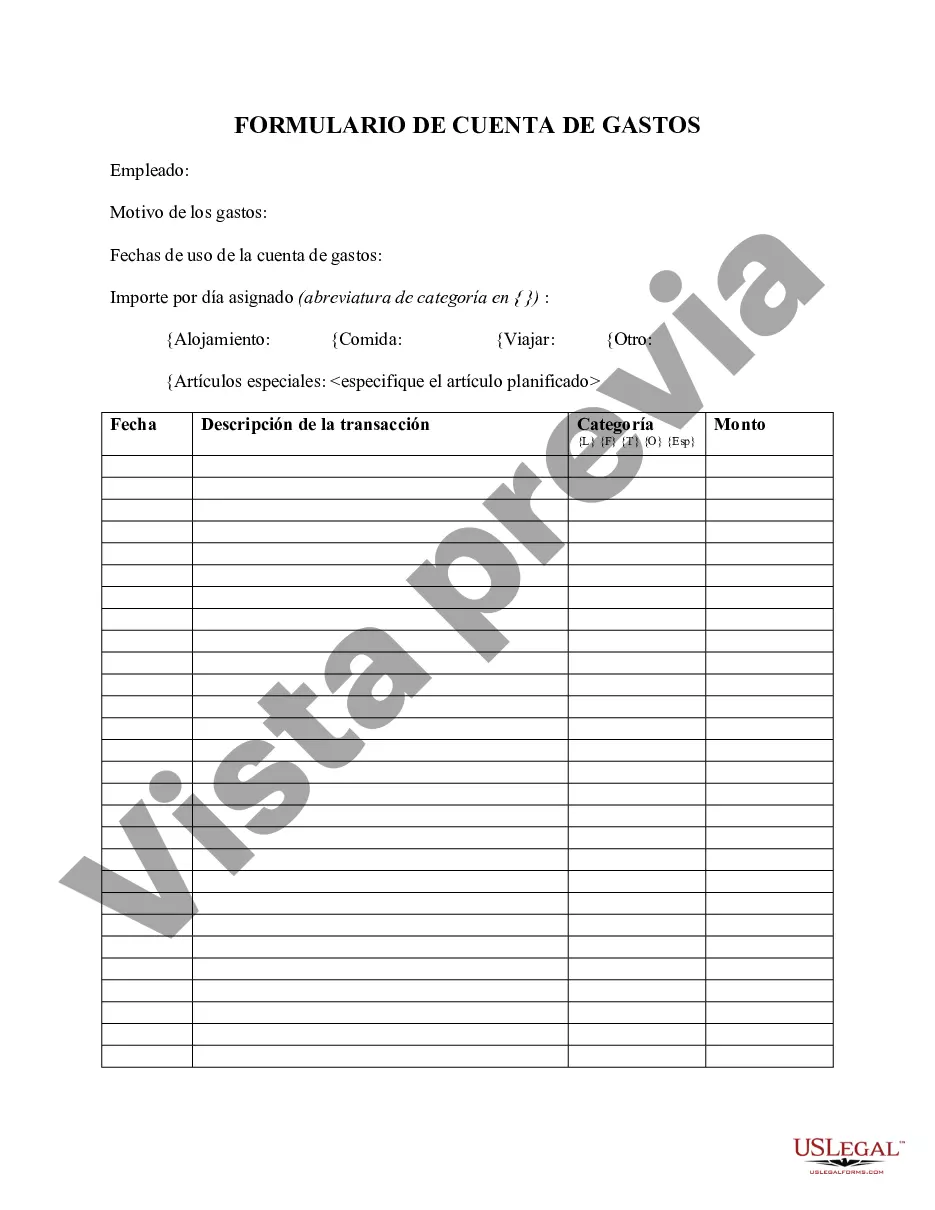

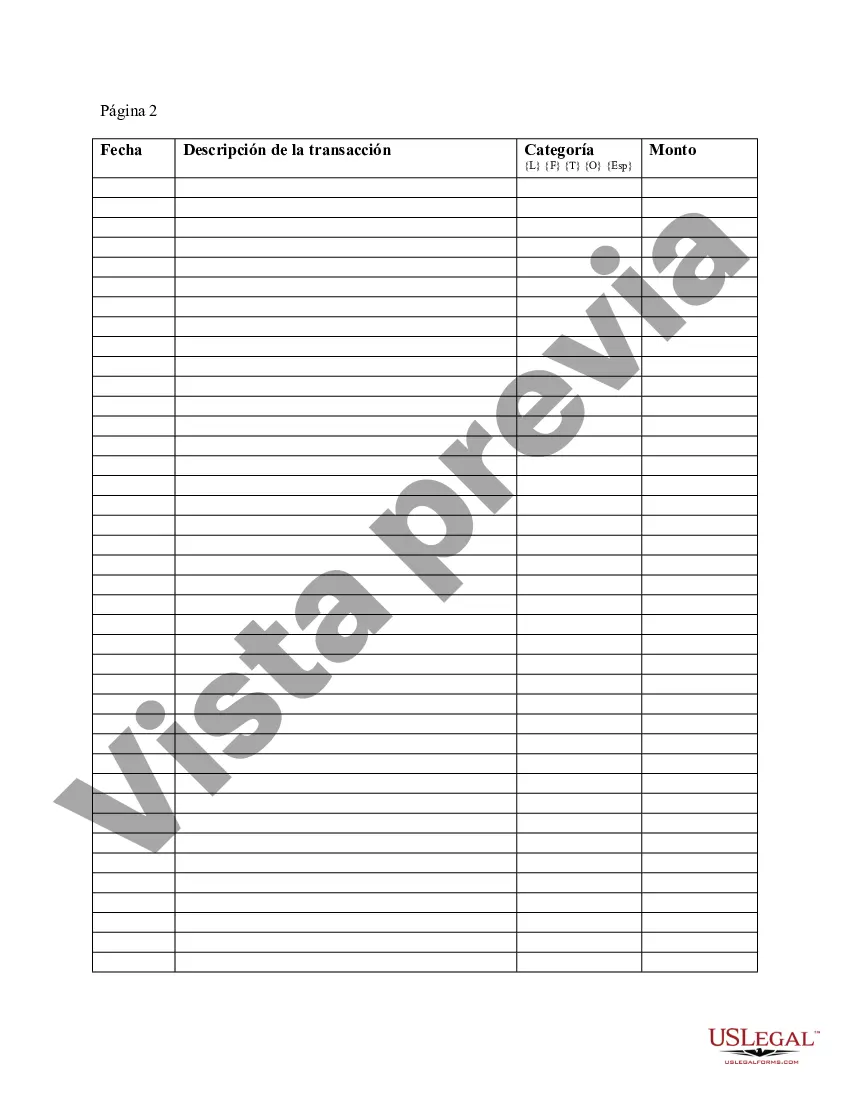

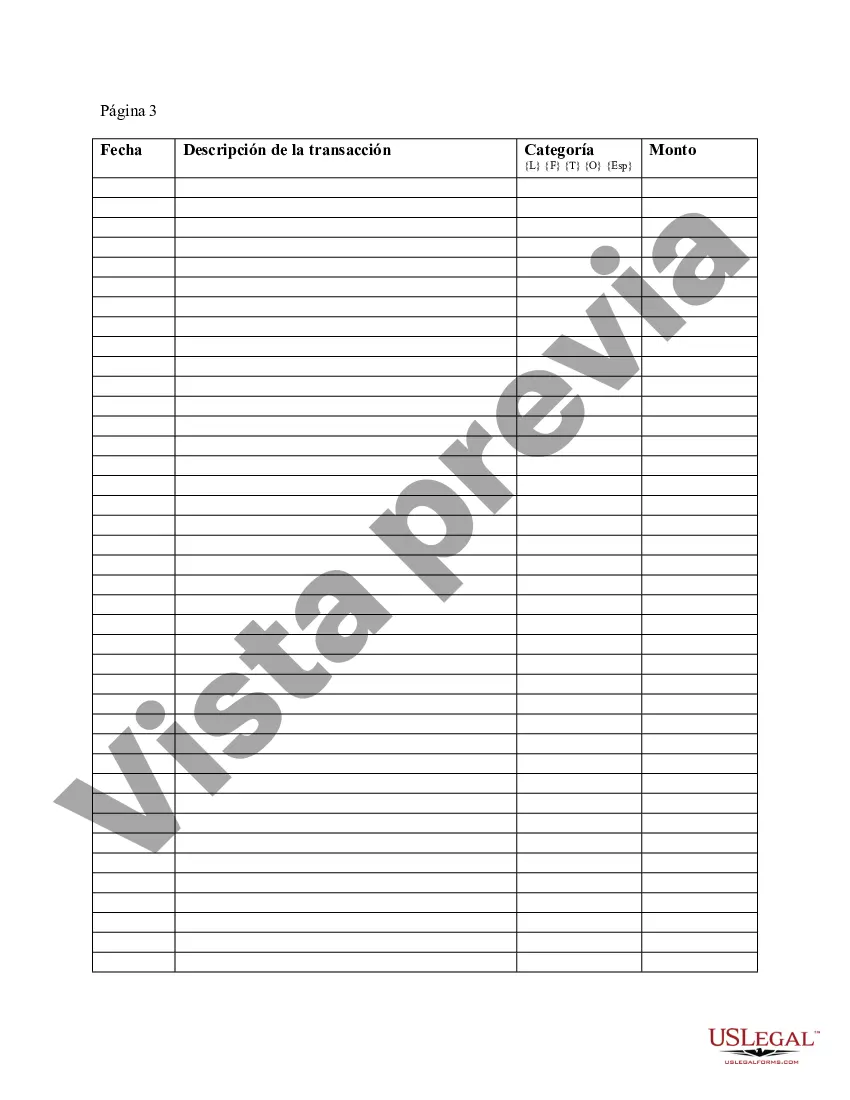

Cook Illinois is a reputable transportation company offering a variety of transportation services to its customers. To ensure smooth financial transactions and manage expenses effectively, Cook Illinois provides its employees with an Expense Account Form. This form enables employees to conveniently request reimbursement for any approved business-related expenses incurred during their work. The Cook Illinois Expense Account Form is a standardized document designed to record and track various expenditures. It is divided into relevant sections to capture specific details, ensuring accuracy and ease of processing. This comprehensive form features sections for employee information, including their name, employee ID, contact details, and department. Further, sections include date and purpose of the expense, where employees can specify the specific event, project, or reason behind the expenditure. Employees also have the option to indicate if the expense was incurred locally or during a business trip. The form allows for a breakdown of expenses by category, which helps streamline the reimbursement process. Common expense categories may include transportation costs, meals, lodging, client entertainment, office supplies, and miscellaneous expenditures. This breakdown ensures that both the employee and employer have a clear understanding of the nature of the expenses. Additionally, the Cook Illinois Expense Account Form requires employees to attach supporting documentation, such as receipts and invoices, to provide evidence of the incurred expenses. This practice enables the company's finance department to verify the authenticity and appropriateness of the expenses before processing reimbursement. Depending on the nature of the expenses, Cook Illinois may offer different types of Expense Account Forms to cater to the specific needs of its employees. These variations may include forms for daily travel expenses, monthly expense reports, or project-specific expense accounts. Each form type will have unique requirements and sections tailored to the specific circumstances under which the expenses were incurred. The Cook Illinois Expense Account Form is an essential tool in ensuring transparency, accountability, and proper financial management within the company. It enables employees to maintain accurate records of their business-related expenses and facilitates efficient reimbursement processes. By utilizing this form effectively, both employees and Cook Illinois can maintain financial accuracy, ensuring a smooth operation for the company as a whole.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Formulario de cuenta de gastos - Expense Account Form

Description

How to fill out Cook Illinois Formulario De Cuenta De Gastos?

Do you need to quickly draft a legally-binding Cook Expense Account Form or probably any other document to take control of your personal or business matters? You can select one of the two options: hire a legal advisor to write a legal paper for you or create it entirely on your own. Luckily, there's a third solution - US Legal Forms. It will help you receive professionally written legal documents without paying sky-high fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant document templates, including Cook Expense Account Form and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, carefully verify if the Cook Expense Account Form is adapted to your state's or county's regulations.

- If the document has a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by using the search box in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Cook Expense Account Form template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the paperwork we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!