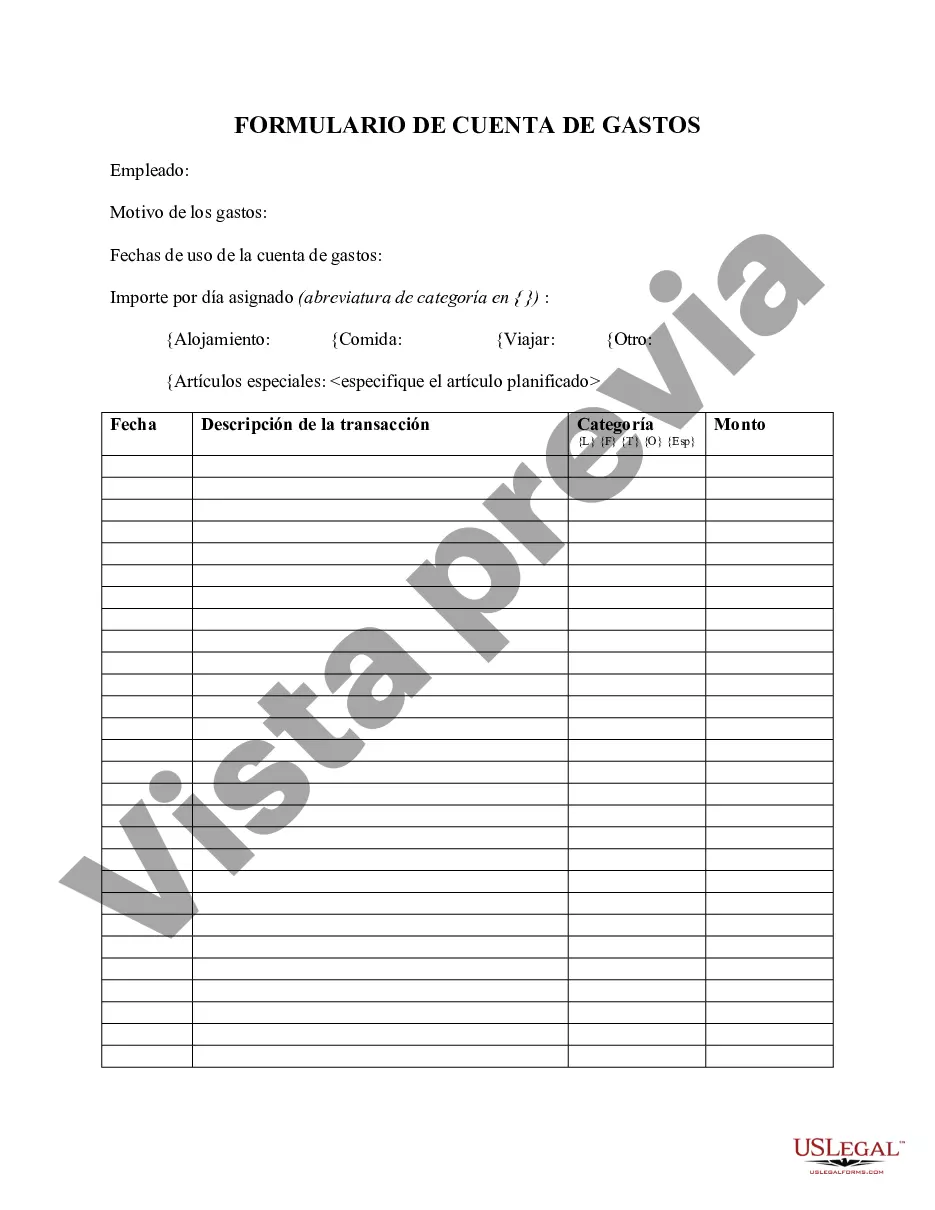

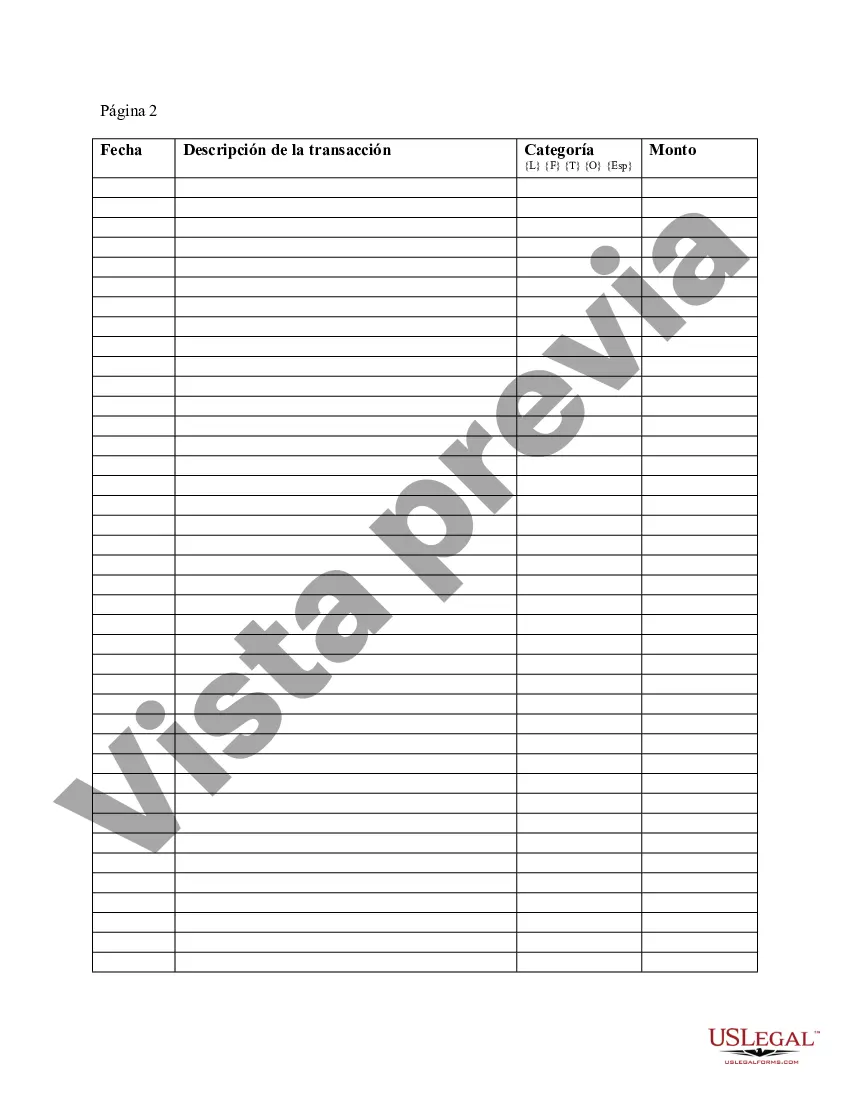

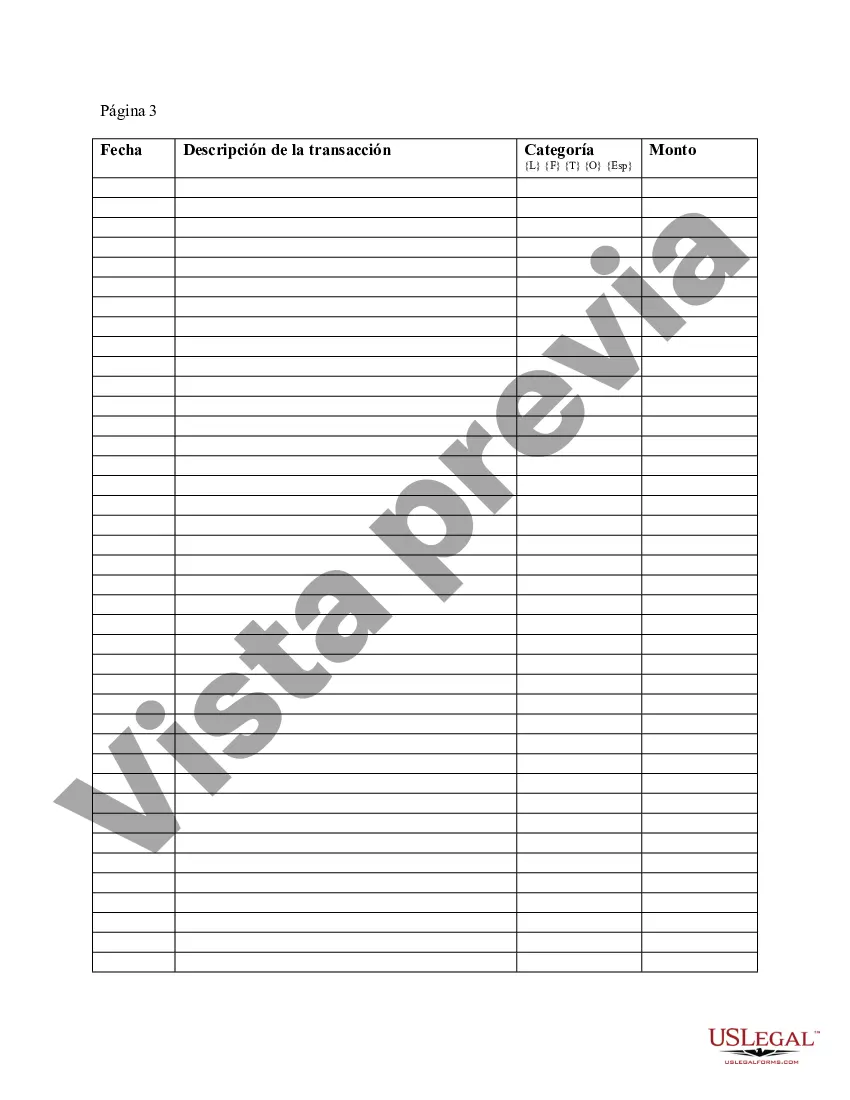

Fairfax Virginia Expense Account Form is a document used to report and track expenses incurred by individuals associated with Fairfax, Virginia. It is designed to ensure transparency, accuracy, and accountability in managing expenditure related to various activities within Fairfax. The Fairfax Virginia Expense Account Form is typically used by employees, contractors, or officials who are authorized to spend on behalf of their respective organizations or affiliated entities in Fairfax. This form serves as a means to document and seek reimbursement for eligible expenses in compliance with the established policies and guidelines. The form captures vital information such as the date, purpose, description, and amount of each expense. It may include categories like travel expenses, accommodation costs, meals, transportation, office supplies, conference fees, utilities, research materials, equipment rentals, and other relevant expenditure categories. In addition to these common expense categories, there can be specific variations of Fairfax Virginia Expense Account Forms tailored for different entities or departments within Fairfax. These may include: 1. Fairfax County Expense Account Form: This form is specific to the Fairfax County government, allowing employees and officials to report expenses related to county operations, services, and initiatives. 2. Fairfax City Expense Account Form: This variant is used by employees and officials of the City of Fairfax. It covers expenses incurred within the city jurisdiction, including administrative costs, event expenses, and community-related expenditures. 3. Fairfax Public Schools Expense Account Form: This form is designed for employees and staff members of Fairfax County Public Schools. It enables them to claim reimbursement for educational supplies, travel expenses for school-related activities, professional development costs, and other expenditures associated with the school district's operations. 4. Fairfax Chamber of Commerce Expense Account Form: This particular form is used by members and representatives of the Fairfax Chamber of Commerce. It allows them to document expenses incurred in attending networking events, conferences, marketing initiatives, and other activities promoting the local business community. By utilizing the Fairfax Virginia Expense Account Form, organizations, employees, and officials can maintain accurate records, facilitate timely reimbursements, adhere to budgetary guidelines, and ensure financial transparency. It plays a crucial role in managing expenses effectively, tracking spending patterns, and enabling efficient financial management within the Fairfax, Virginia community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Formulario de cuenta de gastos - Expense Account Form

Description

How to fill out Fairfax Virginia Formulario De Cuenta De Gastos?

Drafting documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Fairfax Expense Account Form without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Fairfax Expense Account Form on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Fairfax Expense Account Form:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!

Form popularity

More info

If you need to report your earnings on your tax return, or make payments, you will need to complete an FLL reimbursement form. This form is required and must be received by the FLL Office no later than July 1st and no later than July 31st each year for the current year. The FLL Office will send a reimbursement request letter to you along with the actual FLL Receipt form by electronic means. You will be notified by e-mail of your FLL tax refund as soon as it is received. Click here to download the FLL reimbursement form from the web. Contact our office to request an appointment to file. Call us at (or fill out an FLL Reimbursement Request form), or stop by our office in Downtown Las Cruces at the Main Lobby, Room 1017 or the Courtroom 1F, if available. You will need the following information. Date of Birth. Date (mm/dd/YYY) FFL License Holder AIR Number FLL Receipt Number Employer Student Year Please Note: A 3.00 re-stamp fee for each form is required on all approved forms.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.