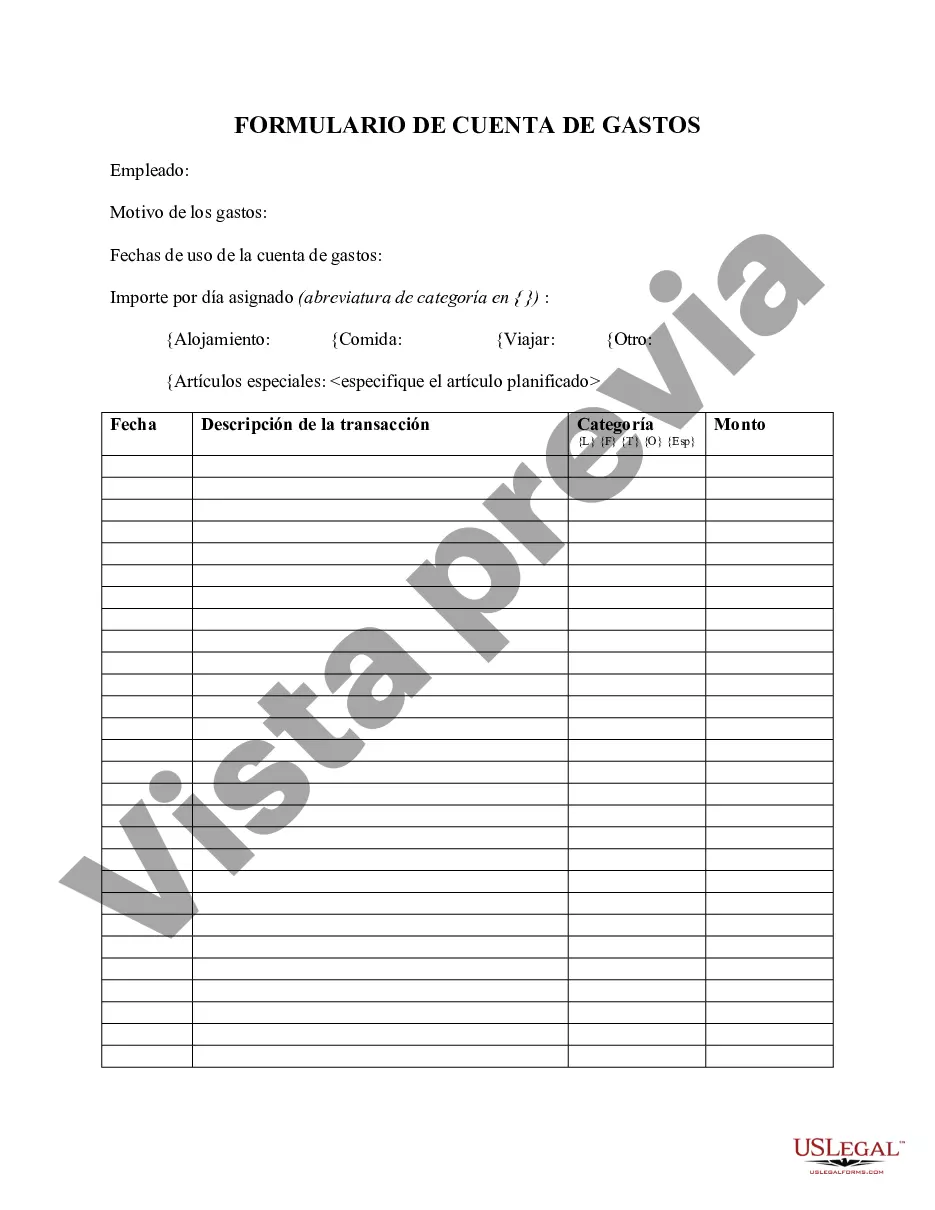

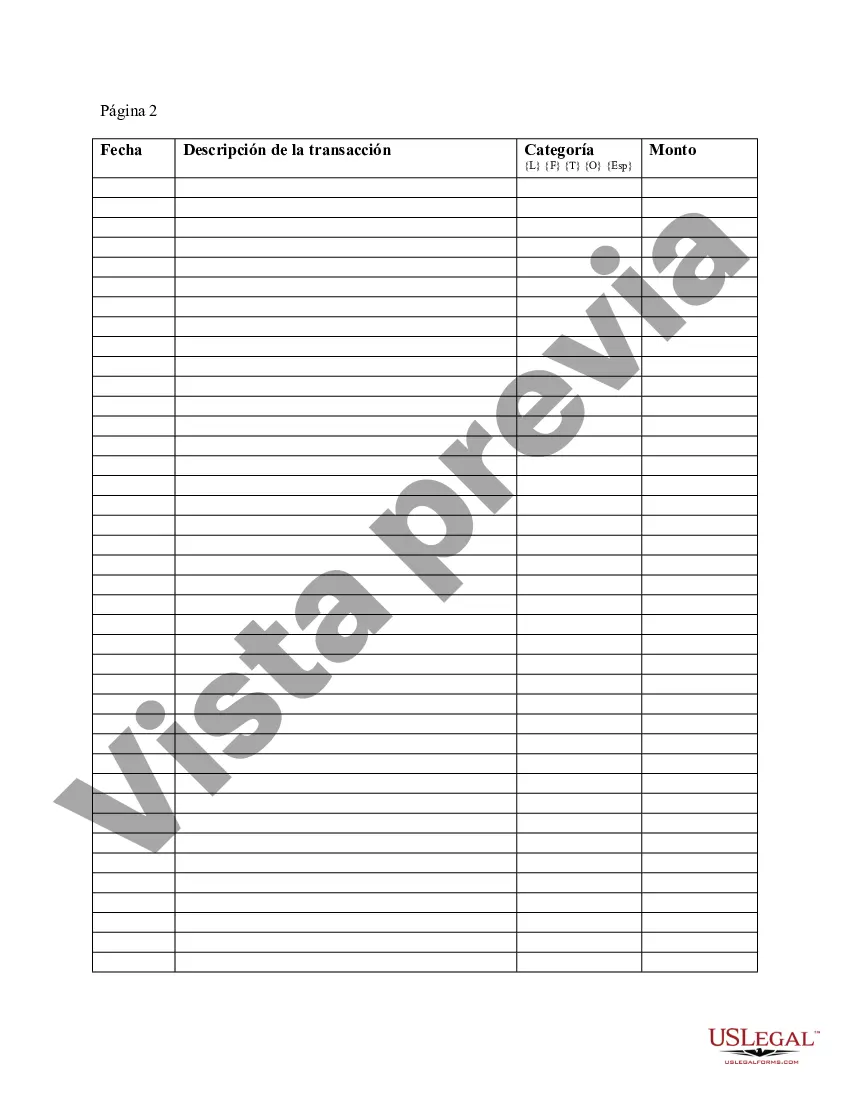

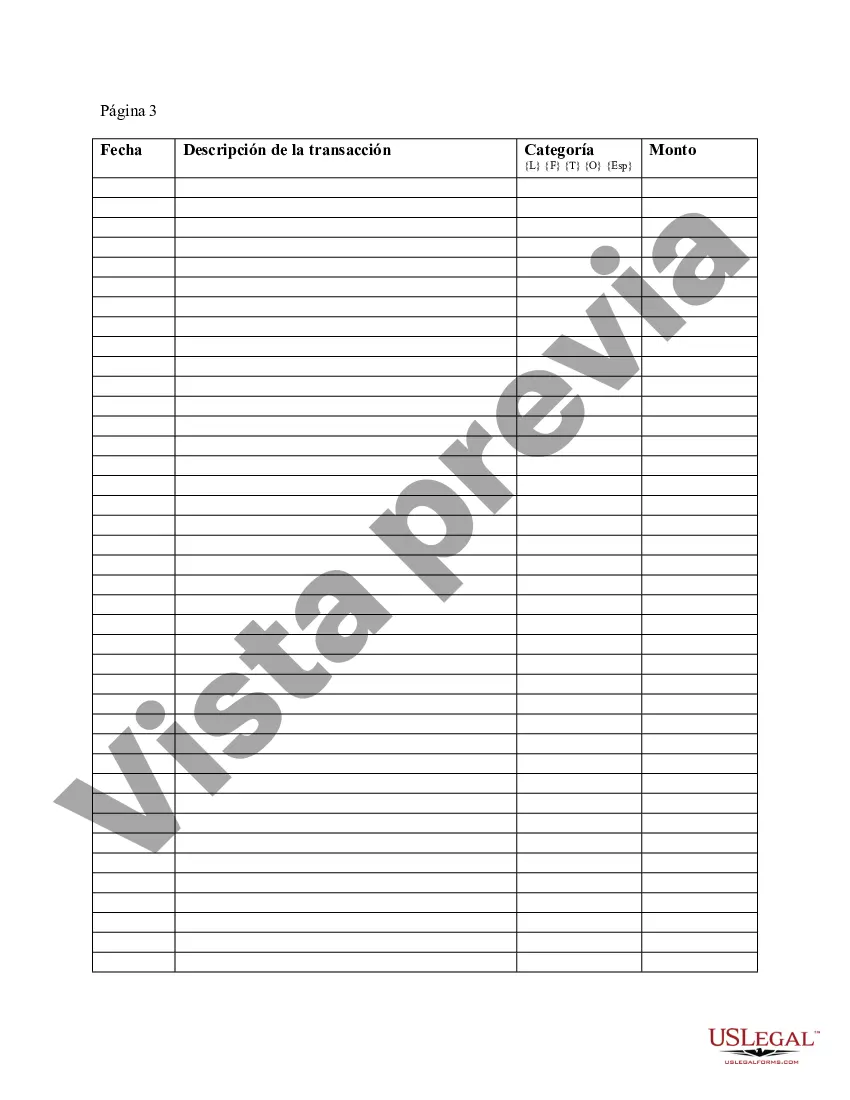

Phoenix, Arizona Expense Account Form is a standardized document used by individuals or organizations to track and report their expenses incurred in Phoenix, Arizona. This form allows users to record various types of expenses and provide detailed information for reimbursement purposes. The Phoenix, Arizona Expense Account Form is essential for maintaining accurate financial records and ensuring transparency in expense management. It helps employers or organizations establish clear guidelines for reimbursable expenses and streamline the process of approving and reimbursing expenses. Key features of the Phoenix, Arizona Expense Account Form include: 1. Personal Information: This section requires the essential personal details of the individual or employee submitting the expense report. It typically includes name, department, employee ID, and contact information. 2. Date and Purpose: Users are required to specify the date(s) of the expense(s) and provide a detailed description of the purpose for each expense incurred. This helps in identifying the reason behind the expenditure and justifies the claim. 3. Expense Categories: The form provides a list of predefined expense categories such as travel, accommodation, meals, transportation, entertainment, and more. Users need to select the appropriate category for each expense. 4. Payment Method: This section records the payment method used for the expense, whether it was paid using cash, credit card, or any other payment mode. It is crucial for verifying the legitimacy of the expenses claimed. 5. Supporting Documents: The form allows users to attach supporting documents, such as receipts, invoices, or bills that validate the expenses being claimed. This strengthens the claim's credibility and helps with the auditing process. 6. Calculation and Subtotal: The form typically includes columns or sections to enter the amount spent for each expense item. It automatically calculates subtotals and possibly applies any applicable tax or currency conversion. 7. Total Reimbursement Request: This section sums up the total expenses claimed, calculates any applicable taxes or fees, and provides the final reimbursement request amount. Different types of Phoenix, Arizona Expense Account Forms may exist depending on the specific requirements of different organizations or industries. Some variations include: 1. Phoenix, Arizona Travel Expense Account Form: Specifically designed for individuals who incur travel-related expenses within Phoenix, Arizona. It may include additional sections to record travel-specific details like flight costs, hotel stays, and rental car expenses. 2. Phoenix, Arizona Meal Expense Account Form: Primarily used by employees or individuals seeking reimbursement for meals eaten while on business in Phoenix, Arizona. This form typically focuses on recording meal expenses, including tips and taxes. 3. Phoenix, Arizona Entertainment Expense Account Form: Specifically tailored for individuals and organizations involved in entertainment-related industries, such as event planning or media production. This form may have specific sections to detail expenses related to venue rentals, ticket purchases, artist fees, or equipment rentals. In conclusion, the Phoenix, Arizona Expense Account Form is a crucial tool for individuals and organizations to accurately record and report expenses incurred in Phoenix, Arizona. It enables efficient reimbursement processes, ensures compliance with expense policies, and promotes financial transparency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Formulario de cuenta de gastos - Expense Account Form

Description

How to fill out Phoenix Arizona Formulario De Cuenta De Gastos?

If you need to get a trustworthy legal form provider to find the Phoenix Expense Account Form, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can search from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it easy to get and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Phoenix Expense Account Form, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Phoenix Expense Account Form template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Phoenix Expense Account Form - all from the comfort of your home.

Join US Legal Forms now!