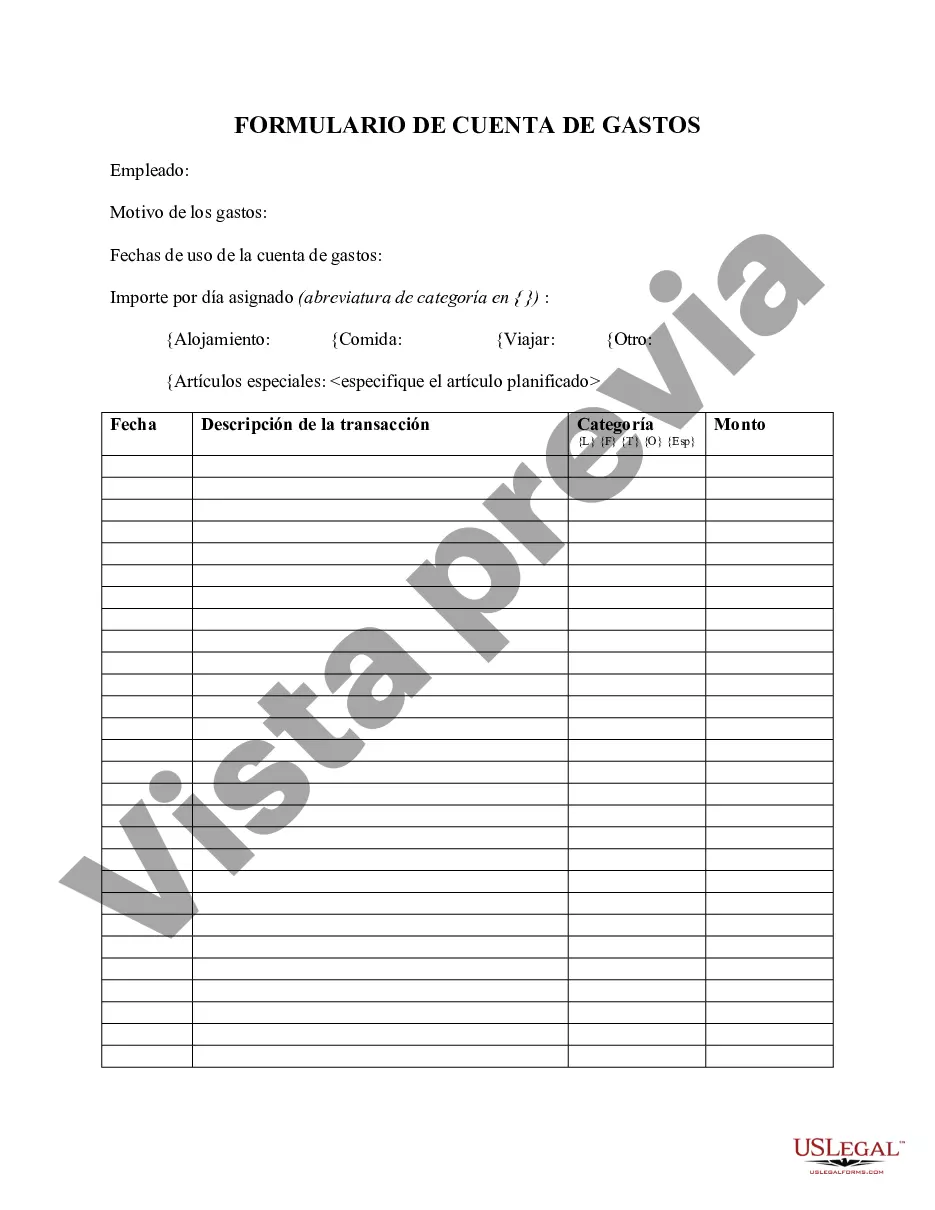

Queens, New York Expense Account Form is a document used by individuals or businesses to track and record expenses incurred in Queens, New York. This form allows users to maintain an organized record of expenditures related to travel, meals, entertainment, transportation, and other business-related costs while in Queens. Keywords: Queens, New York, expense account form, tracking expenses, record expenditures, travel expenses, meals expenses, entertainment expenses, transportation expenses, business-related costs. Different types of Queens, New York Expense Account Forms may include: 1. Travel Expense Account Form: This form specifically focuses on tracking expenses related to travel while in Queens, New York. It allows users to record costs such as airfare, hotel accommodations, rental car expenses, and any other travel-related costs. 2. Meals and Entertainment Expense Account Form: This form is designed to track expenses incurred for meals and entertainment purposes in Queens, New York. It enables users to document the cost of meals, client entertainment, business meetings, and any other related expenses. 3. Transportation Expense Account Form: This specific form concentrates on recording expenses related to transportation in Queens, New York. It allows users to track costs associated with taxi fares, public transportation, rental cars, and any other modes of transportation utilized for business purposes. 4. Miscellaneous Expense Account Form: This form serves as a catch-all for any other business-related expenses that do not fall under specific categories mentioned above. It enables users to document miscellaneous costs like office supplies, postage, printing, or any other expenses that do not fit into the other three types of forms. Overall, Queens, New York Expense Account Forms facilitate accurate and organized tracking of expenses incurred while conducting business in the Queens area, ensuring proper record-keeping and accountability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Formulario de cuenta de gastos - Expense Account Form

Description

How to fill out Queens New York Formulario De Cuenta De Gastos?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Queens Expense Account Form, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the current version of the Queens Expense Account Form, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Queens Expense Account Form:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Queens Expense Account Form and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Estos son los cambios del formulario de proyeccion de gastos personales 2022. Podra presentar su proyeccion de gastos personales hasta el 31 de enero del presente ano.

¿Como diferenciar un gasto deducible y no deducible? Un gasto es deducible cuando: Es necesario para desempenar una actividad economica o empresarial. Esta adecuadamente justificado mediante la documentacion necesaria, es decir, una factura o comprobante fiscal que cumpla con los datos para ser validada.

Las personas naturales que laboran bajo relacion de dependencia o que hagan uso de la rebaja por sus gastos personales de su impuesto a la renta causado deberan presentar a su empleador una proyeccion de gastos personales que seran considerados como rebaja de su impuesto a la renta.

Para poder calcular tus gastos deducibles primero deberias sumar lo que piensas gastar en esas categorias durante todo el ano. Por ejemplo: Gasto $200 mensuales en alimentacion para mi familia. En todo el ano gastare $2.400 (12 X $200). Asi, podre deducir $2.400 en gastos de alimentacion de mi impuesto a la renta.

Para cumplir con esta obligacion, el contribuyente debe ingresar con su usuario y contrasena a SRI en Linea, opcion Anexos, seleccionar Anexo de gastos personales en linea y dar clic en Generacion anexo.

Se llaman gastos no deducibles a los que no se pueden descontar fiscalmente. Es decir que, no pueden ser tomados en cuenta para la determinacion del resultado fiscal.

Que son los gastos deducibles Son aquellos que realiza una empresa y que son legitimos para fines tributarios. Aquellos gastos que no son validos desde el punto de vista tributario, son los gastos No deducibles.

En la parte superior, llenar la ciudad y la fecha de entrega del documento. Luego se llena el numero de cedula, y los apellidos y nombres del trabajador. Se registraran el valor de los ingresos, sin los dos decimos ni los fondos de reserva, que esperar recibir en el ano (sin descontar los aportes personales al IESS).

Una proyeccion de gastos personales es de mucha utilidad para que delimites los gastos que tendras durante el ano. De los valores que coloques en tu proyeccion, dependera la retencion del Impuesto a la Renta que tu empleador te realizara mes a mes.