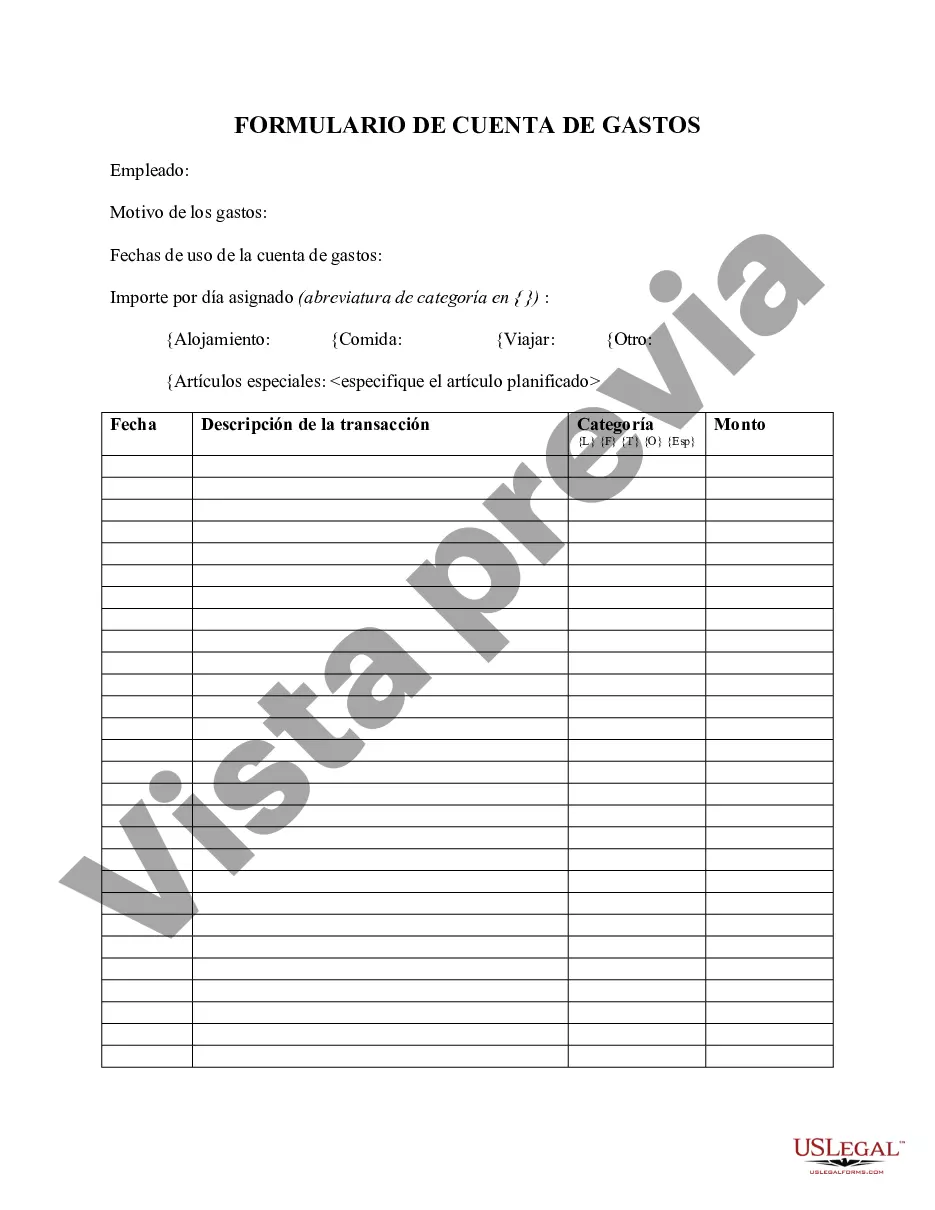

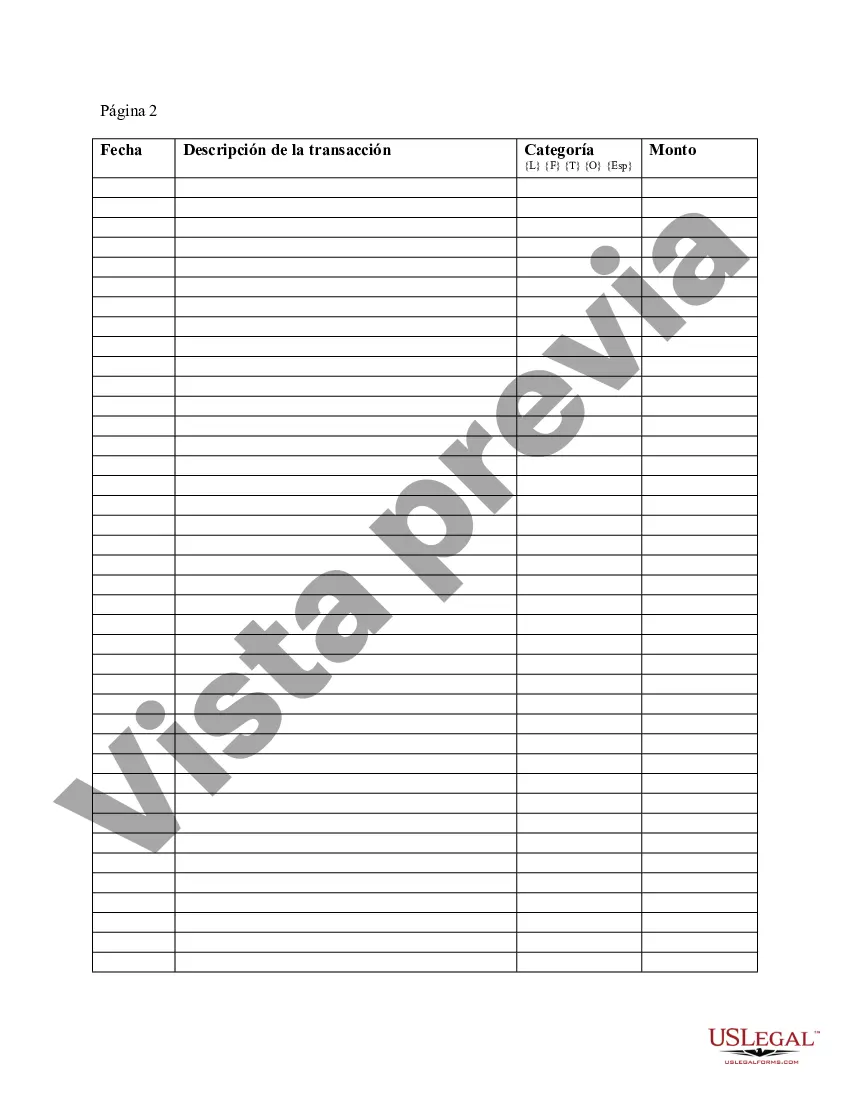

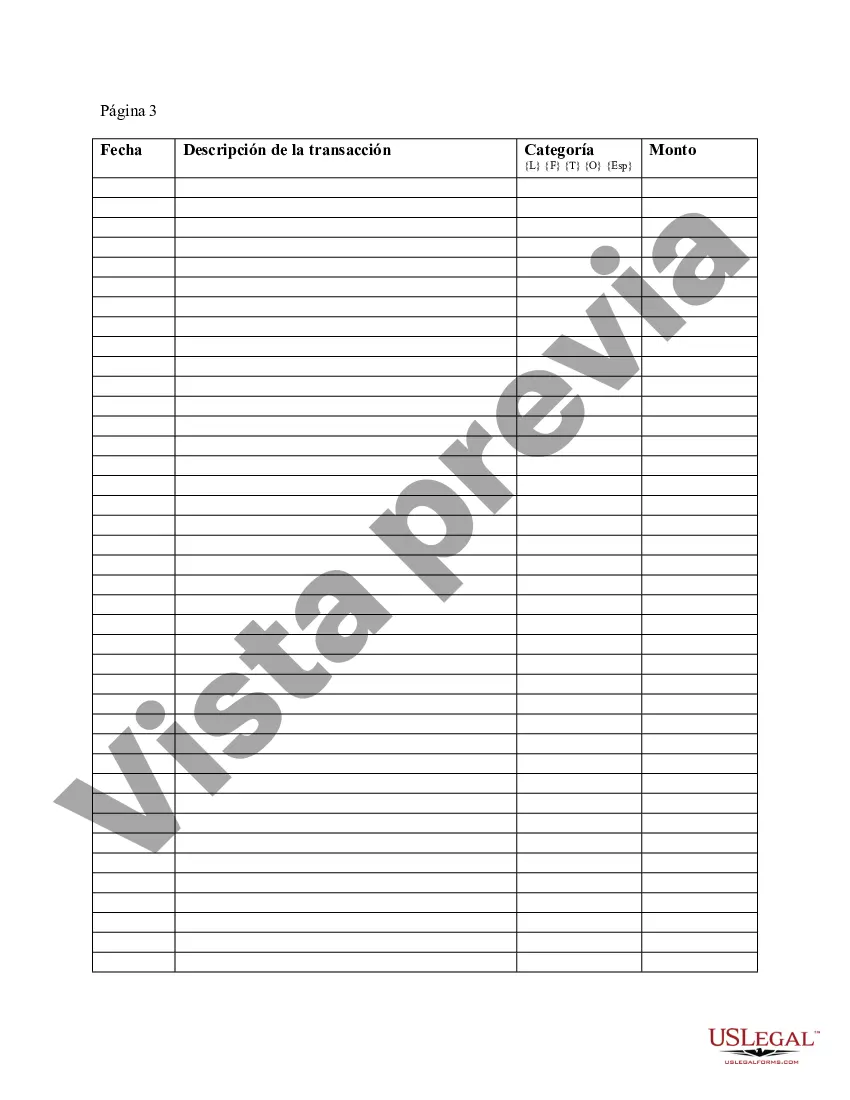

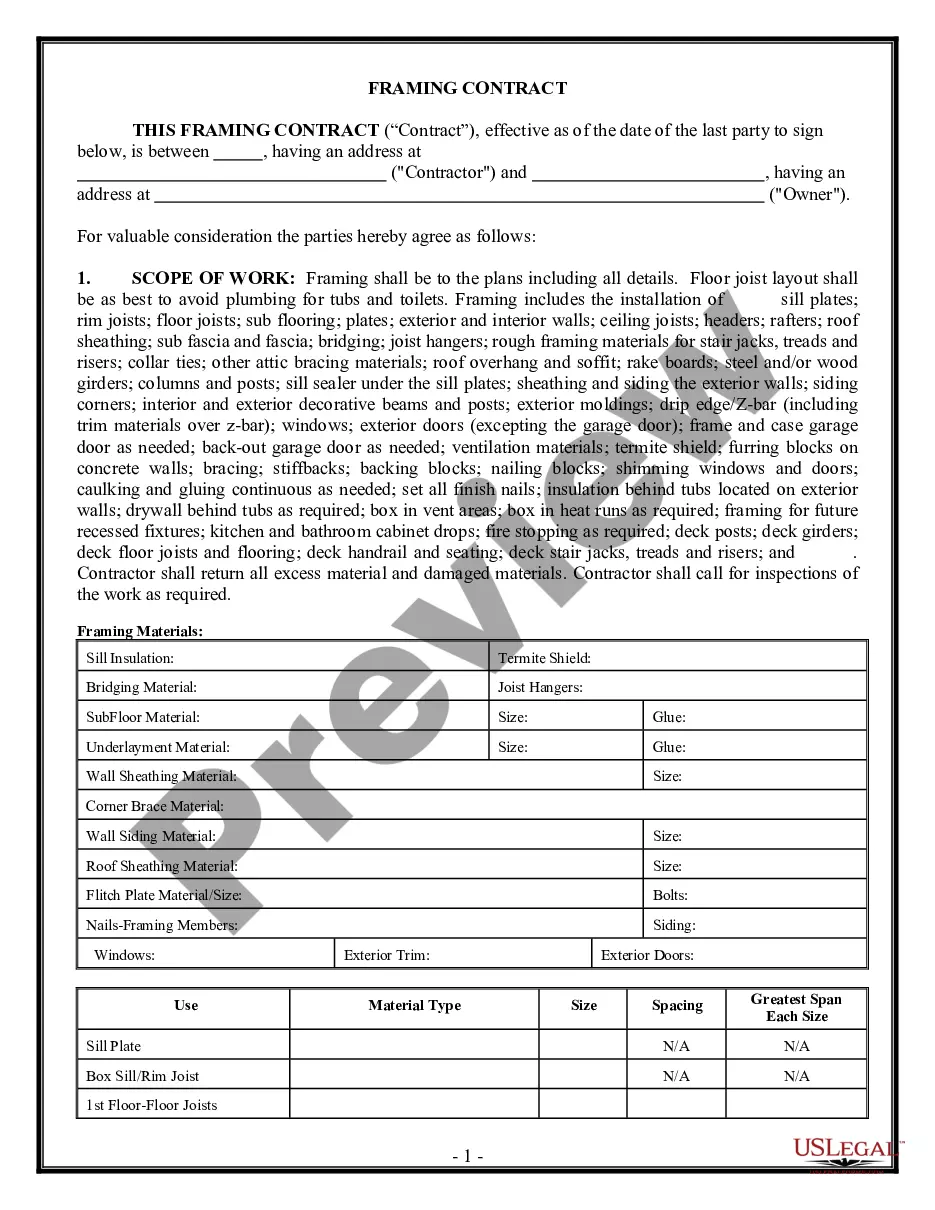

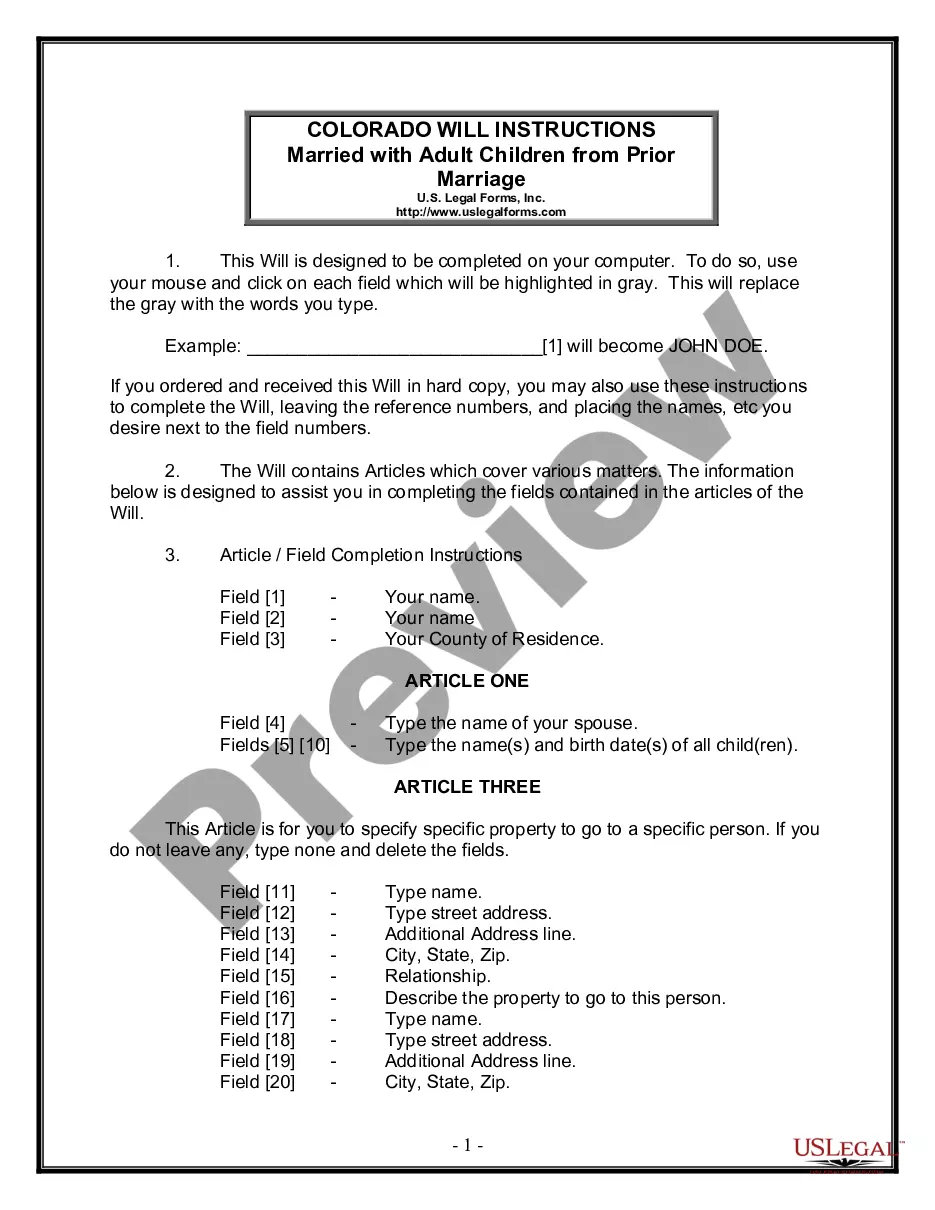

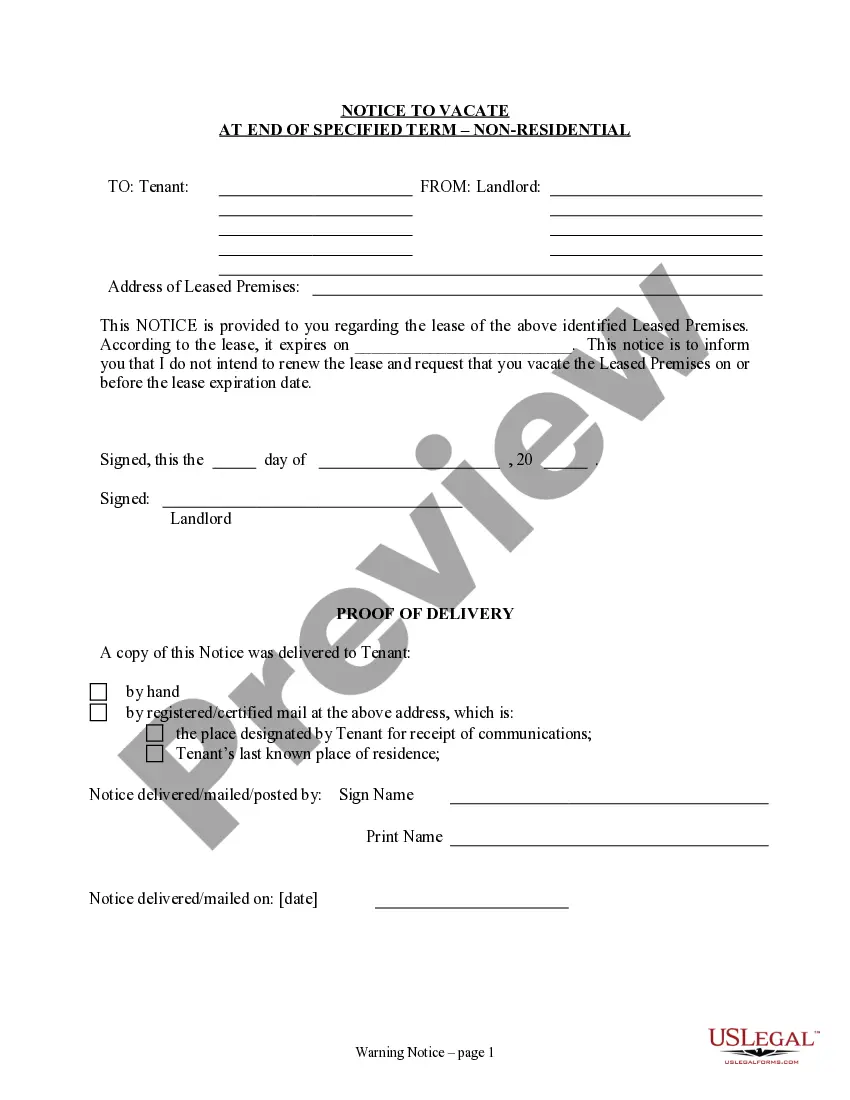

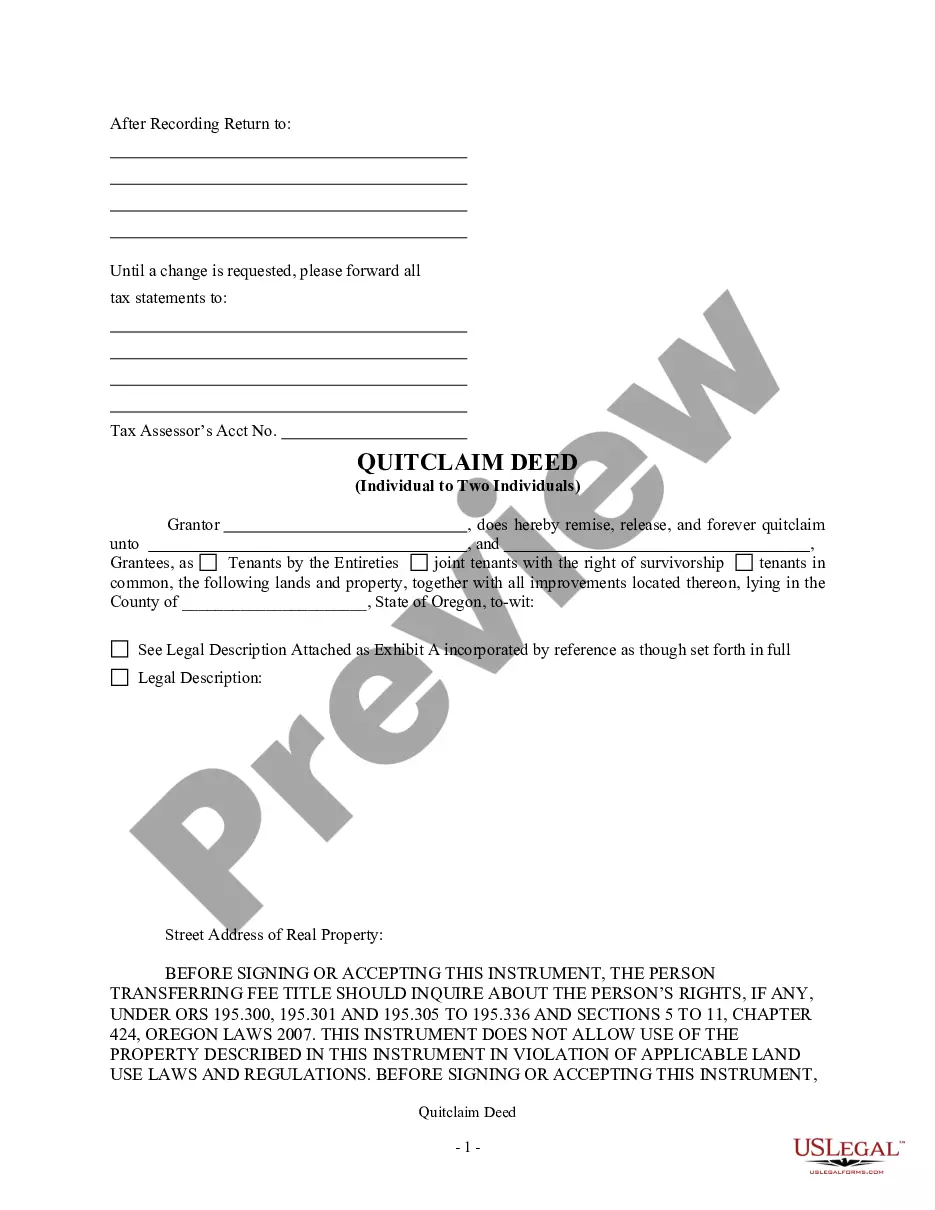

The Suffolk New York Expense Account Form is a comprehensive document utilized by individuals, businesses, or organizations to accurately record and submit expense claims incurred during official activities in Suffolk County, New York. This form plays a crucial role in reimbursing individuals or providing an overview of expenses incurred for financial purposes. It is an essential tool for maintaining financial transparency and controlling expenditure within organizations. The Suffolk New York Expense Account Form allows users to detail various expenses within different categories such as travel, meals, accommodation, transportation, supplies, and miscellaneous expenses. The form requires individuals to provide specific information regarding each expenditure, including the date, description, vendor name, payment method, and the amount spent. By utilizing the Suffolk New York Expense Account Form, individuals can ensure that their claims align with the policies and regulations set by their respective organizations or the county government. This form provides a standardized format for reporting expenses, thereby streamlining the reimbursement process and reducing the chances of errors or discrepancies. Different types or variations of the Suffolk New York Expense Account Form may include: 1. Individual Expense Account Form: This type of form is typically used by employees or individuals who need to track and claim their expenses incurred during official activities within Suffolk County, New York. 2. Business Expense Account Form: This variation of the form is specifically designed for businesses and organizations operating in Suffolk County. It allows businesses to consolidate and account for their expenses accurately while adhering to county guidelines and regulations. 3. County Government Expense Account Form: This specific type of form is utilized by agencies or departments within the Suffolk County government to authorize expenses for official purposes. It ensures that government employees follow prescribed procedures and guidelines when requesting reimbursement for expenses. In conclusion, the Suffolk New York Expense Account Form serves as an essential tool for accurately recording and documenting expenses incurred within the county. Whether it is for individual, business, or government-related purposes, this form allows users to maintain financial transparency and efficiently manage expense claims. By following the guidelines and utilizing this standardized form, individuals and organizations can ensure compliance with regulations and expedite the reimbursement process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Formulario de cuenta de gastos - Expense Account Form

Description

How to fill out Suffolk New York Formulario De Cuenta De Gastos?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Suffolk Expense Account Form, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how to find and download Suffolk Expense Account Form.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the related document templates or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Suffolk Expense Account Form.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Suffolk Expense Account Form, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you have to cope with an extremely challenging situation, we advise using the services of a lawyer to review your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

El registro en el libro de ingresos y egresos debe tener en cuenta que los ingresos percibidos o devengados y los egresos pagados o adeudados, deben ser plasmados en pesos, segun corresponda el tipo de movimiento. Se debe incorporar una glosa de acuerdo a la operacion realizada, es decir, sea un ingreso o egreso.

Guarde los recibos: Conservar sus recibos es una excelente manera de asegurarse de que recordara los gastos durante el dia. Use su tarjeta: Utilizar una tarjeta de credito o de debito en lugar de efectivo para la mayoria de sus compras crea un registro documentado de sus gastos.

En el Debe se registran todas aquellas operaciones que implican un ingreso o un aumento. Todos los ingresos y los debitos se contabilizan en el debe. Mientras que en el Haber se registran aquellas que implican una salida o una disminucion. Se contabilizan todos los gastos y creditos.

Es un registro generado en un acto de administracion interna que confirma la afectacion preventiva de un credito presupuestario aprobado y que disminuye la disponibilidad de la cuota de compromiso establecida para un periodo determinado.

El registro en el libro de ingresos y egresos debe tener en cuenta que los ingresos percibidos o devengados y los egresos pagados o adeudados, deben ser plasmados en pesos, segun corresponda el tipo de movimiento. Se debe incorporar una glosa de acuerdo a la operacion realizada, es decir, sea un ingreso o egreso.

Es una herramienta financiera que permite analizar el patron de ingresos y gastos en la actualidad. Una vez elaborado el registro, se lo puede usar para tomar decisiones financieras.

6 estrategias para reducir y controlar gastos Preparar presupuestos.Definir indicadores clave de desempeno y productividad.Implementar el tracking o seguimiento de los gastos.Alianzas con proveedores o contratistas.Controlar los inventarios.Uso de herramientas automatizadas.

El registro en el libro de ingresos y egresos debe tener en cuenta que los ingresos percibidos o devengados y los egresos pagados o adeudados, deben ser plasmados en pesos, segun corresponda el tipo de movimiento. Se debe incorporar una glosa de acuerdo a la operacion realizada, es decir, sea un ingreso o egreso.

Una forma sencilla de llevar el registro y control de los egresos es clasificarlos en Compras y Gastos. Las compras se relacionan con adquisiciones como las materias primas para elaborar un producto, mercancias para la venta, equipo o maquinaria que posteriormente se traducen en los ingresos del negocio.

Las cuentas de gastos son aquellas cuentas contables que se asignan a las operaciones especificas de una empresa con el objetivo de llevar un registro de todos los gastos derivados en el ejercicio de su actividad.