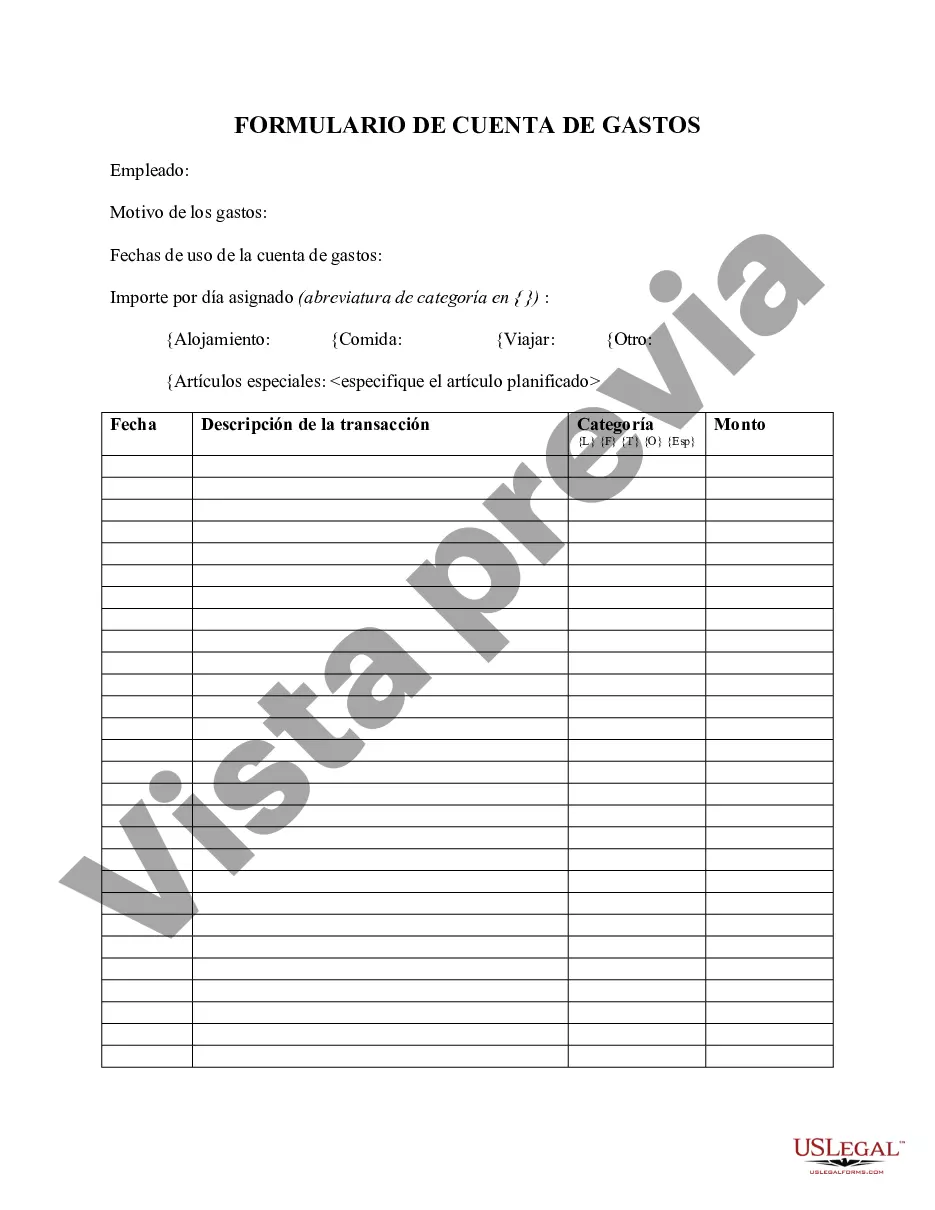

Travis Texas Expense Account Form is a standardized document used for tracking and reporting expenses incurred during business travel or any other authorized expenditure. This form serves as a comprehensive tool that allows employees to record and itemize all eligible expenses, ensuring accurate reimbursement and proper financial documentation. The Travis Texas Expense Account Form includes several sections to capture essential details. Firstly, it requires the employee's personal information, such as their full name, department, employee ID, and contact details. This ensures that the form is linked to the correct individual and helps in streamlining the reimbursement process. The form then proceeds to gather information regarding the travel or expense details. This section typically includes fields for indicating the purpose and duration of the trip, the destination, and whether it was domestic or international. Furthermore, it allows employees to specify the date of travel and provide an itinerary if applicable. The next critical component of the Travis Texas Expense Account Form is the expense breakdown section. Here, employees can record each individual expense incurred during the trip or expenditure. Common expenses that can be documented include transportation costs (flight tickets, car rental, public transportation), accommodation expenses (hotel bills), meals, entertainment, and miscellaneous expenses (parking fees, toll charges, etc.). For each expense entry, employees are required to provide the expense date, a brief description, the amount spent, and the currency used. It is crucial to attach all original receipts to validate the expenses listed. The form may also include specific fields to categorize expenses according to company-defined cost centers or expense types. Additionally, the Travis Texas Expense Account Form may have a section for capturing any cash advances issued to the employee before their trip. Employees can indicate the amount received, date of issuance, and any unspent balance that should be deducted from the reimbursement amount. It is important to note that depending on the organization and its policies, there might be variations or additional sections in the Travis Texas Expense Account Form. These could include sections for recording mileage reimbursement for personal vehicles used during the trip, per diem rates, or any other relevant information as required by the organization. Overall, the Travis Texas Expense Account Form serves as a crucial tool for employees and employers alike, ensuring transparency and accuracy in managing expenses related to business travel or any authorized expenditure. By using this form, organizations can streamline the reimbursement process while maintaining proper financial control and compliance with internal policies and external regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Formulario de cuenta de gastos - Expense Account Form

Description

How to fill out Travis Texas Formulario De Cuenta De Gastos?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Travis Expense Account Form.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Travis Expense Account Form will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Travis Expense Account Form:

- Make sure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Travis Expense Account Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!