Chicago, the third-largest city in the United States and one of the most significant financial hubs, offers various options for partnerships to open deposit accounts and procure loans. The Chicago Illinois Authority of Partnership is a governing body that regulates and oversees the process. When a partnership in Chicago wishes to open a deposit account, it must adhere to the guidelines set forth by the Chicago Illinois Authority of Partnership. This authority ensures that all necessary documents are submitted, such as partnership agreements, identification documents of partners, and proof of address. The authority reviews the application thoroughly, conducting due diligence to validate the authenticity and legality of the partnership. Additionally, the Chicago Illinois Authority of Partnership plays a crucial role in facilitating partnerships in securing loans. It provides assistance and guidance throughout the loan application process and serves as a mediator between the partnership and financial institutions. Their expertise ensures that partnerships meet the requirements and regulations specific to Chicago, and they help review loan terms and conditions to protect the interests of the partnership. The authority offers different types of partnership accounts and loans based on the specific needs of businesses. Some commonly available options include: 1. Partnership Deposit Accounts: These accounts allow partnerships to securely deposit their funds and receive interest on their balances. The authority may offer different types of deposit accounts such as current accounts, savings accounts, or fixed-term deposit accounts. 2. Working Capital Loans: Designed to fulfill short-term financial needs, working capital loans help partnerships manage their day-to-day operations. The authority assists in procuring such loans by reviewing financial statements, assessing creditworthiness, and connecting partnerships with suitable lending institutions. 3. Expansion Loans: When partnerships seek to expand their operations, the Chicago Illinois Authority of Partnership can facilitate loans specifically tailored for growth initiatives. These loans can include funds for acquiring new assets, opening new branches, or investing in research and development. 4. Project Financing Loans: For partnerships undertaking substantial projects, such as infrastructure development or real estate ventures, project financing loans come into play. The authority helps partnerships in navigating the complex loan application process, ensuring compliance with local regulations and investment requirements. By working closely with the Chicago Illinois Authority of Partnership, businesses can confidently open deposit accounts and apply for loans, knowing that they are following all necessary legal and financial protocols specific to the city. The authority is committed to supporting partnerships in their financial endeavors and ensuring a transparent and seamless process throughout.

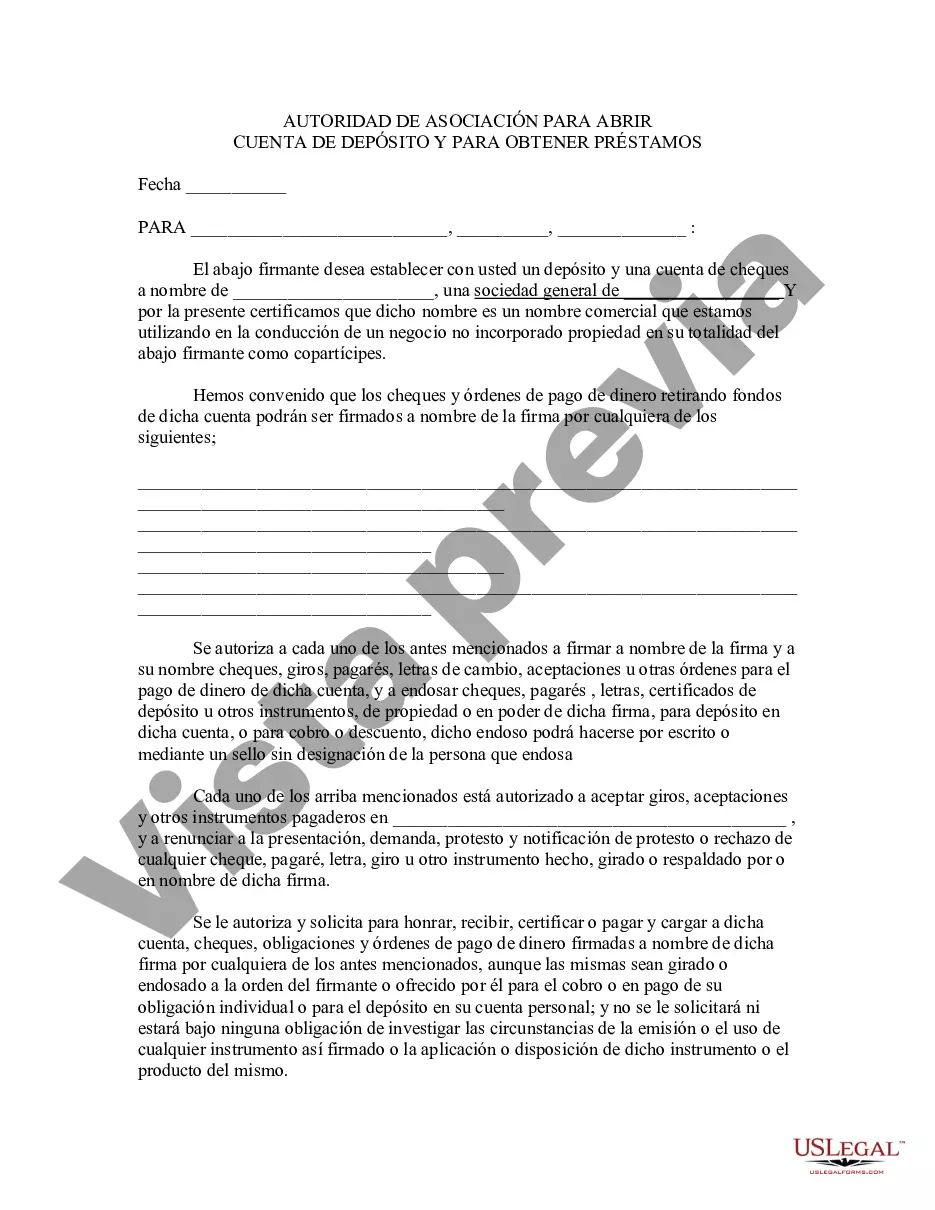

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Autoridad de la Asociación para Abrir Cuentas de Depósito y Procurar Préstamos - Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Chicago Illinois Autoridad De La Asociación Para Abrir Cuentas De Depósito Y Procurar Préstamos?

Creating documents, like Chicago Authority of Partnership to Open Deposit Account and to Procure Loans, to take care of your legal affairs is a tough and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents intended for a variety of cases and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Chicago Authority of Partnership to Open Deposit Account and to Procure Loans template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Chicago Authority of Partnership to Open Deposit Account and to Procure Loans:

- Make sure that your form is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Chicago Authority of Partnership to Open Deposit Account and to Procure Loans isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our service and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!