Collin Texas Authority of Partnership to Open Deposit Account and to Procure Loans refers to the legal jurisdiction and regulations governing partnerships in Collin County, Texas, when it comes to opening deposit accounts and procuring loans. Partnerships are formed when two or more individuals or entities come together with the objective of carrying out a business venture. In Collin County, Texas, partnerships are subject to specific rules and regulations related to financial transactions such as opening deposit accounts and obtaining loans. The Collin Texas Authority of Partnership ensures that these activities are conducted in compliance with the law. To open a deposit account as a partnership in Collin County, Texas, certain procedures and requirements must be followed. The partnership needs to submit the necessary documentation, which may include the partnership agreement, identification documents of the partners, and any other relevant information as prescribed by the Collin Texas Authority. The Authority will review the application, verifying the authenticity of the partnership and conducting due diligence measures before granting permission to open a deposit account. Similarly, when a partnership requires a loan to finance their business activities, they must adhere to the regulations set by the Collin Texas Authority. The partnership needs to present a detailed loan application, including the purpose of the loan, repayment plan, and financial documentation such as income statements, balance sheets, and cash flow projections. The Authority evaluates the loan application, taking into consideration factors such as the partnership's creditworthiness, business viability, and the purpose of the loan. It's important to note that the Collin Texas Authority of Partnership to Open Deposit Account and to Procure Loans may have different types based on the nature of the partnership and the purpose of the financial transactions. Some specialized types may include: 1. General Partnership: A partnership where all partners have equal rights and responsibilities. Each partner is liable for the partnership's debts and obligations. 2. Limited Partnership: A partnership that consists of both general partners and limited partners. Limited partners have limited liability and are not actively involved in the partnership's management. 3. Limited Liability Partnership (LLP): A partnership where all partners have limited liability for the actions and debts of the partnership. This structure is often preferred by professionals such as lawyers, accountants, or architects. 4. Registered Limited Liability Partnership (RLL): A limited liability partnership that has filed with the Collin Texas Authority to gain certain legal benefits and protections. By understanding the Collin Texas Authority of Partnership to Open Deposit Account and to Procure Loans and the different types of partnerships, business owners and partners in Collin County can ensure compliance with the appropriate regulations and smoothly carry out their financial activities.

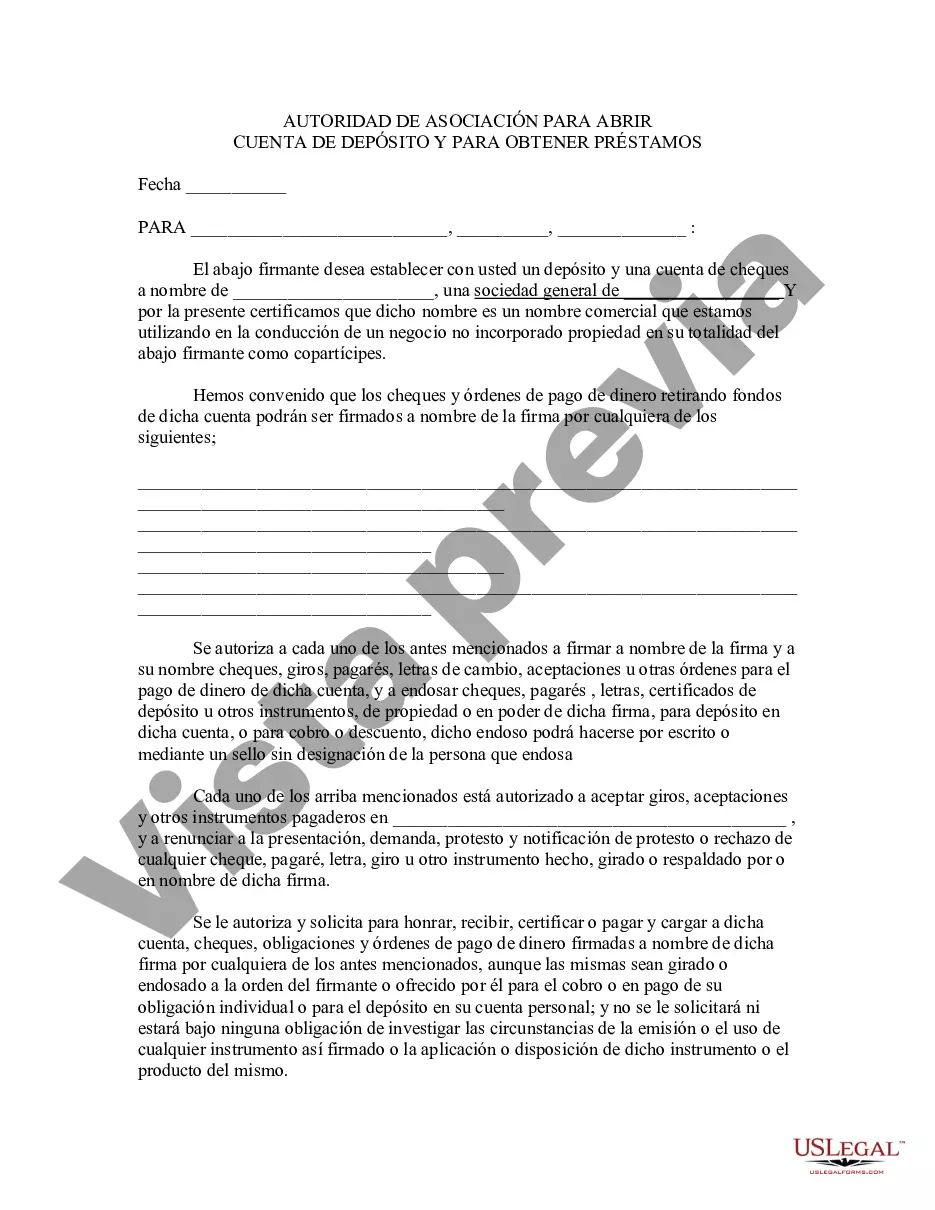

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Autoridad de la Asociación para Abrir Cuentas de Depósito y Procurar Préstamos - Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Collin Texas Autoridad De La Asociación Para Abrir Cuentas De Depósito Y Procurar Préstamos?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your county, including the Collin Authority of Partnership to Open Deposit Account and to Procure Loans.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Collin Authority of Partnership to Open Deposit Account and to Procure Loans will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Collin Authority of Partnership to Open Deposit Account and to Procure Loans:

- Make sure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Collin Authority of Partnership to Open Deposit Account and to Procure Loans on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!