Los Angeles California Authority of Partnership is a regulatory organization responsible for overseeing the establishment of deposit accounts and the provision of loans by partnerships within Los Angeles, California. This authority ensures compliance with relevant financial regulations and safeguards the interests of both partners and consumers. To open a deposit account under the Los Angeles California Authority of Partnership, partnership entities need to follow specific guidelines and procedures. This includes submitting required documentation such as partnership agreements, tax identification numbers, and financial statements to demonstrate the partnership's eligibility and legitimacy. The authority reviews these applications and ensures that all necessary requirements are met before granting permission to open a deposit account. Similarly, partnerships looking to procure loans must follow specific protocols established by the Los Angeles California Authority of Partnership. This involves presenting a comprehensive loan proposal that outlines the purpose, amount, and terms of the loan. The authority evaluates these proposals to assess the partnership's financial standing, repayment capacity, and potential risks associated with the loan. Different types of Los Angeles California Authority of Partnership to Open Deposit Account and to Procure Loans may include: 1. General Partnership Accounts and Loans — This category encompasses partnerships formed by two or more individuals or entities conducting business together. They rely on the Los Angeles California Authority of Partnership to open deposit accounts and secure loans to support their business operations. 2. Limited Partnership Accounts and Loans — These partnerships consist of at least one general partner, who holds unlimited liability, and one or more limited partners with limited liability. The Los Angeles California Authority of Partnership applies specific guidelines to open deposit accounts and issue loans for this type of partnership structure. 3. Limited Liability Partnership Accounts and Loans — In this type of partnership, partners enjoy limited liability, protecting personal assets from business-related liabilities. The Los Angeles California Authority of Partnership ensures that deposit accounts and loans for such partnerships adhere to the applicable laws and regulations. 4. Registered Limited Liability Partnerships Accounts and Loans — These partnerships combine elements of both general and limited liability partnerships. The Los Angeles California Authority of Partnership regulates the opening of deposit accounts and obtaining loans for registered limited liability partnerships, providing oversight and compliance assurance. In summary, the Los Angeles California Authority of Partnership plays a vital role in ensuring the proper establishment of deposit accounts and the procurement of loans by partnerships operating in Los Angeles. They maintain regulatory standards, evaluate eligibility, and protect the financial interests of partners and consumers alike.

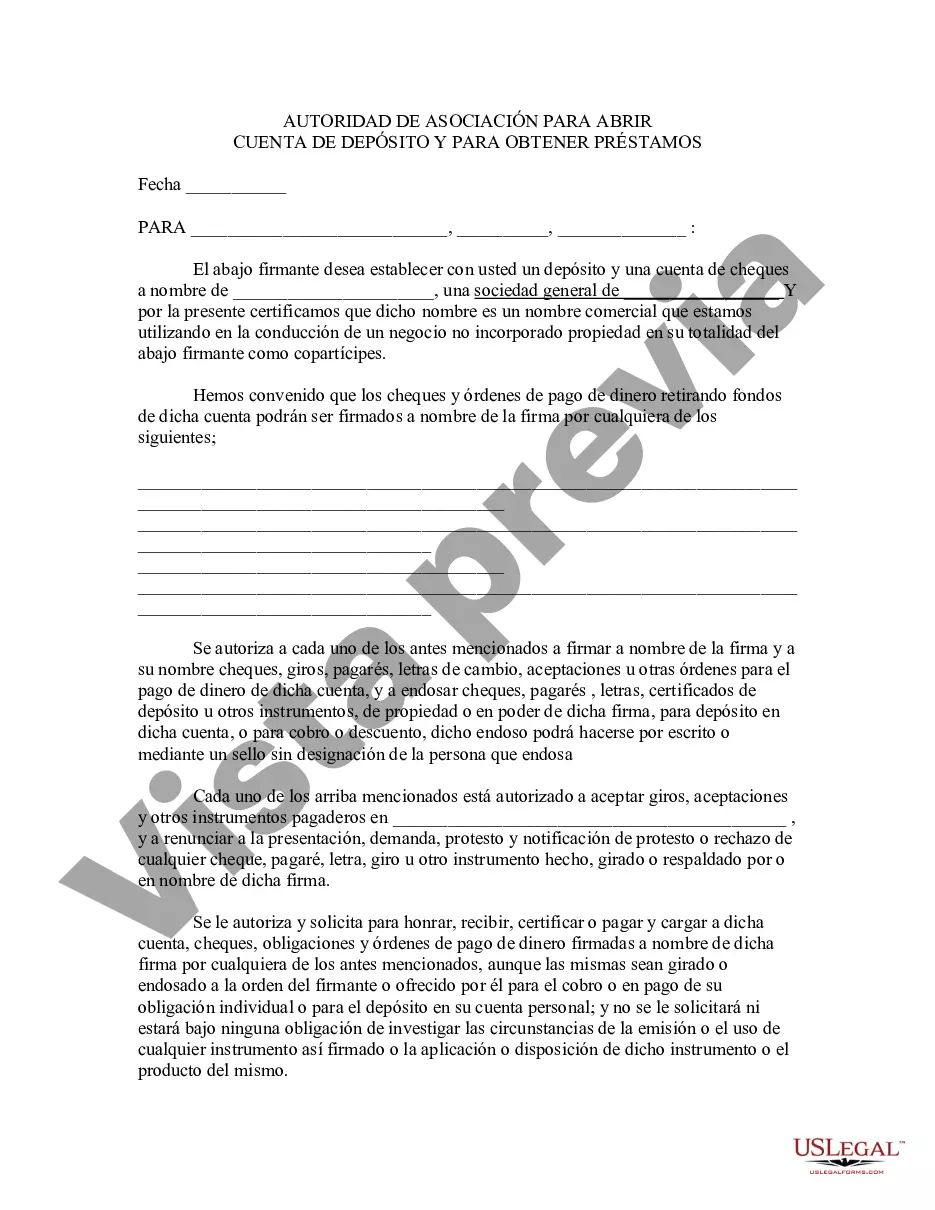

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Autoridad de la Asociación para Abrir Cuentas de Depósito y Procurar Préstamos - Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Los Angeles California Autoridad De La Asociación Para Abrir Cuentas De Depósito Y Procurar Préstamos?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Los Angeles Authority of Partnership to Open Deposit Account and to Procure Loans, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any activities related to document completion simple.

Here's how you can purchase and download Los Angeles Authority of Partnership to Open Deposit Account and to Procure Loans.

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Check the related document templates or start the search over to locate the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Los Angeles Authority of Partnership to Open Deposit Account and to Procure Loans.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Los Angeles Authority of Partnership to Open Deposit Account and to Procure Loans, log in to your account, and download it. Of course, our platform can’t replace an attorney entirely. If you have to cope with an exceptionally challenging case, we advise getting an attorney to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!