The Santa Clara California Authority of Partnership to Open Deposit Account and to Procure Loans is an organization dedicated to facilitating financial transactions for partnerships in the Santa Clara area. As the name suggests, it provides partnerships with the authority to open deposit accounts and procure loans for their business operations. This authority is crucial for partnerships looking to establish a strong financial foundation and access the necessary funds for growth and sustainability. By partnering with the Santa Clara California Authority of Partnership to Open Deposit Account and to Procure Loans, businesses can benefit from a range of services and expertise tailored to their specific needs. The authority works closely with local banks and financial institutions to streamline the account opening process for partnerships, ensuring a seamless experience. This collaboration enables partners to access various types of deposit accounts, including checking accounts, savings accounts, and certificates of deposit, while also benefiting from competitive interest rates and convenient online banking services. Moreover, the Santa Clara California Authority of Partnership to Open Deposit Account and to Procure Loans assists partnerships in procuring loans to support their business activities. These loans can be used for various purposes such as expanding operations, purchasing equipment or inventory, or undertaking infrastructure development. The authority helps partnerships navigate the loan application process, providing guidance on the required documentation, financial assessment, and eligibility criteria set by lending institutions. By leveraging their expertise and network, the authority aims to ensure that partnerships receive favorable loan terms and successfully secure the necessary funds to fuel their growth. It is important to note that the Santa Clara California Authority of Partnership to Open Deposit Account and to Procure Loans offers different types of accounts and loan options to cater to the diverse needs of partnerships. These may include opening joint accounts for partnerships to manage shared funds, business credit lines to provide a flexible source of financing, or specialized loans tailored to specific industries such as real estate or manufacturing. The authority recognizes that each business has unique requirements, and endeavors to offer customized solutions that align with their goals and objectives. In summary, the Santa Clara California Authority of Partnership to Open Deposit Account and to Procure Loans plays a pivotal role in empowering partnerships with the financial authority they need to establish deposit accounts and access loans. By leveraging its partnerships with local financial institutions, the authority simplifies the process, enabling businesses to focus on their core operations. Whether partnerships require a range of deposit accounts or are seeking financial assistance through loans, the authority provides comprehensive support to maximize their financial capabilities and foster growth.

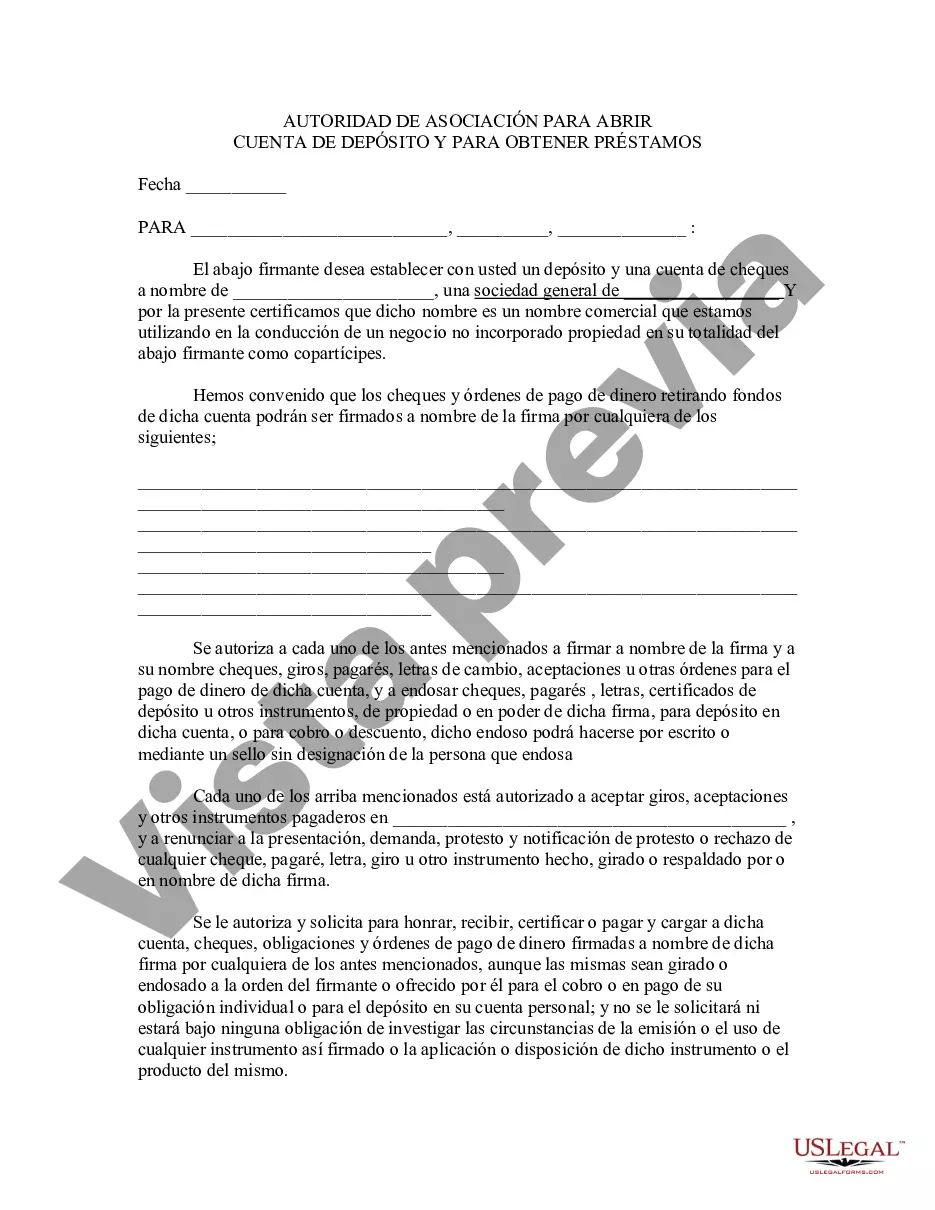

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Autoridad de la Asociación para Abrir Cuentas de Depósito y Procurar Préstamos - Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Santa Clara California Autoridad De La Asociación Para Abrir Cuentas De Depósito Y Procurar Préstamos?

Preparing paperwork for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Santa Clara Authority of Partnership to Open Deposit Account and to Procure Loans without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Santa Clara Authority of Partnership to Open Deposit Account and to Procure Loans on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Santa Clara Authority of Partnership to Open Deposit Account and to Procure Loans:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!