Allegheny Pennsylvania Debt Adjustment Agreement with Creditor is a legally binding document that outlines the terms and conditions agreed upon between a debtor and their creditor(s) in relation to the repayment of a debt. This agreement is designed to help the debtor in Allegheny County, Pennsylvania, manage their debt and establish a structured repayment plan that is mutually acceptable for both parties involved. The agreement typically involves negotiating a new payment plan that takes into consideration the debtor's financial capabilities and the creditor's expectations for debt resolution. It aims to provide the debtor with a manageable repayment schedule while ensuring the creditor receives their owed funds. There might be different types of Allegheny Pennsylvania Debt Adjustment Agreements with Creditors, depending on the nature of the debt and the specific circumstances of the debtor. Some common types may include: 1. Allegheny Pennsylvania Personal Debt Adjustment Agreement: This type of agreement involves an individual debtor who needs assistance in negotiating a repayment plan with their personal creditors. It is often used when an individual is struggling with overwhelming credit card debts, medical bills, or personal loans. 2. Allegheny Pennsylvania Business Debt Adjustment Agreement: Businesses facing financial hardships can enter into this type of agreement, which aims to facilitate restructuring of their debts with multiple creditors. It enables businesses to maintain operations while repaying their debts over an extended period, allowing them to regain financial stability. 3. Allegheny Pennsylvania Mortgage Debt Adjustment Agreement: Homeowners in Allegheny County who are struggling to make their mortgage payments can enter into this type of agreement with their mortgage lender(s). The agreement may involve modifying the loan terms, such as adjusting the interest rate or extending the loan period, to make the monthly payments more affordable. 4. Allegheny Pennsylvania Student Loan Debt Adjustment Agreement: Individuals burdened with student loan debts can potentially negotiate repayment plans with their student loan lenders through this agreement. It may involve adjusting the monthly payment amount based on the debtor's income or opting for an income-driven repayment plan. Regardless of the type of Allegheny Pennsylvania Debt Adjustment Agreement with Creditor, it is essential for both parties to thoroughly review and understand the terms and conditions before signing. Seeking legal advice or consulting a financial professional may also be advisable to ensure the agreement adequately addresses the debtor's financial situation and provides a feasible pathway towards debt resolution.

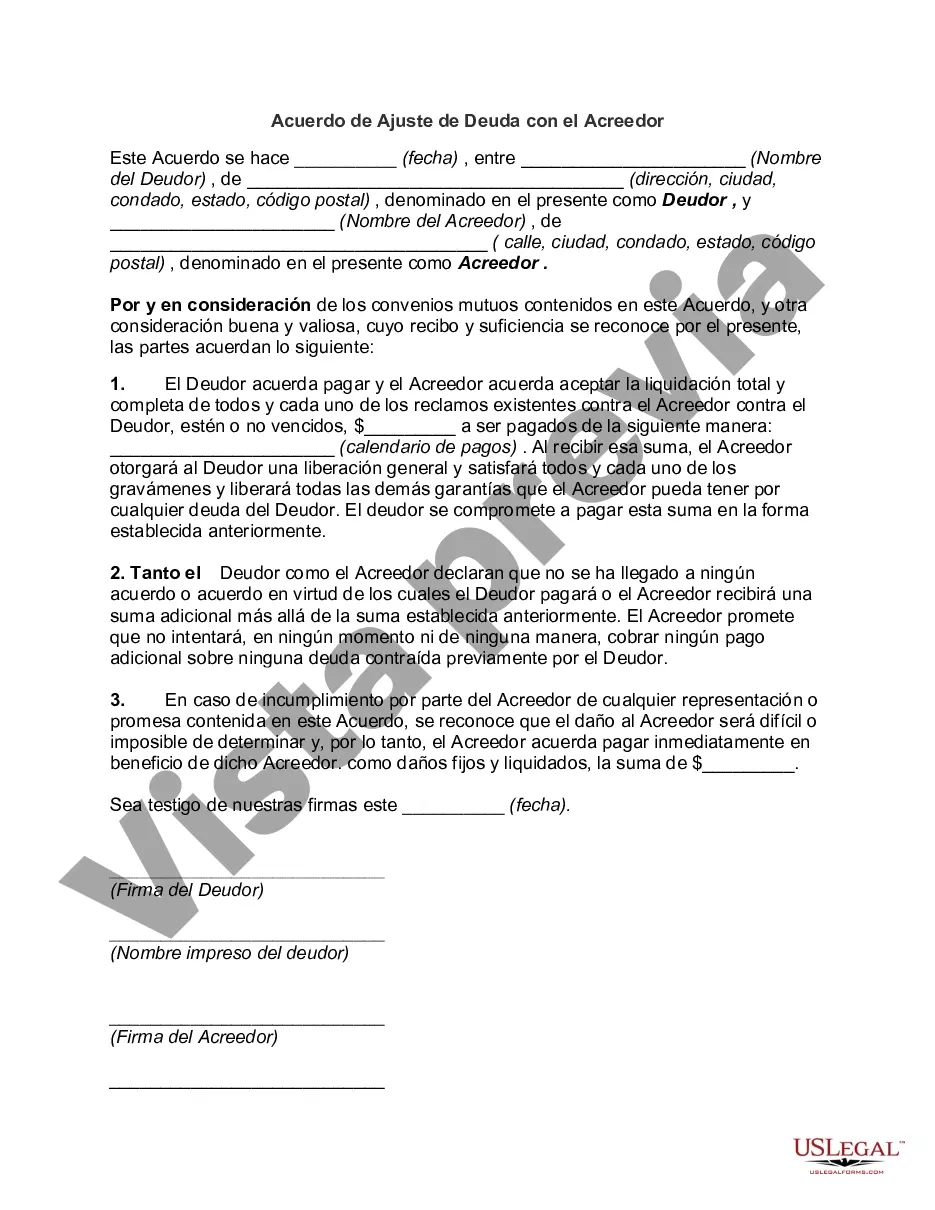

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Allegheny Pennsylvania Acuerdo De Ajuste De Deuda Con El Acreedor?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Allegheny Debt Adjustment Agreement with Creditor meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Allegheny Debt Adjustment Agreement with Creditor, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Allegheny Debt Adjustment Agreement with Creditor:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Allegheny Debt Adjustment Agreement with Creditor.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!