Bronx New York Debt Adjustment Agreement with Creditor: A Comprehensive Overview A Bronx New York Debt Adjustment Agreement with Creditor is a legally binding contract that helps individuals or businesses in Bronx, New York, negotiate and manage their outstanding debts with their creditors. This type of agreement provides an opportunity for debtors to restructure their debts, create a repayment plan, and potentially reduce their overall debt burden. Debt adjustment agreements are typically entered into when a debtor is facing financial distress or overwhelming debt, and they are unable to meet their payment obligations as originally agreed. This can occur due to various reasons, such as job loss, medical expenses, or unforeseen financial emergencies. These agreements aim to assist debtors in regaining control of their financial situation by working collaboratively with their creditors. Through negotiation and dialogue, debtors and their creditors can reach a mutually beneficial arrangement that allows for repayment of debt while considering the debtor's financial capabilities. Some key features of a Bronx New York Debt Adjustment Agreement with Creditor may include: 1. Debt Assessment: The debtor's financial situation is carefully evaluated to determine the total outstanding debt amount, interest rates, and other relevant details. 2. Repayment Plan: A realistic repayment plan is formulated based on the debtor's income, expenses, and financial resources. This plan typically extends the repayment term, reduces interest rates, or both, to make it more manageable for the debtor. 3. Creditor Approval: The agreement requires the creditor's approval, as it involves modifying the original debt terms. Creditors may agree to adjust the terms to recover a portion of the debt rather than risk potential non-payment. 4. Legal Protection: Once the agreement is signed, it provides legal protection to both parties, ensuring that the terms are enforced and adhered to by all parties involved. This protection safeguards the debtor from any legal actions or harassment by the creditor. Types of Bronx New York Debt Adjustment Agreements with Creditors: 1. Debt Settlement Agreement: This agreement typically involves negotiating with creditors to settle the debt for less than the full amount owed. In such cases, debtors typically make a lump-sum payment or agree to a structured payment plan to settle the debt. 2. Debt Consolidation Agreement: This agreement involves combining multiple debts into a single manageable payment plan. Debtors may secure a consolidation loan or work with a debt consolidation agency to streamline their debt repayment process. 3. Debt Management Agreement: In this type of agreement, a credit counseling agency acts as an intermediary between the debtor and the creditor. They negotiate an affordable repayment plan, often with reduced interest rates, and handle direct disbursements to the creditors on behalf of the debtor. In conclusion, a Bronx New York Debt Adjustment Agreement with Creditor provides a viable solution for debtors to address their financial difficulties while avoiding bankruptcy or severe credit damage. These agreements offer an opportunity for debtors to regain control of their finances through structured repayment plans, potential debt reduction, and legal protection. Whether it is a debt settlement, consolidation, or management agreement, debtors in the Bronx can explore various options to find the best fit for their specific circumstances.

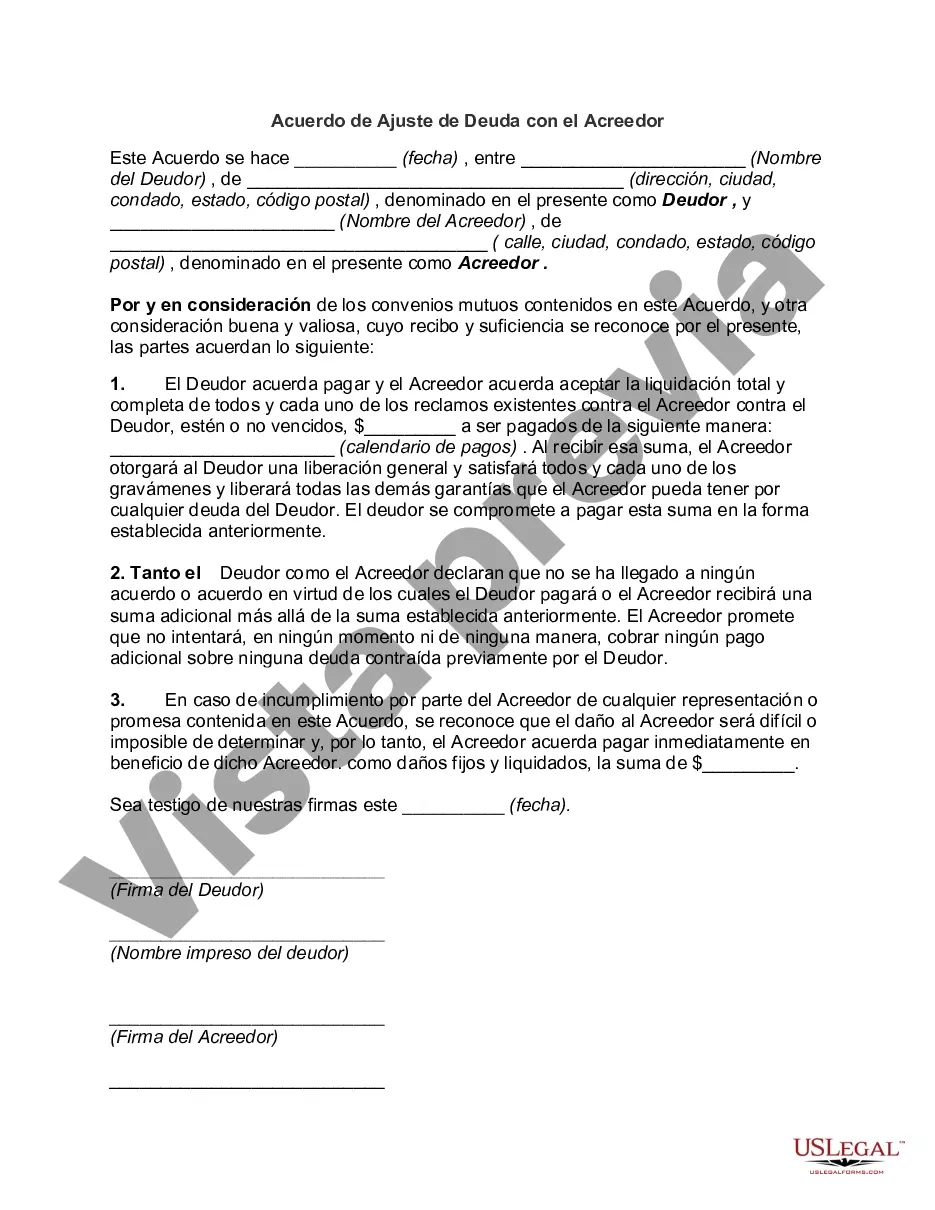

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Bronx New York Acuerdo De Ajuste De Deuda Con El Acreedor?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Bronx Debt Adjustment Agreement with Creditor, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how to find and download Bronx Debt Adjustment Agreement with Creditor.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the related forms or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Bronx Debt Adjustment Agreement with Creditor.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Bronx Debt Adjustment Agreement with Creditor, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer completely. If you need to deal with an exceptionally complicated situation, we advise using the services of an attorney to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!