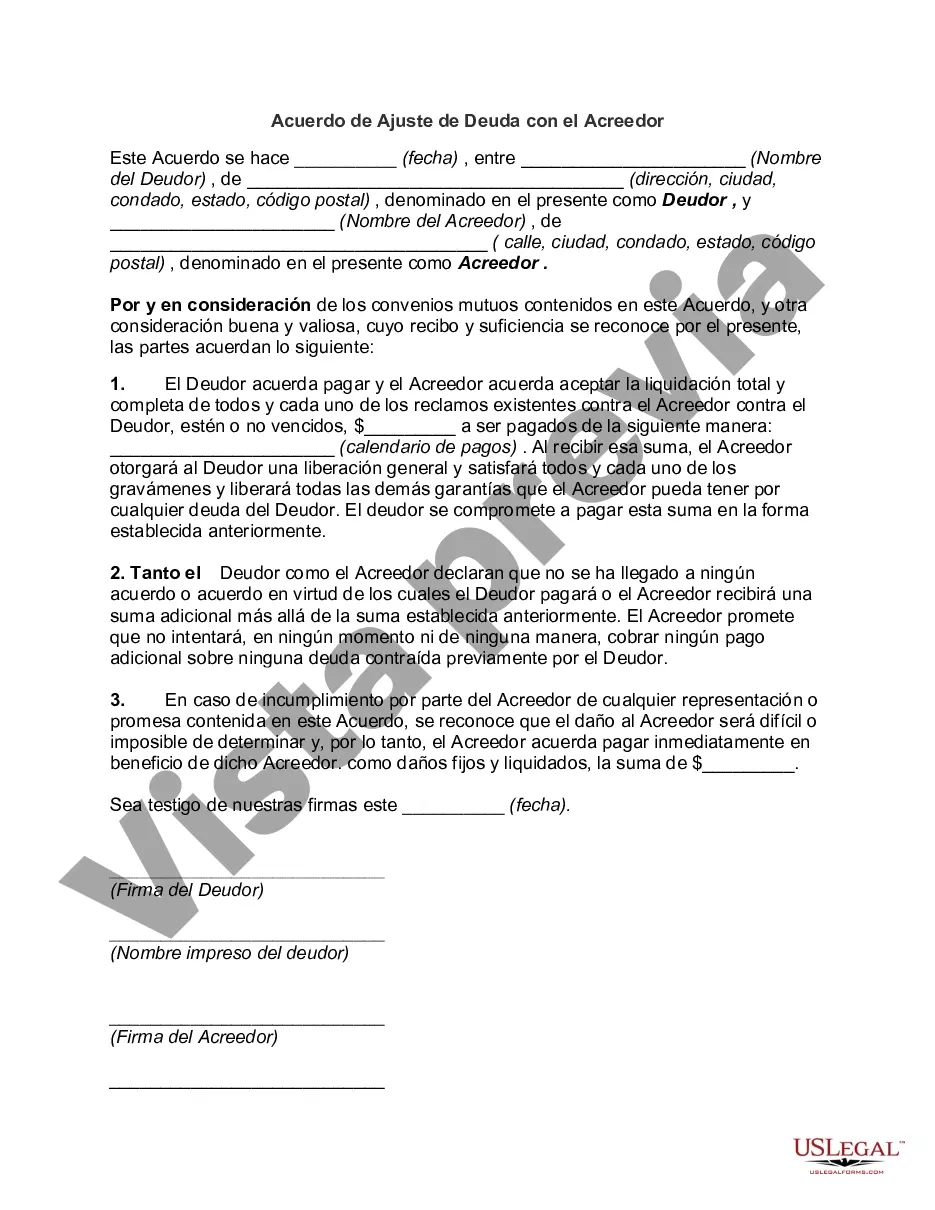

A Clark Nevada Debt Adjustment Agreement with a Creditor is a legally binding document that outlines the terms and conditions for resolving outstanding debt between a debtor residing in Clark County, Nevada, and a creditor. This agreement is specifically designed to assist individuals in efficiently managing their debts and implementing feasible repayment plans. The primary purpose of a Clark Nevada Debt Adjustment Agreement with a Creditor is to establish a systematic framework for debt repayment that suits the debtor's financial situation while striving to satisfy the creditor's interests. It typically involves negotiating a revised payment plan, potential interest rate reductions, and sometimes even a partial debt forgiveness. There are various types of Clark Nevada Debt Adjustment Agreements with a Creditor catering to different circumstances: 1. Standard Debt Adjustment Agreement: This is the most common type of agreement wherein the debtor and creditor agree upon revised terms, such as lower monthly installment amounts or extended repayment periods, to fulfill the debt obligations. Typically, both parties have to compromise to ensure the successful resolution of the debts. 2. Consolidation Debt Adjustment Agreement: In cases where an individual has multiple debts from different creditors, a consolidation agreement may be reached. This agreement involves combining all outstanding debts into one single loan with a fixed interest rate and favorable repayment terms. This allows for easier management, as the debtor only needs to make one monthly payment instead of multiple payments. 3. Settlement Debt Adjustment Agreement: When a debtor is facing extreme financial hardship and cannot meet the full debt amount, a settlement agreement may be negotiated. This agreement entails the debtor paying a lump sum or an agreed-upon reduced amount to the creditor in exchange for the complete discharge of debt. The creditor may agree to this option if they believe it is the most viable way to recover at least a portion of the debt. 4. Modification Debt Adjustment Agreement: If the debtor is experiencing temporary financial difficulties, a modification agreement may be sought. In this case, the debtor and creditor may agree to temporarily reduce or suspend payments until the debtor's financial situation improves. Once the agreed-upon period ends, the original repayment terms are reinstated. In summary, a Clark Nevada Debt Adjustment Agreement with a Creditor is a flexible tool that helps debtors in Clark County, Nevada, resolve their financial obligations in a manageable and efficient manner. The type of agreement entered into depends on the debtor's specific circumstances and financial capabilities, ensuring an equitable resolution between the debtor and creditor for everyone involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Clark Nevada Acuerdo De Ajuste De Deuda Con El Acreedor?

Preparing papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Clark Debt Adjustment Agreement with Creditor without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Clark Debt Adjustment Agreement with Creditor by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step instruction below to get the Clark Debt Adjustment Agreement with Creditor:

- Examine the page you've opened and check if it has the sample you require.

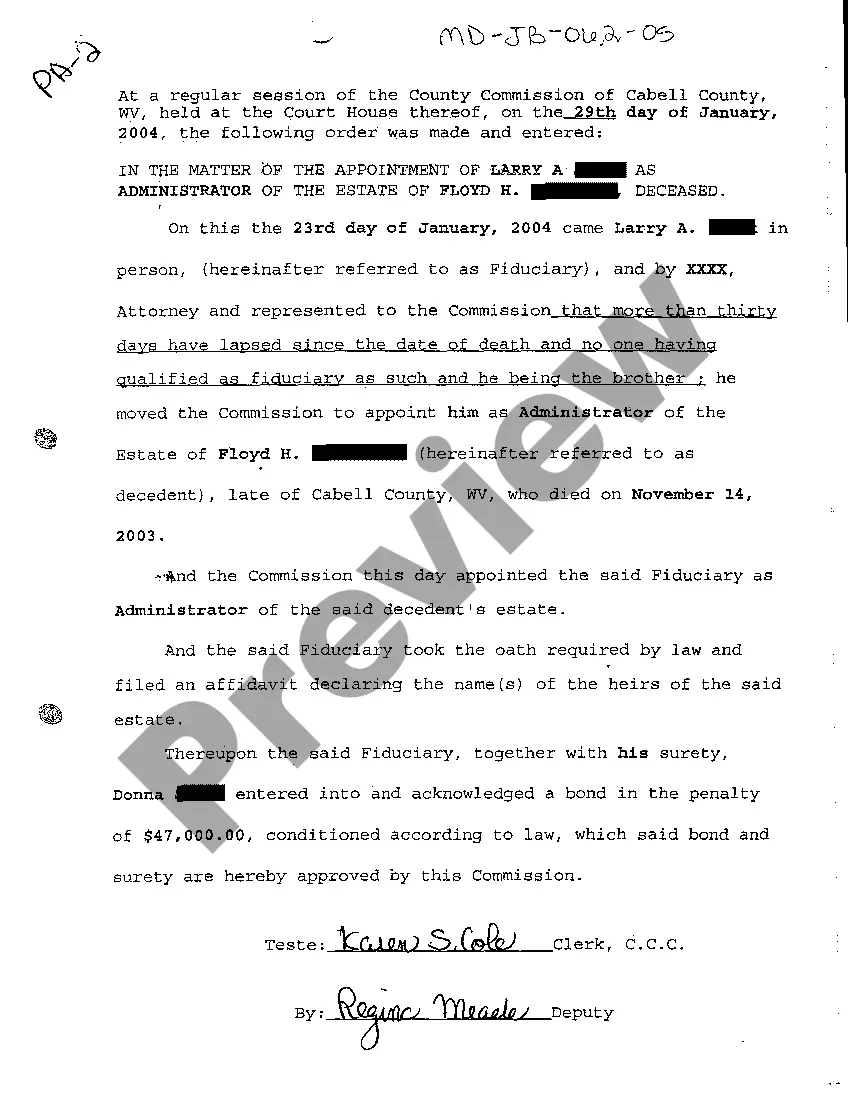

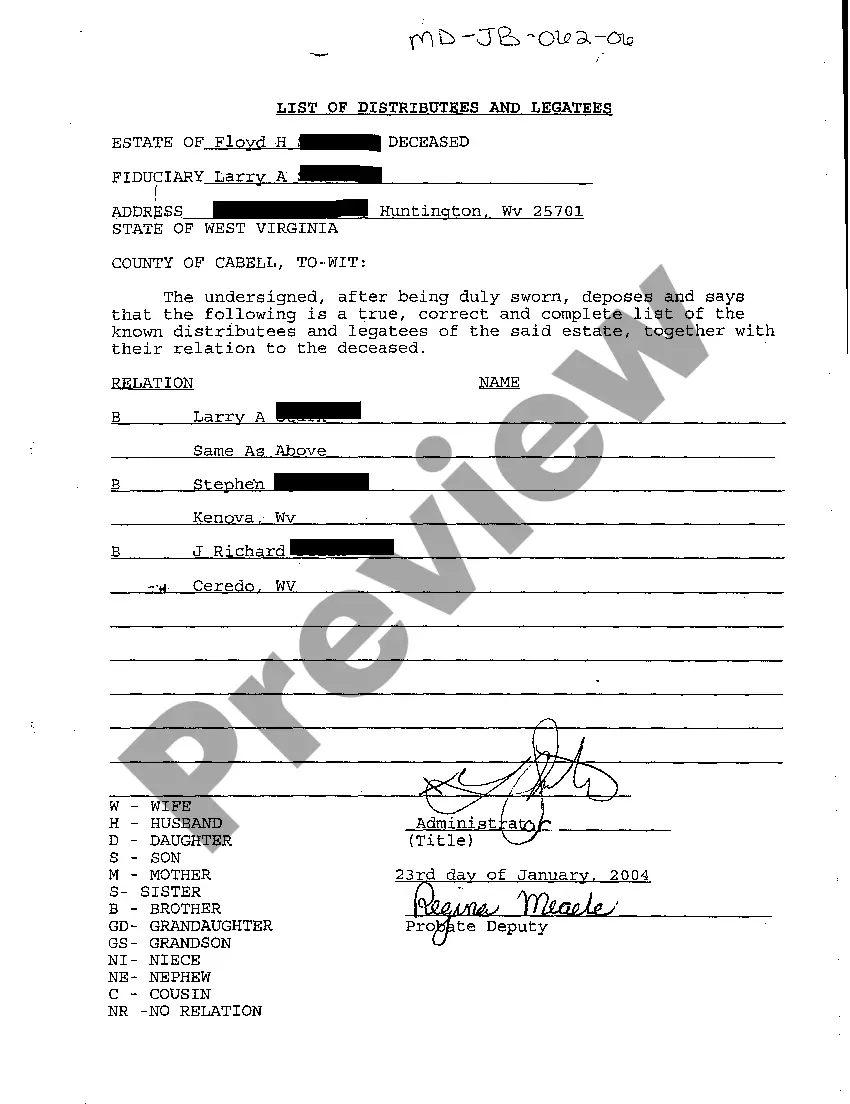

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!