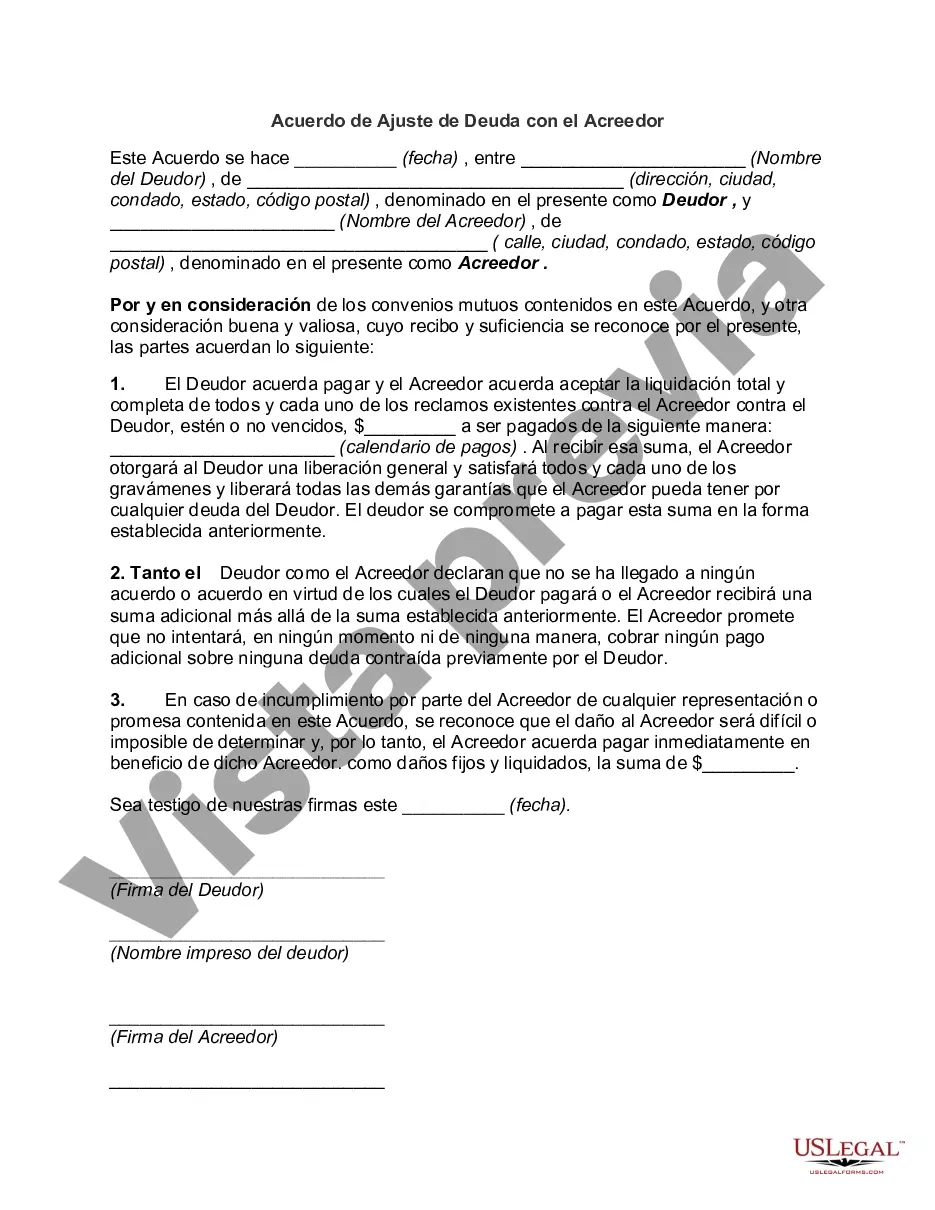

Contra Costa County, located in California, offers individuals struggling with debt a debt adjustment agreement with creditors to help manage and repay their outstanding debts. This agreement serves as a formal arrangement between the debtor and the creditor, outlining a structured plan for debt repayment. The Contra Costa County Debt Adjustment Agreement with Creditor provides individuals with an opportunity to establish a realistic and manageable payment plan, enabling them to gradually eliminate their debts over a specified period. This agreement aims to alleviate financial burdens, reduce interest rates, and potentially negotiate for reduced payment amounts. There are different types of Contra Costa County Debt Adjustment Agreements with Creditors, each catering to specific debt situations. Here are a few common types: 1. Personal Loan Debt Adjustment Agreement: This type of agreement focuses on individuals struggling with personal loans such as student loans, car loans, or personal lines of credit. It aims to negotiate modified repayment terms that fit within the debtor's financial capabilities to avoid default. 2. Credit Card Debt Adjustment Agreement: This agreement targets individuals with sizeable credit card debts. It involves negotiations with creditors to potentially reduce interest rates, waive late fees, and establish reasonable repayment plans, making it more manageable for debtors. 3. Medical Debt Adjustment Agreement: Medical expenses can quickly accumulate, leading to significant debts. This agreement helps individuals navigate medical debt by negotiating with healthcare providers for reduced payment amounts, flexible repayment terms, or potential discounts. 4. Mortgage Debt Adjustment Agreement: Individuals facing challenges with their mortgage payments can opt for a debt adjustment agreement to avoid foreclosure. This agreement may involve modifying the loan terms, extending the repayment period, or temporarily reducing monthly payments to provide much-needed relief. Overall, the Contra Costa County Debt Adjustment Agreements with Creditors allow debtors to regain control of their financial situations by establishing structured plans and negotiations tailored to their specific debts. These agreements aim to prevent further financial distress, encourage responsible debt management, and provide individuals with an opportunity to regain their financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Contra Costa California Acuerdo De Ajuste De Deuda Con El Acreedor?

Are you looking to quickly create a legally-binding Contra Costa Debt Adjustment Agreement with Creditor or maybe any other form to handle your own or corporate affairs? You can go with two options: contact a professional to draft a legal paper for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant form templates, including Contra Costa Debt Adjustment Agreement with Creditor and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, carefully verify if the Contra Costa Debt Adjustment Agreement with Creditor is adapted to your state's or county's laws.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were hoping to find by using the search box in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Contra Costa Debt Adjustment Agreement with Creditor template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the templates we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!