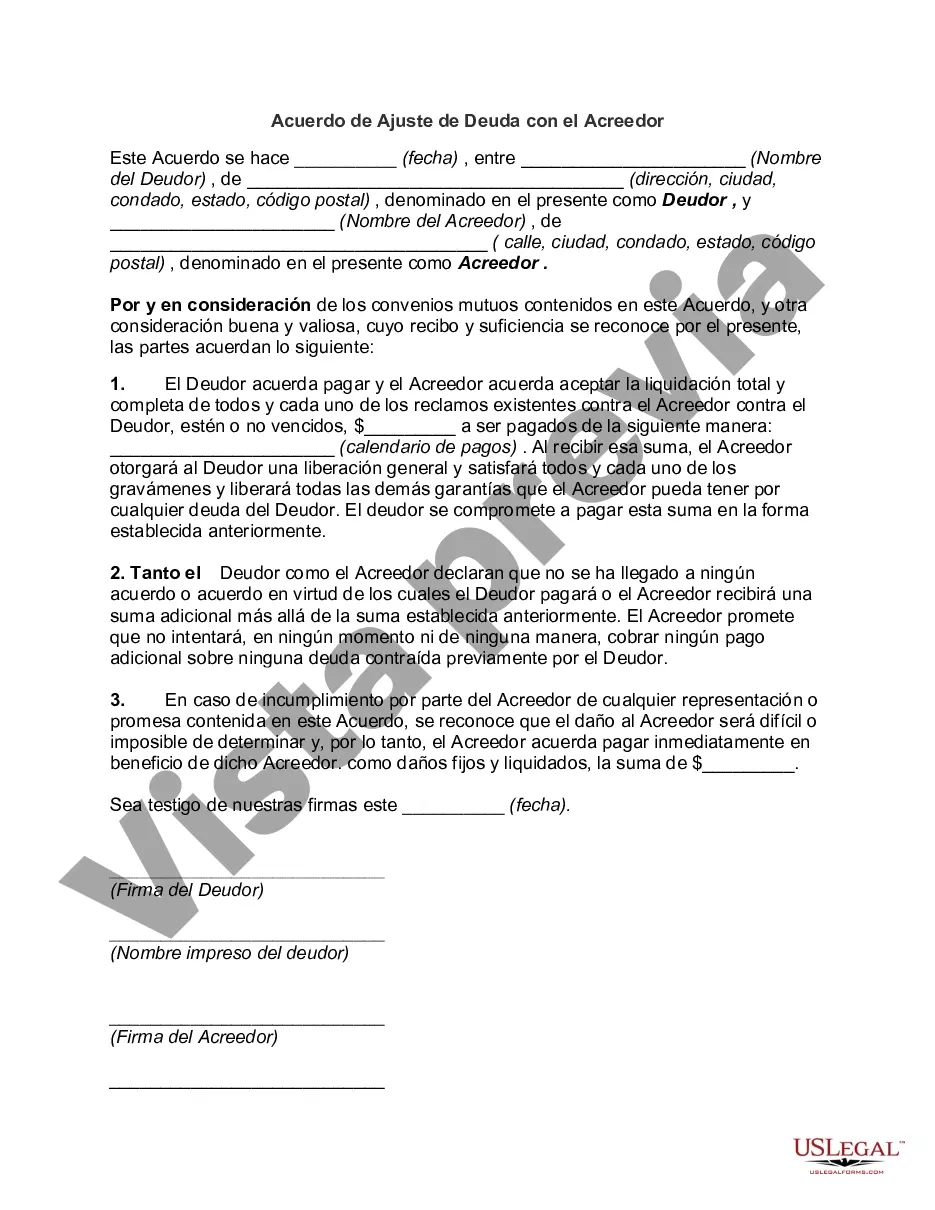

The Cook Illinois Debt Adjustment Agreement with Creditor is a legal contract that outlines a plan for the restructuring and repayment of debt owed to creditors by Cook Illinois Corporation. This agreement is designed to provide a solution for the financial difficulties faced by the company, allowing it to address its outstanding debts in an organized and structured manner. Within the Cook Illinois Debt Adjustment Agreement with Creditor, various types of agreements may be established depending on the specific circumstances and needs of the company. Some common types include: 1. Installment Payments Agreement: Under this type of agreement, Cook Illinois Corporation agrees to make regular payments to the creditor over a specified period of time. The payments are typically divided into fixed installments, allowing for better financial planning and management. 2. Debt-for-Equity Swap Agreement: In certain cases, the Cook Illinois Debt Adjustment Agreement may involve a debt-for-equity swap arrangement. In this scenario, a portion of the outstanding debt may be converted into equity or ownership shares of the company. This allows creditors to become shareholders and potentially benefit from the company's future growth and profitability. 3. Interest Rate Modification Agreement: Cook Illinois Corporation may negotiate with its creditors to modify the interest rates on its existing debt. This can lead to reduced interest expenses and more manageable monthly payments, facilitating the company's path towards debt repayment. 4. Principal Reduction Agreement: In a principal reduction agreement, Cook Illinois Corporation and its creditors may agree to lower the overall amount of debt owed. This can be achieved through a negotiated settlement or by restructuring the debt in a way that reduces the principal balance. Such an agreement can provide significant financial relief to the company, enabling it to gradually eliminate its debts. The Cook Illinois Debt Adjustment Agreement with Creditor is a crucial step in resolving the financial challenges faced by Cook Illinois Corporation. It provides an opportunity for the company to regain financial stability and create a roadmap for successfully repaying its outstanding debts. By establishing clear terms, repayment schedules, and potentially modifying interest rates or reducing principal, the agreement creates a mutually beneficial arrangement for both the company and its creditors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Cook Illinois Acuerdo De Ajuste De Deuda Con El Acreedor?

Do you need to quickly draft a legally-binding Cook Debt Adjustment Agreement with Creditor or probably any other document to handle your personal or business affairs? You can select one of the two options: hire a legal advisor to write a legal document for you or draft it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal papers without having to pay sky-high fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Cook Debt Adjustment Agreement with Creditor and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, double-check if the Cook Debt Adjustment Agreement with Creditor is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to verify what it's suitable for.

- Start the search again if the document isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Cook Debt Adjustment Agreement with Creditor template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the templates we provide are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Basicamente, el pagare se formaliza con dos partes representadas: El deudor o librado, que es quien emite el documento y se compromete a pagar la suma estipulada. Tambien se denomina tenedor. El acreedor o librador, que actua como beneficiario y tiene el poder de cobrar la deuda en la fecha de su vencimiento.

Formato de la carta de compromiso de pago Datos del pagador: Despues incluye los datos del particular o empresa a quien va dirigida. Fecha de la carta: En lado superior derecho coloca la fecha en la que se redacta la carta. Cantidad de pago y condiciones: En el cuerpo de la carta haz constar el compromiso de pago.

COMPONENTES DE UN EMAIL DE COBRANZA Nombre de quien envia el email.Asunto del email.Motivo del contacto.Deuda.Llamada a la accion.Penalidades (opcional).Disclaimer.Firma.

Formato de la carta de compromiso de pago Utilizar membrete para poner los dato del remitente; si es una empresa, colocaremos el logo, si un particular, el nombre, seguido de los datos de contacto: direccion, telefono y correo electronico.En lado superior derecho colocaremos la fecha en la que se redacta la carta.

Documento cuya funcion es acreditar que el contribuyente ha realizado el ingreso que debia en el Tesoro Publico. Llamada tambien recibo, es el documento en el que el acreedor reconoce haber recibido todo lo que se le debia, o parte solamente de ello.

Tres maneras de llegar a un equilibrio Conoce lo que debes. Es como tomar nota de todo lo que comes cuando tratas de estar mas saludable.Reduce el saldo. Clasifica tus deudas por orden de tamano o de tasa de interes.Administra tus deudas. Continua administrando tus deudas como parte de tu plan financiero general.

Una carta de compromiso de pago es un documento, a traves del cual una persona fisica o juridica acepta hacerse cargo del pago de una cantidad de dinero que mantenia a modo de deuda con una persona o empresa.

La primera opcion a la que debes recurrir es acudir a negociar con la institucion financiera, quien te podra dar algunas opciones para que puedas hacer frente a todos tus compromisos....¿Que opciones tienes? Reestructuracion.Consolidacion de deudas.Quita.Solicitar un prestamo personal.

Dependiendo de cual sea su situacion financiera, le presentamos seis maneras de manejar su deuda, y cuando conviene aplicarlas. Evalue y establezca un plan. Comuniquese con un especialista en credito. Negocie o difiera. Considere consolidar las deudas. Investigar sobre la condonacion de la deuda.

Los elementos imprescindibles de un acuerdo de pago son: Datos del acreedor y del deudor: El nombre y los apellidos, asi como el documento nacional de identidad deben estar presentes en los documentos. Clausulas: Deben establecerse las clausulas o declaraciones que modifican o cumplimentan al acuerdo original.