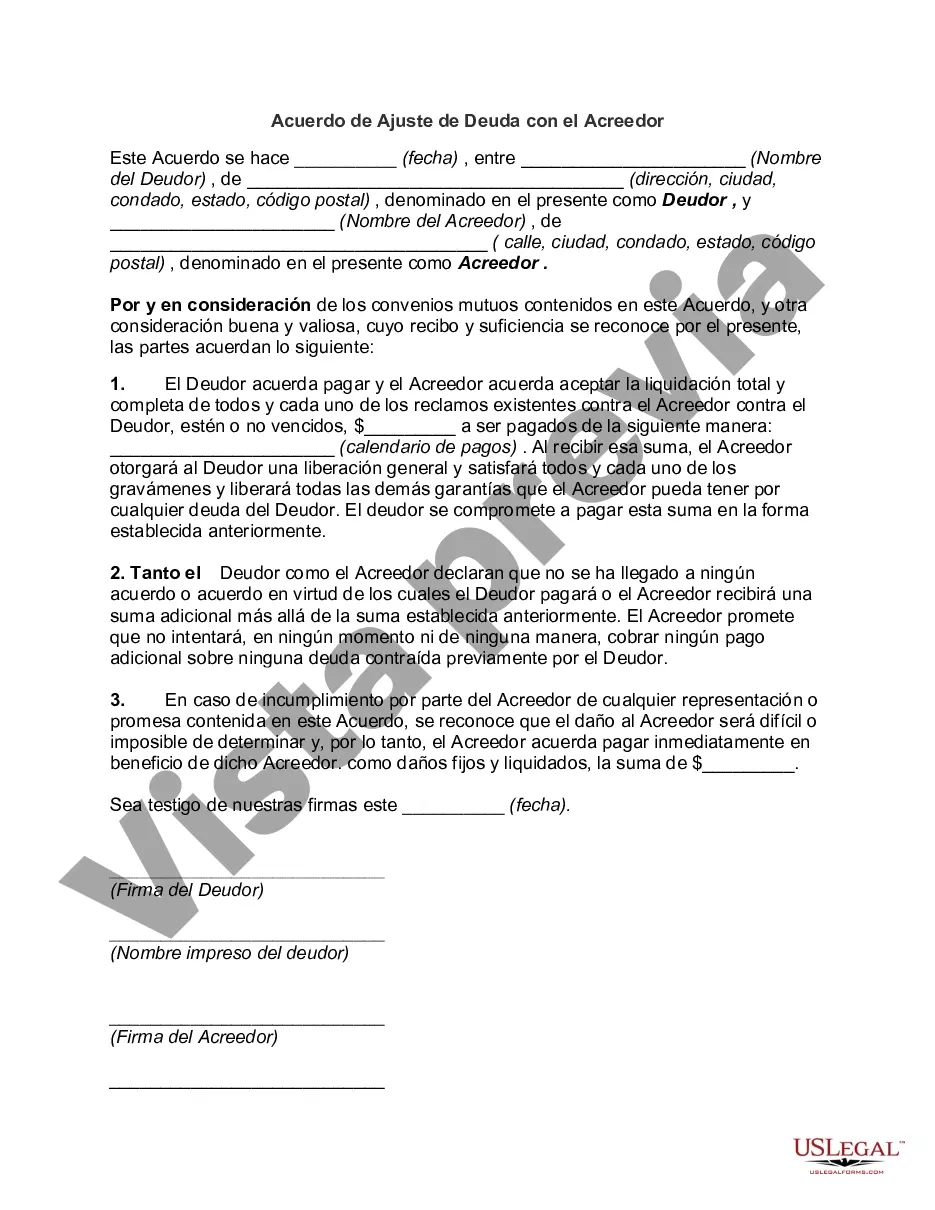

Cuyahoga County, located in Ohio, offers individuals struggling with debt the opportunity to enter into a Debt Adjustment Agreement with their creditors. This agreement is a legally binding arrangement that aims to help debtors manage and eventually repay their outstanding debts in a manageable and structured manner. The Cuyahoga Ohio Debt Adjustment Agreement with Creditor is specifically designed for residents of Cuyahoga County who require assistance in resolving their debts. By entering into this agreement, debtors gain the ability to negotiate modified repayment plans with their creditors, taking into consideration their financial situations and ability to pay. There are several types of Cuyahoga Ohio Debt Adjustment Agreements with Creditors available to debtors, each catering to different financial circumstances. These include: 1. Debt Consolidation Agreement: This type of agreement allows debtors to consolidate multiple debts into one monthly payment, typically at a reduced interest rate. It simplifies the repayment process, ensuring a single payment to a third-party organization handling the consolidated debt. 2. Debt Settlement Agreement: This agreement involves negotiating with creditors to settle outstanding debts for a lower amount than what is actually owed. Debtors may negotiate a lump sum payment or a structured repayment plan at a reduced amount. 3. Debt Management Agreement: With this agreement, a third-party debt management agency steps in to negotiate new payment terms with creditors on behalf of the debtor. The agency often helps create a realistic budget and repayment plan that suits the debtor's financial situation. 4. Creditor Repayment Agreement: In some cases, a debtor may directly negotiate a repayment plan with their creditors, which may include lower interest rates, reduced monthly payments, or extended repayment periods. It is important to note that the specific terms and conditions of each Debt Adjustment Agreement may vary depending on the individual's financial circumstances and the creditor's policies. Before entering into any agreement, it is recommended that individuals consult with a financial advisor or seek legal advice to understand the potential implications and ensure it aligns with their financial goals. Overall, the Cuyahoga Ohio Debt Adjustment Agreement with Creditor provides residents with a means to regain control of their finances and work towards becoming debt-free. It offers an opportunity for debtors to negotiate manageable repayment plans and find an achievable path towards financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Cuyahoga Ohio Acuerdo De Ajuste De Deuda Con El Acreedor?

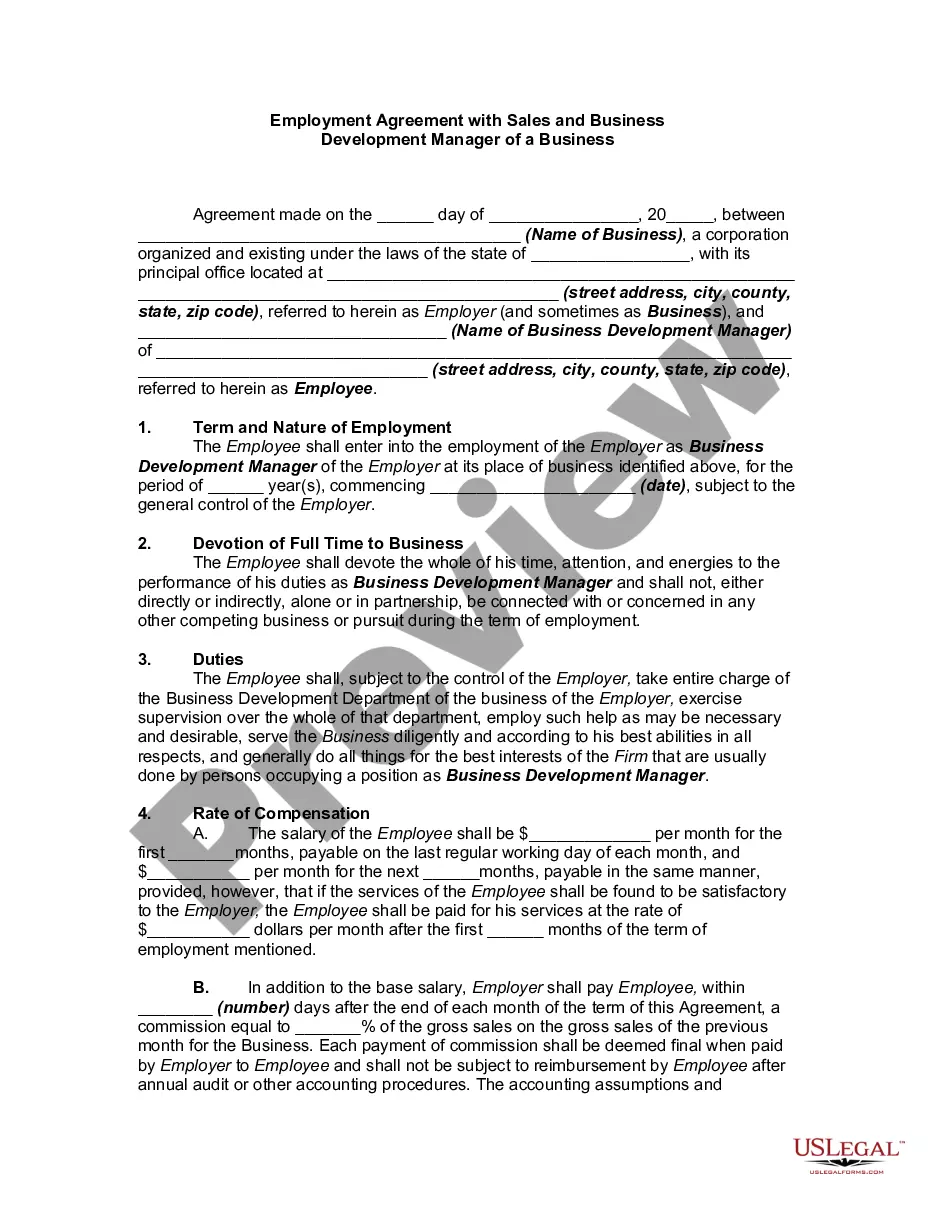

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cuyahoga Debt Adjustment Agreement with Creditor, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the current version of the Cuyahoga Debt Adjustment Agreement with Creditor, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Debt Adjustment Agreement with Creditor:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Cuyahoga Debt Adjustment Agreement with Creditor and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!