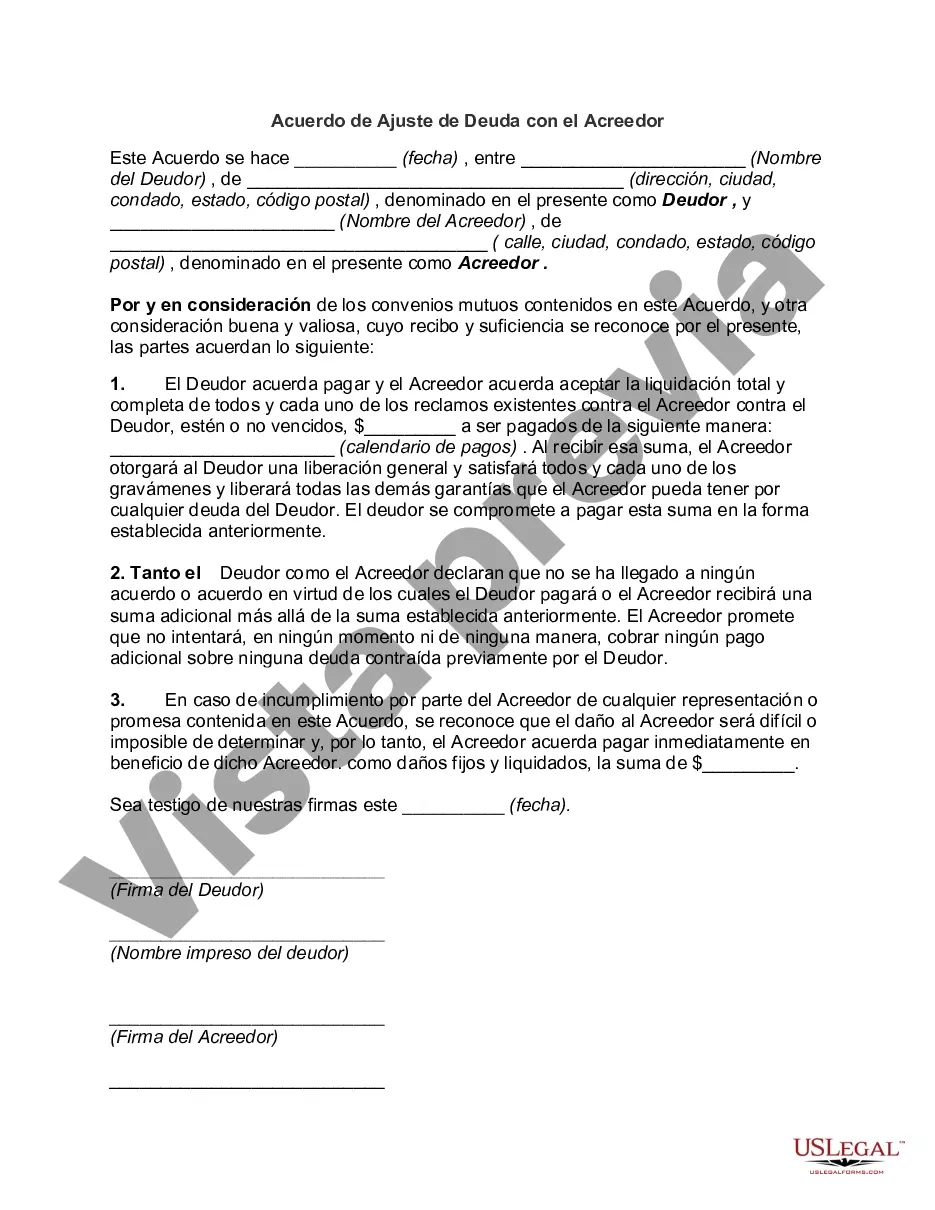

Dallas Texas Debt Adjustment Agreement with Creditor is a legally binding contract between a debtor and a creditor that outlines the terms and conditions for the adjustment of outstanding debts. This agreement is designed to provide financial relief to individuals or businesses who are facing difficulties in repaying their debts. Keywords: Dallas Texas, Debt Adjustment Agreement, Creditor, legally binding contract, outstanding debts, financial relief, repaying debts. There are several types of Dallas Texas Debt Adjustment Agreements with Creditors, each suited for different circumstances: 1. Dallas Texas Debt Settlement Agreement: This type of agreement is reached when a debtor negotiates with their creditor to settle the outstanding debt for a reduced amount. The debtor pays a lump sum or agrees to a structured payment plan to clear the debt, often at a percentage of the original amount owed. 2. Dallas Texas Debt Consolidation Agreement: In this arrangement, multiple debts are combined into a single loan or payment plan. The debtor works with a debt consolidation company or takes out a consolidation loan to pay off all their existing debts. This simplifies repayment by having only one monthly payment at a potentially lower interest rate. 3. Dallas Texas Debt Management Agreement: This agreement involves enlisting the help of a professional debt management company or credit counseling agency. They work with the debtor and their creditors to develop a customized repayment plan, negotiate interest rate reductions or waived fees, and provide financial education and budgeting assistance. 4. Dallas Texas Debt Repayment Agreement: This type of agreement is a formalized plan between a debtor and a creditor to repay existing debts gradually over a specific period. The agreement may include lowered interest rates, extended repayment terms, or restructured payment schedules to alleviate financial strain. 5. Dallas Texas Debt Relief Agreement: This agreement is designed to provide immediate relief to debtors experiencing extreme financial hardship. Debt relief programs, such as debt forgiveness or debt cancellation, may be available to eligible individuals or businesses who meet specific criteria. Regardless of the type of Dallas Texas Debt Adjustment Agreement with Creditor, it is crucial for debtors to thoroughly review and understand the terms and conditions before signing. Seeking legal advice or consulting with a reputable financial professional can help ensure that the agreement is fair and suitable for their individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Dallas Texas Acuerdo De Ajuste De Deuda Con El Acreedor?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Dallas Debt Adjustment Agreement with Creditor, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the latest version of the Dallas Debt Adjustment Agreement with Creditor, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Dallas Debt Adjustment Agreement with Creditor:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Dallas Debt Adjustment Agreement with Creditor and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!