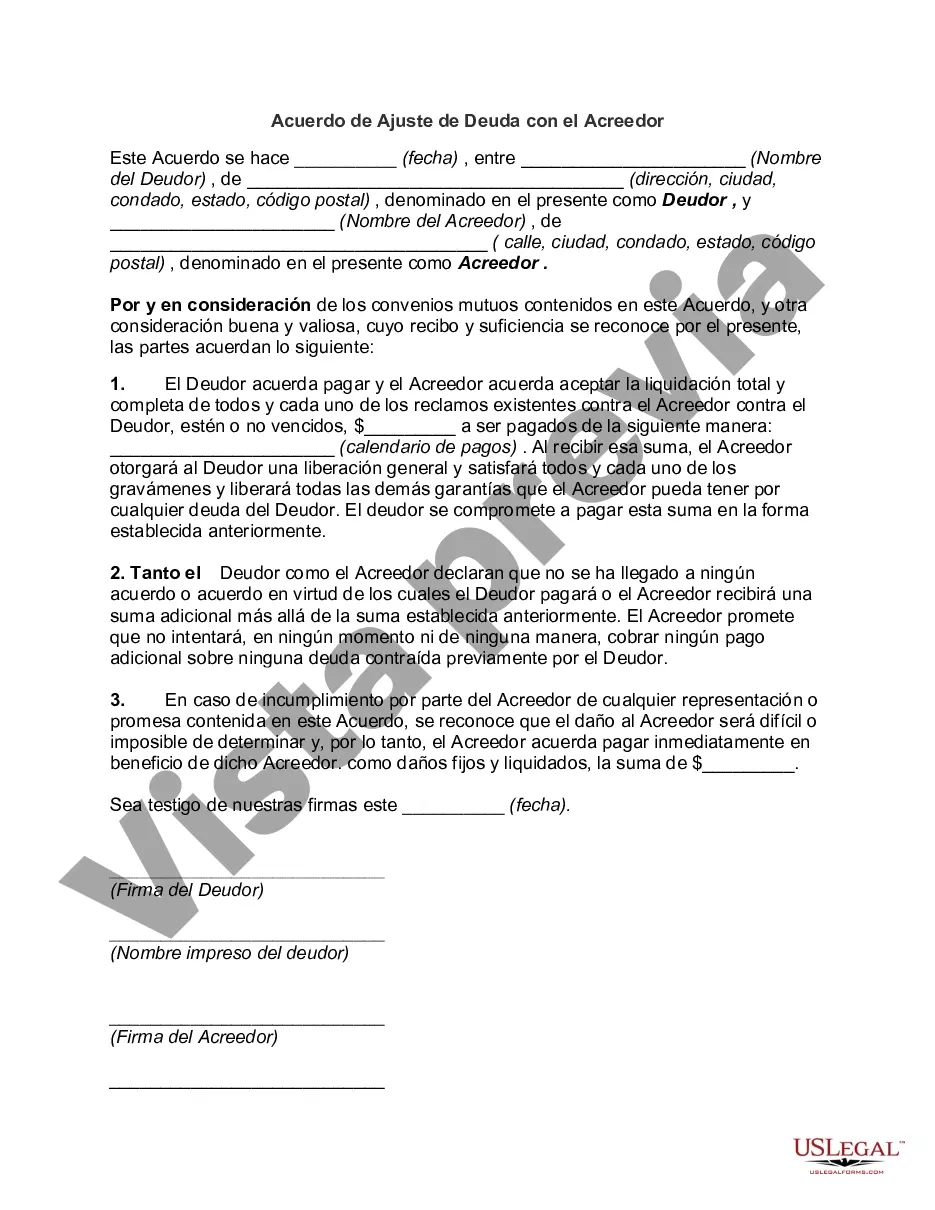

Fairfax Virginia Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Acuerdo De Ajuste De Deuda Con El Acreedor?

If you are looking to locate a reliable legal document provider to obtain the Fairfax Debt Adjustment Agreement with Creditor, your search ends here at US Legal Forms. Whether you wish to initiate your LLC enterprise or oversee your asset distribution, we have you covered.

US Legal Forms has been a dependable service providing legal documents to millions of users since 1997.

You can easily opt to search or browse for the Fairfax Debt Adjustment Agreement with Creditor either by using a keyword or by the specific state/county the document is designed for.

Once you locate the necessary document, you can Log In and download it or save it in the My documents section.

Don't have an account? It's simple to get started! Just find the Fairfax Debt Adjustment Agreement with Creditor template and review the document's preview and description (if available). If you are satisfied with the template’s wording, proceed to click Buy now. Create an account and choose a subscription plan. The template will be instantly available for download once the payment is processed. Now you can complete the document.

- You do not have to be well-versed in legal matters to find and download the required document.

- You can choose from over 85,000 documents categorized by state/county and case.

- The user-friendly interface, range of educational materials, and dedicated support team simplify the process of obtaining and executing various documents.

Form popularity

FAQ

Una carta de compromiso de pago es un documento, a traves del cual una persona fisica o juridica acepta hacerse cargo del pago de una cantidad de dinero que mantenia a modo de deuda con una persona o empresa.

COMPONENTES DE UN EMAIL DE COBRANZA Nombre de quien envia el email.Asunto del email.Motivo del contacto.Deuda.Llamada a la accion.Penalidades (opcional).Disclaimer.Firma.

Con mayores probabilidades de exito. Primero analiza al deudor y la deuda.Separa la deuda del deudor.Centrate en cobrar, no en demostrar que tienes la razon.Estudia todas las alternativas de cobro.Se duro con la deuda, no con el deudor.Deja primero que hable el deudor.Haz ver al deudor que todo es de buena fe.

5 tips para que puedas pagar tus deudas si no tienes dinero Ajusta tus gastos. Elabora tu presupuesto para que sepas cuanto estas gastando cada mes y cuanto te queda al final.Haz un plan con fechas y cantidades.Busca otros ingresos.Intenta negociar con la institucion financiera.Considera un prestamo.

El ajuste de la deuda se refiere a cualquier accion que cambie el historial de la cuenta de una deuda que figura en su reporte de credito. En algunos casos, estos cambios pueden ser buenos para un consumidor.

Formato de la carta de compromiso de pago Datos del pagador: Despues incluye los datos del particular o empresa a quien va dirigida. Fecha de la carta: En lado superior derecho coloca la fecha en la que se redacta la carta. Cantidad de pago y condiciones: En el cuerpo de la carta haz constar el compromiso de pago.

Pregunta cualquier duda, asi evitaras malos entendidos y la negociacion sera mas agil. Analiza tus opciones.... Fija un acuerdo. Considera que este debe ser realista con tu situacion.Informa sobre tu situacion real y actual.Manten una comunicacion abierta.Comprometete.

Si llega a un acuerdo de pago con su deudor, debe ser realista y lo mas claro posible. Un acuerdo, impreciso y mal planificado solo puede empeorar la situacion....Redacte y acuerde un calendario de pagos El monto a pagar; El numero de cuotas y fechas de pago.El interes de demora calculado (si acordado) en las cuotas;

¿Como negociar una deuda de mi credito con el banco? 8 consejos para negociar una deuda con tu banco. #1 Atiende a todo lo que se te dice.#2 Analiza las opciones.#3 Busca distintas soluciones.#4 Realiza acuerdos.#5 Informa sobre tu situacion.#6 Manten una comunicacion cordial.#7 Comprometete.

Los elementos imprescindibles de un acuerdo de pago son: Datos del acreedor y del deudor: El nombre y los apellidos, asi como el documento nacional de identidad deben estar presentes en los documentos. Clausulas: Deben establecerse las clausulas o declaraciones que modifican o cumplimentan al acuerdo original.