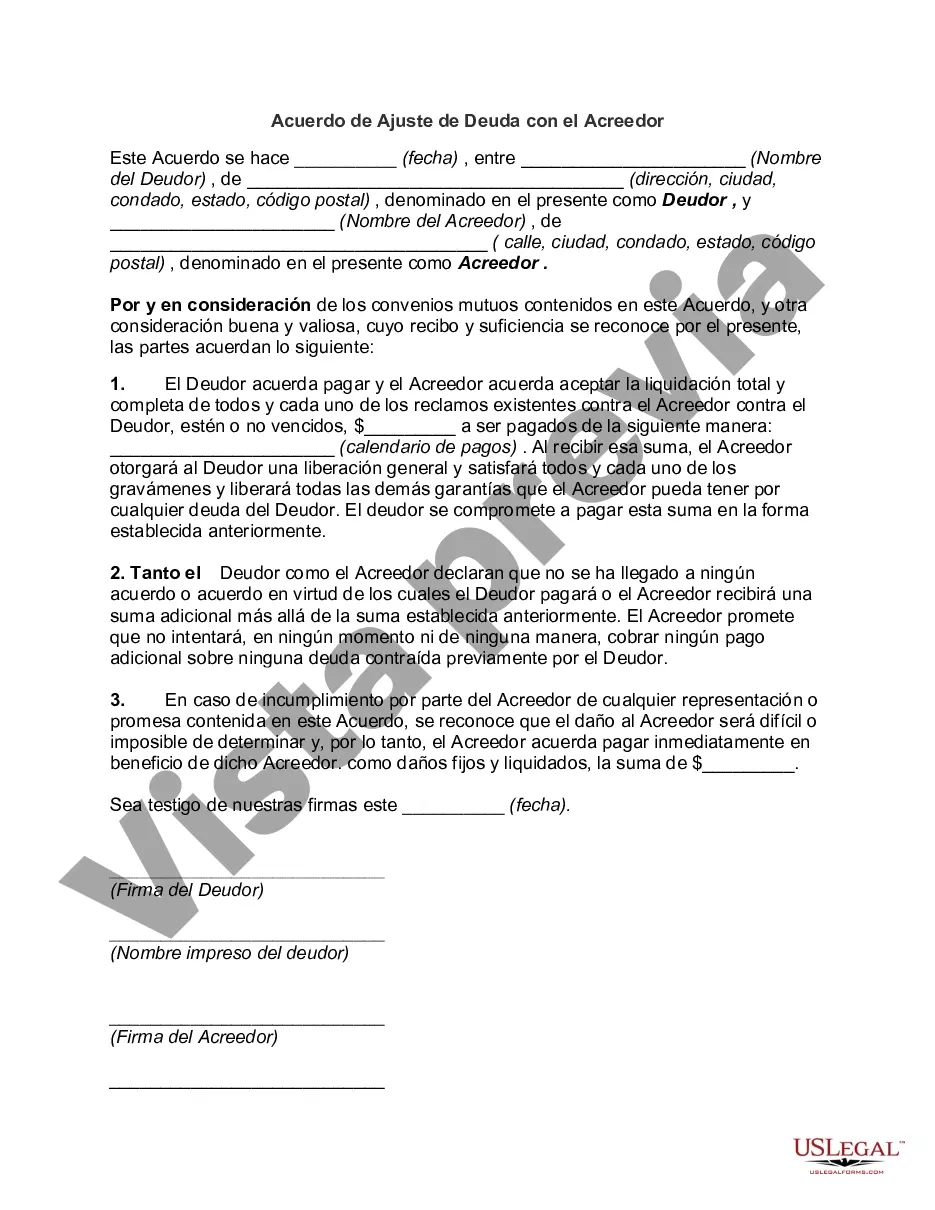

Franklin Ohio Debt Adjustment Agreement with Creditor is a legally binding agreement between a debtor residing in Franklin, Ohio and their creditor. This agreement is designed to help individuals in debt to restructure their financial obligations and create a manageable repayment plan. The purpose of a Franklin Ohio Debt Adjustment Agreement with Creditor is to provide relief to debtors who are struggling to meet their financial obligations. By negotiating with their creditor, debtors can potentially reduce their outstanding debt, extend repayment terms, or lower interest rates. This agreement aims to help debtors regain control of their finances and avoid bankruptcy. There are different types of Franklin Ohio Debt Adjustment Agreements with Creditors that can be tailored to the specific needs of the debtor and the creditor. Some common types include: 1. Debt settlement agreement: In this type of agreement, the debtor and creditor agree to settle the debt for a reduced amount. This can provide immediate relief to the debtor by significantly reducing the total amount owed. 2. Repayment plan agreement: This type of agreement establishes a structured repayment plan, typically over an extended period, allowing the debtor to repay the debt in affordable installments. The creditor may agree to lower interest rates or waive late fees, making it easier for the debtor to meet their obligations. 3. Debt consolidation agreement: This agreement merges multiple debts into a single loan or line of credit. By consolidating debts, the debtor can benefit from having a single monthly payment with a potentially lower interest rate, simplifying their repayment process. 4. Forbearance agreement: A forbearance agreement provides temporary relief to the debtor by suspending or reducing payments for a limited period. This is often employed in situations where the debtor is temporarily unable to make payments due to unforeseen circumstances such as unemployment or medical emergencies. 5. Settlement and repayment agreement: This type of agreement combines debt settlement and repayment plan elements. It may involve negotiating a reduced amount to settle the debt, followed by the establishment of a manageable repayment plan for the remaining balance. In conclusion, a Franklin Ohio Debt Adjustment Agreement with Creditor is an important tool for individuals struggling with overwhelming debt. Through negotiations and various types of agreements, debtors can work towards regaining control of their finances and finding a path towards a debt-free future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Franklin Ohio Acuerdo De Ajuste De Deuda Con El Acreedor?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Franklin Debt Adjustment Agreement with Creditor, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any activities associated with paperwork execution simple.

Here's how to find and download Franklin Debt Adjustment Agreement with Creditor.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Examine the related document templates or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Franklin Debt Adjustment Agreement with Creditor.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Franklin Debt Adjustment Agreement with Creditor, log in to your account, and download it. Of course, our website can’t take the place of a lawyer entirely. If you have to cope with an extremely difficult case, we recommend using the services of a lawyer to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-compliant documents effortlessly!