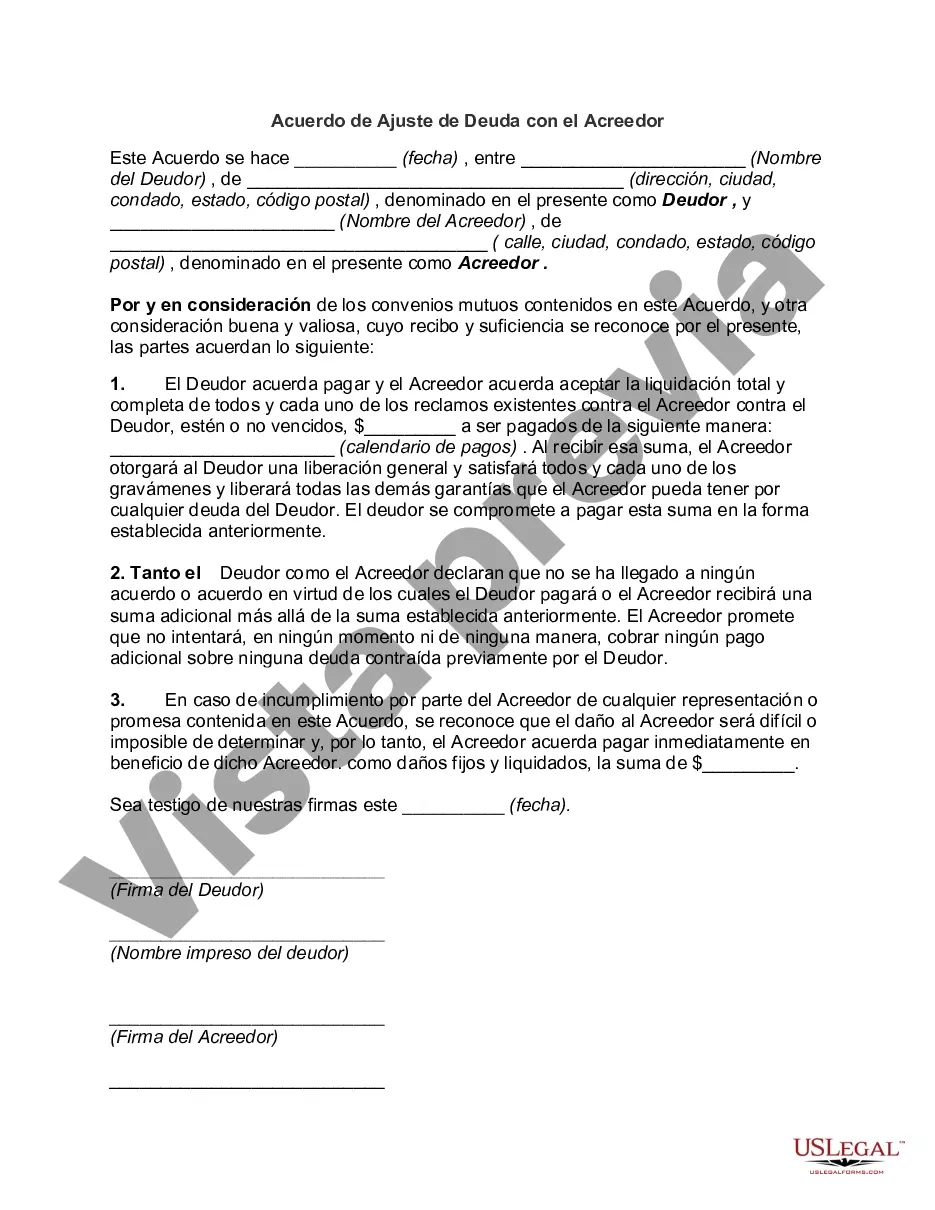

Hennepin Minnesota Debt Adjustment Agreement with Creditor: Explained In Hennepin County, Minnesota, individuals facing overwhelming debt may have the option to enter into a Debt Adjustment Agreement with their creditors. A Debt Adjustment Agreement is a legally binding agreement between a debtor and a creditor that aims to restructure the debt repayment terms in a way that is more feasible for the debtor. This agreement is often sought by individuals experiencing financial hardship and struggling to meet their debt obligations. The Hennepin Minnesota Debt Adjustment Agreement with Creditor provides a proactive strategy for debt management, allowing debtors to negotiate new terms and conditions with their creditors. This agreement typically involves the assignment of a licensed and approved debt adjustment agency to act as an intermediary between the debtor and creditor during the negotiation process. The agency assesses the debtor's financial situation and proposes a manageable repayment plan to the creditor. There are different types of Debt Adjustment Agreements available in Hennepin County, Minnesota. These agreements can vary based on the specific circumstances of the debtor and the type of debt involved. 1. Personal Debt Adjustment Agreement: This type of agreement is often sought by individuals facing high credit card debt, medical bills, personal loans, or other unsecured debts. Individuals may submit a proposal to the debt adjustment agency, which, if approved by the creditor, can lead to the creation of a revised payment plan with reduced interest rates, extended repayment terms, or even a lump-sum settlement. 2. Business Debt Adjustment Agreement: Businesses in Hennepin County facing mounting debts, such as loans, lines of credit, or other financial obligations, can also enter into Debt Adjustment Agreements. With the help of a debt adjustment agency, the business can negotiate new repayment terms with its creditors, often aimed at avoiding bankruptcy or foreclosure. Benefits of a Hennepin Minnesota Debt Adjustment Agreement include the opportunity for debtors to regain control of their finances, avoid bankruptcy, and prevent further damage to their credit scores. By working with a debt adjustment agency, debtors gain professional expertise and experience in negotiating with creditors, increasing their chances of obtaining favorable repayment terms and reducing the burden of debt. As with any legal agreement, it is important for individuals considering a Hennepin Minnesota Debt Adjustment Agreement to consult with a qualified attorney or seek guidance from reputable debt adjustment agencies. They can provide crucial advice, ensure compliance with relevant laws and regulations, and assist in drafting an effective agreement that protects the debtor's rights and interests. In summary, the Hennepin Minnesota Debt Adjustment Agreement with Creditor offers a practical solution for individuals or businesses struggling with overwhelming debt. By engaging in negotiations and restructuring repayment terms, debtors can aim to regain financial stability and ease their burdensome debt load.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Hennepin Minnesota Acuerdo De Ajuste De Deuda Con El Acreedor?

Draftwing forms, like Hennepin Debt Adjustment Agreement with Creditor, to manage your legal affairs is a difficult and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents created for different scenarios and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Hennepin Debt Adjustment Agreement with Creditor form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Hennepin Debt Adjustment Agreement with Creditor:

- Ensure that your form is compliant with your state/county since the rules for writing legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Hennepin Debt Adjustment Agreement with Creditor isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our service and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!