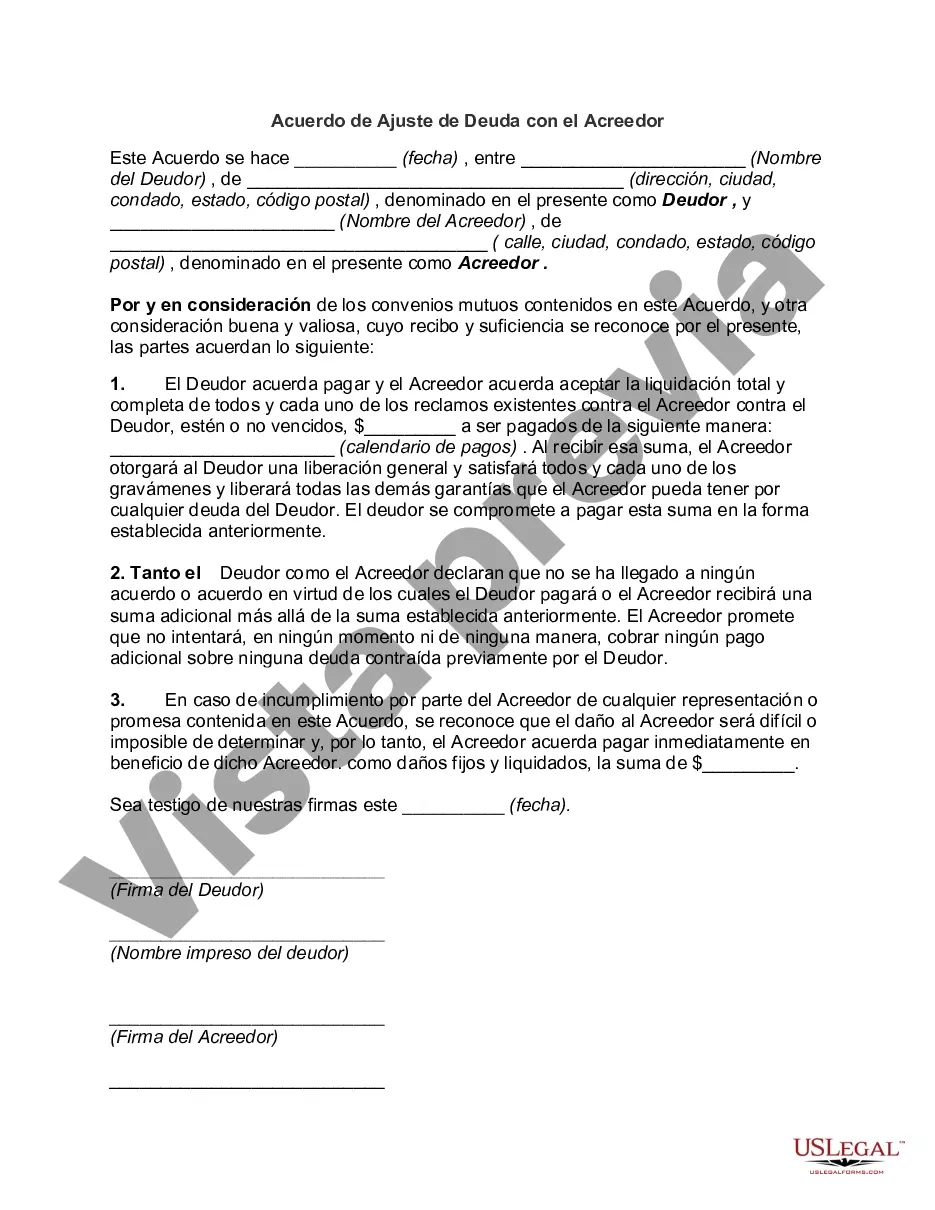

A Los Angeles California Debt Adjustment Agreement with Creditor is a legally binding document that outlines the terms and conditions of restructuring debt between a debtor and a creditor in Los Angeles, California. This agreement is designed to provide the debtor with a feasible repayment plan while ensuring that the creditor receives at least a portion of the owed amount. In Los Angeles, California, there are primarily two types of Debt Adjustment Agreements with Creditors: 1. Debt Settlement Agreement: This type of agreement allows debtors to negotiate with their creditors to settle their debts for a lump sum payment that is lower than the total outstanding balance. Through effective negotiations, debtors can often reduce the amount owed and arrange for a one-time payment or a series of payments to clear the debt. 2. Debt Repayment Plan: This type of agreement establishes a structured repayment plan for debtors who are unable to make a lump sum payment. Debtors can work with a debt management agency or credit counseling service to create a repayment plan that suits their financial situation. The agency negotiates with the creditors to reduce interest rates and consolidate debts into a single monthly payment, making it more manageable for the debtor. The Los Angeles California Debt Adjustment Agreement with Creditor should include several key elements to ensure clarity and protect the rights of both parties involved. These elements may include: 1. Identification of the parties: Clearly state the names, addresses, and contact details of both the debtor and the creditor involved in the agreement. 2. Debt details: Provide a detailed breakdown of the outstanding debt, including the principal amount, interest rates, and any additional fees or charges. 3. Repayment terms: Specify the terms of repayment, including the amount to be paid, the frequency of payments, and the duration of the agreement. This section may also outline any specific conditions or provisions agreed upon by both parties. 4. Interest rates and fees: Address any changes to the original interest rates or fees that may arise during the repayment period. 5. Dispute resolution: Include a provision for resolving disputes, such as through mediation or arbitration, to avoid costly litigation in case of disagreements. 6. Default provisions: Clearly outline the consequences of default on the agreement, such as additional fees, interest, or enforcement actions that the creditor may take. It is crucial for debtors in Los Angeles, California, to review and understand the terms and conditions of a Debt Adjustment Agreement with Creditor before signing. Seeking legal advice or consulting with a debt management agency can provide debtors with the necessary guidance and protect their rights throughout the negotiation and repayment process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Los Angeles California Acuerdo De Ajuste De Deuda Con El Acreedor?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Los Angeles Debt Adjustment Agreement with Creditor, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any tasks associated with document execution simple.

Here's how to locate and download Los Angeles Debt Adjustment Agreement with Creditor.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Check the related document templates or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Los Angeles Debt Adjustment Agreement with Creditor.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Los Angeles Debt Adjustment Agreement with Creditor, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to cope with an extremely challenging situation, we advise getting a lawyer to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific documents effortlessly!