Middlesex Massachusetts Debt Adjustment Agreement with Creditor is a legal arrangement designed to help individuals or businesses in Middlesex County, Massachusetts, repay their outstanding debts to creditors. This agreement is usually reached when the debtor is facing financial hardship and is unable to make full payments on their debts. The Middlesex Massachusetts Debt Adjustment Agreement with Creditor typically involves negotiating new terms with the creditor to establish a more feasible repayment plan. This can include lower interest rates, extended payment periods, reduced monthly payments, or a combination of these. It's important to note that there are various types of Middlesex Massachusetts Debt Adjustment Agreements with Creditors, each catering to different financial situations. Some common types include: 1. Debt Consolidation Agreement: This type of agreement consolidates multiple debts into a single payment, making repayment more manageable. Debt consolidation often involves obtaining a new loan to pay off existing debts, and the debtor then makes regular payments to the new lender. 2. Debt Settlement Agreement: With this agreement, the debtor negotiates with the creditor to settle the debt for a lower amount than what is originally owed. In exchange for the reduced payment, the creditor considers the debt as settled. 3. Debt Management Agreement: This agreement is a formal arrangement between the debtor and a credit counseling agency. The agency works with the debtor to create a repayment plan and negotiates with the creditor to lower interest rates and fees. The debtor makes a single payment to the agency, which then distributes the funds to the creditors. 4. Debt Forbearance Agreement: This agreement allows the debtor to temporarily suspend or reduce debt payments for a specific period, typically due to financial hardship. The creditor agrees to this arrangement, providing the debtor with some relief until their financial situation improves. In summary, Middlesex Massachusetts Debt Adjustment Agreement with Creditor is a legally binding agreement between debtors and creditors to establish revised terms for repayment. By utilizing different types of agreements like debt consolidation, debt settlement, debt management, or debt forbearance, debtors in Middlesex County can successfully negotiate more manageable payment plans and gradually eliminate their outstanding debts.

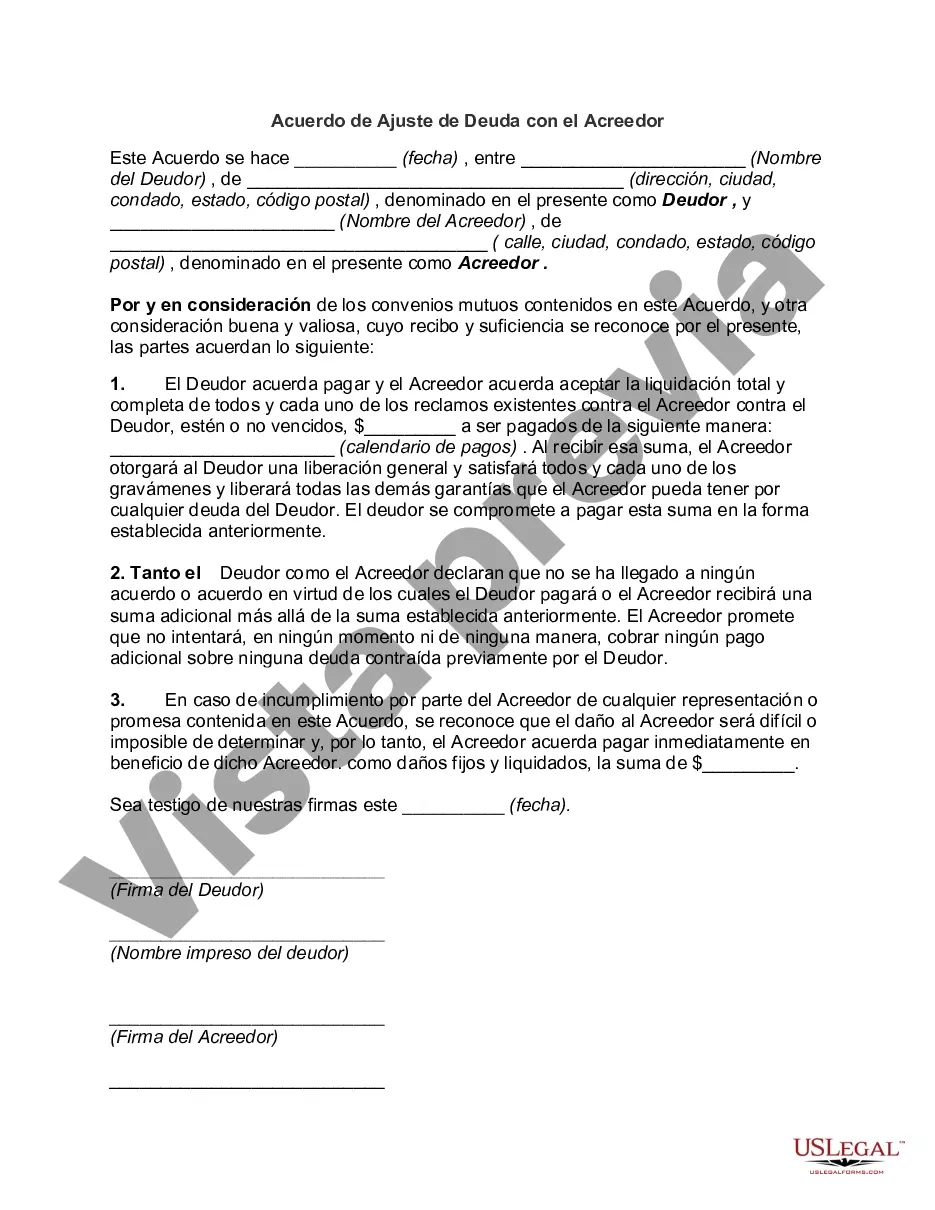

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Middlesex Massachusetts Acuerdo De Ajuste De Deuda Con El Acreedor?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Middlesex Debt Adjustment Agreement with Creditor, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork execution straightforward.

Here's how to locate and download Middlesex Debt Adjustment Agreement with Creditor.

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the validity of some records.

- Check the related forms or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Middlesex Debt Adjustment Agreement with Creditor.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Middlesex Debt Adjustment Agreement with Creditor, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you have to cope with an exceptionally complicated situation, we advise using the services of a lawyer to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork with ease!