A Montgomery Maryland Debt Adjustment Agreement with a creditor refers to a legally binding contract that allows individuals or businesses in Montgomery, Maryland to negotiate and restructure their debts with creditors in order to establish a manageable repayment plan. This agreement helps debtors to avoid bankruptcy and find a feasible solution to their financial challenges while ensuring that creditors receive a portion of the owed amount. Here are some relevant keywords to further elaborate on Montgomery Maryland Debt Adjustment Agreement with a Creditor: 1. Debt negotiation: This process involves discussions and negotiations between debtors and creditors to reach a mutually agreed-upon resolution regarding outstanding debts. 2. Creditors: These are the entities or individuals who are owed money by the debtors, such as banks, financial institutions, or other lenders. 3. Debt restructuring: It refers to the process of modifying the original terms and conditions of the debt, including interest rates, payment terms, or loan duration, to make it more manageable for the debtor. 4. Repayment plan: A structured schedule is established to outline how the debtor will repay the outstanding debt over a specific period. This plan may include modified interest rates or reduced monthly payments based on the debtor's financial situation. 5. Debt relief: Montgomery Maryland Debt Adjustment Agreement with a Creditor provides an opportunity for debtors to alleviate their financial burden by establishing a viable repayment plan that helps them regain control over their finances and avoid more severe consequences of foreclosure or bankruptcy. Types of Montgomery Maryland Debt Adjustment Agreement with Creditor: 1. Consumer Debt Adjustment Agreement: This type of agreement primarily applies to individuals who have accumulated personal debts such as credit card bills, medical expenses, or personal loans. 2. Business Debt Adjustment Agreement: This agreement pertains to businesses or organizations facing financial challenges and seeking to restructure their debts with creditors in order to continue their operations and avoid bankruptcy. 3. Mortgage Debt Adjustment Agreement: Specifically designed for homeowners, this agreement allows individuals who are struggling with mortgage payments to renegotiate the terms and conditions of their loans with their creditors, potentially leading to lower interest rates or reduced monthly payments. In Montgomery Maryland, Debt Adjustment Agreements with Creditors aim to provide a fair and reasonable solution for both debtors and creditors, allowing debtors to establish a realistic repayment plan while ensuring that creditors receive a portion of their owed amount. It is imperative for debtors to work closely with legal professionals who specialize in debt negotiation and restructuring to ensure the best possible outcome and financial stability.

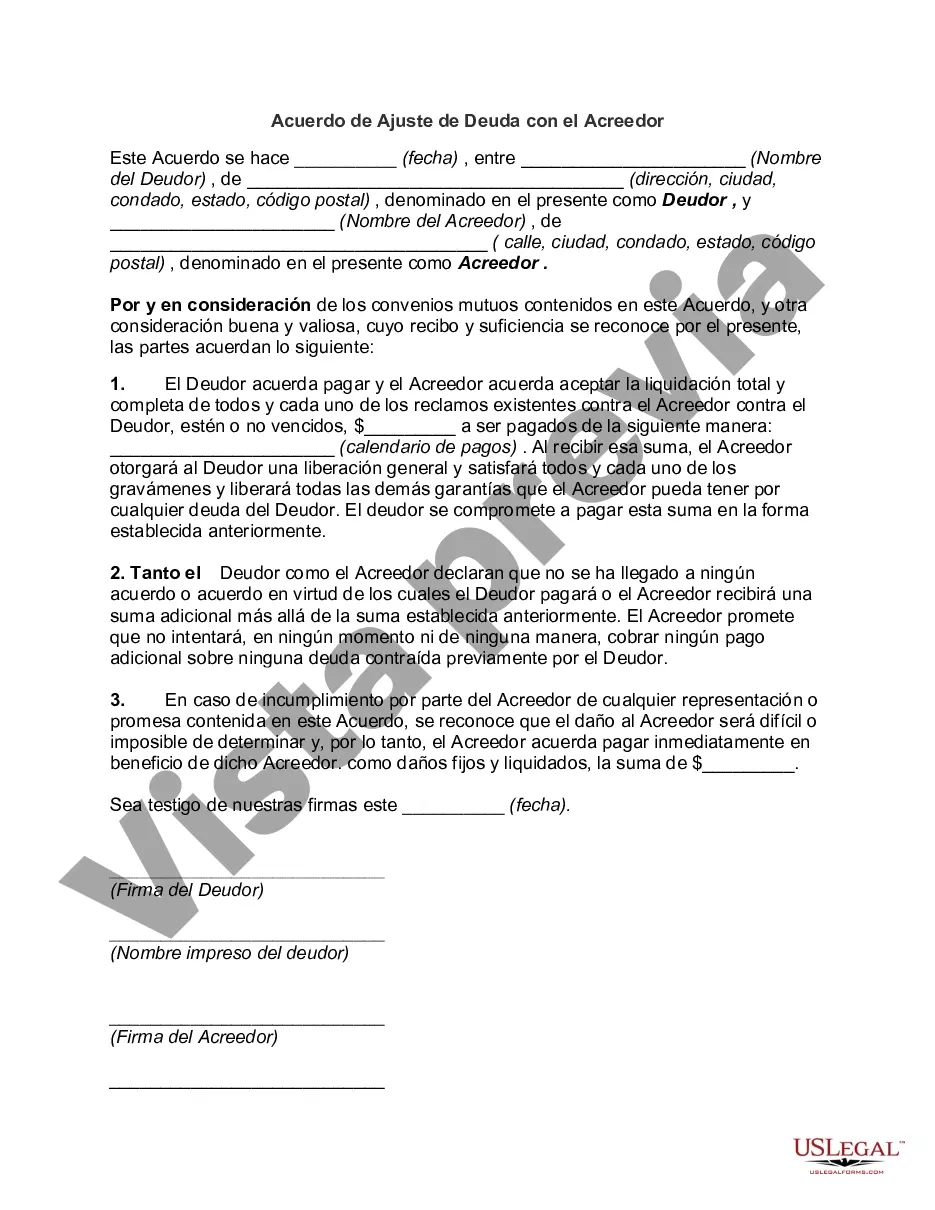

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Montgomery Maryland Acuerdo De Ajuste De Deuda Con El Acreedor?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Montgomery Debt Adjustment Agreement with Creditor suiting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Montgomery Debt Adjustment Agreement with Creditor, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Montgomery Debt Adjustment Agreement with Creditor:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Montgomery Debt Adjustment Agreement with Creditor.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!